‘Neither in nor out’ – Why Bitcoin’s near-term price action depends on this

The last few weeks have been tumultuous for Bitcoin. In fact, consistent sideways movement between $30,000 and $40,000 appeared to push BTC towards the lower range. Over the past few days, however, BTC has managed to consolidate near the $40,000-mark.

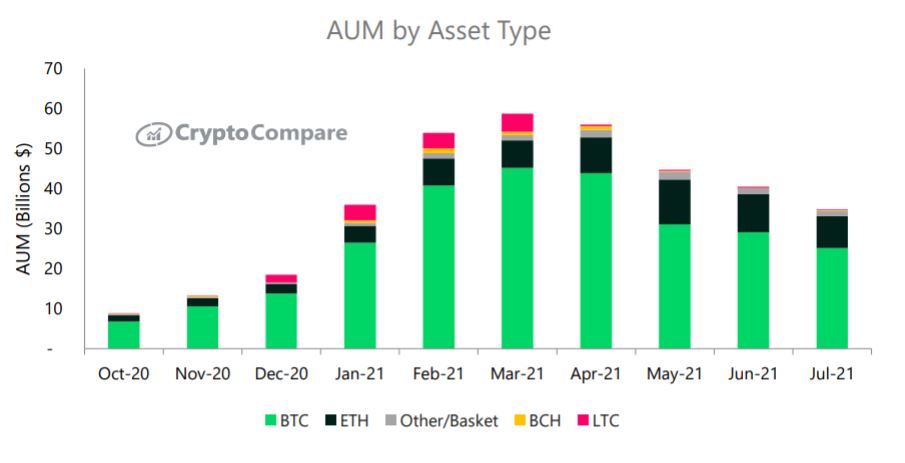

Some bullish momentum is evident in the on-chain sector but over the course of July, there have been legitimate institutional declines. Before analyzing whether accredited investors are back on the Bitcoin bandwagon, we need to incorporate data with respect to digital asset investment products.

Total AUM dropped, Monthly Trading Volume stagnant?

Most institutions do not directly expose themselves to Bitcoin, so their investments are incorporated via investment products. Now, according to CryptoCompare’s Digital Asset Management Review, the total assets under management or AUM dropped by 14% to $34.8 billion before BTC’s price picked up.

At press time, Grayscale’s Bitcoin Trust product AUM had dropped down to $25.96 billion, with 1070 BTCs outflowing from the product over the past 30 days.

The report additionally said,

“Aggregate daily volumes decreased by 35.4% in July to $319mn. Average daily volume for its GBTC and ETHE products stood at $160mm (down 37.7%) and $90.7mn (down 37.1%) respectively.”

It is important to note that these data sets were generated right before the price hike, so these numbers might increase going forward. But, for the time being, investment vehicles are facilitating low activity levels.

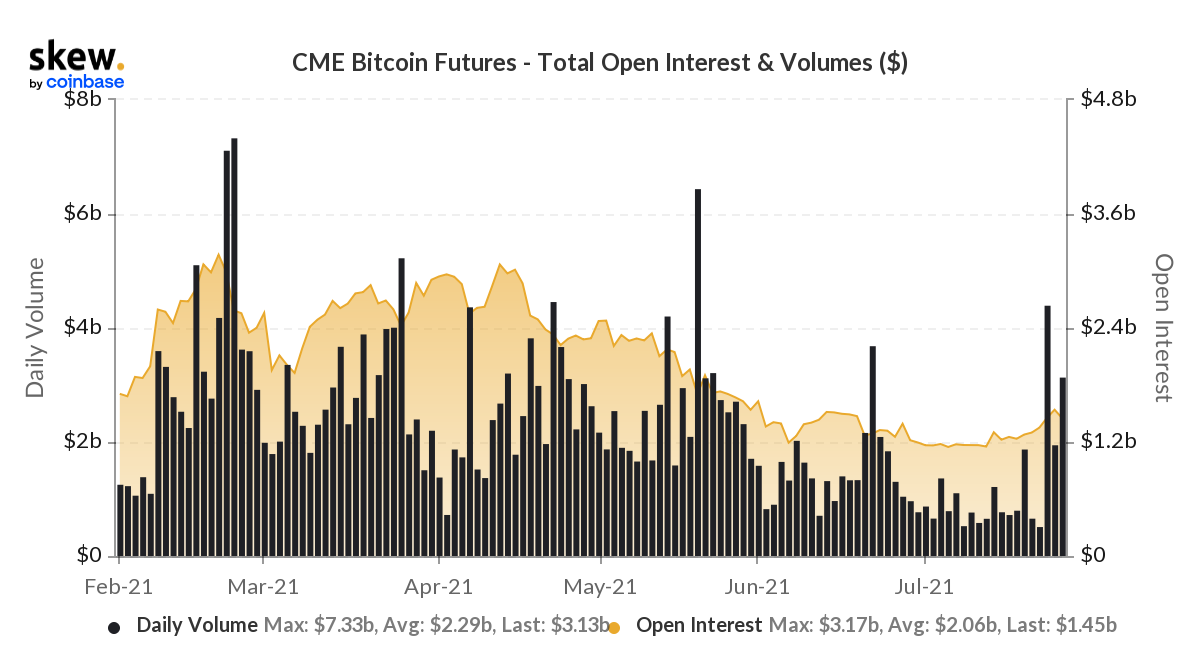

Are Bitcoin CME Futures treading a similar path?

Not exactly.

CME Bitcoin Futures underline institutions’ derivatives interest, and over the past few days, there have important variations. The Open Interest registered was $1.5 billion, a level last seen on 14 June. Coincidentally, it was also the last time Bitcoin tested $40,000.

However, the daily volumes were at a higher average than in June, at press time. CME Futures matched such daily volumes previously at the beginning of May, and only 19 May’s volumes were higher than the trading activity at the time.

So, are institutions in or not?

Overall, they are still cautious.

Touching $40,000 is a start to lure institutional capital back into Bitcoin, but it is currently a waiting game. The narrative might develop further once Bitcoin crosses $42,000, a breach that will settle down some of the volatility nerves.

According to Ecoinometrics, for instance, Smart money witnessed a massive influx in both longs and short positions. So, there is still a lack of clarity in terms of identifying one specific trend. The bottom line, therefore, is this – Institutions are probably not in, not yet. But, this could change.