After XRP, will Chainlink be SEC’s next target?

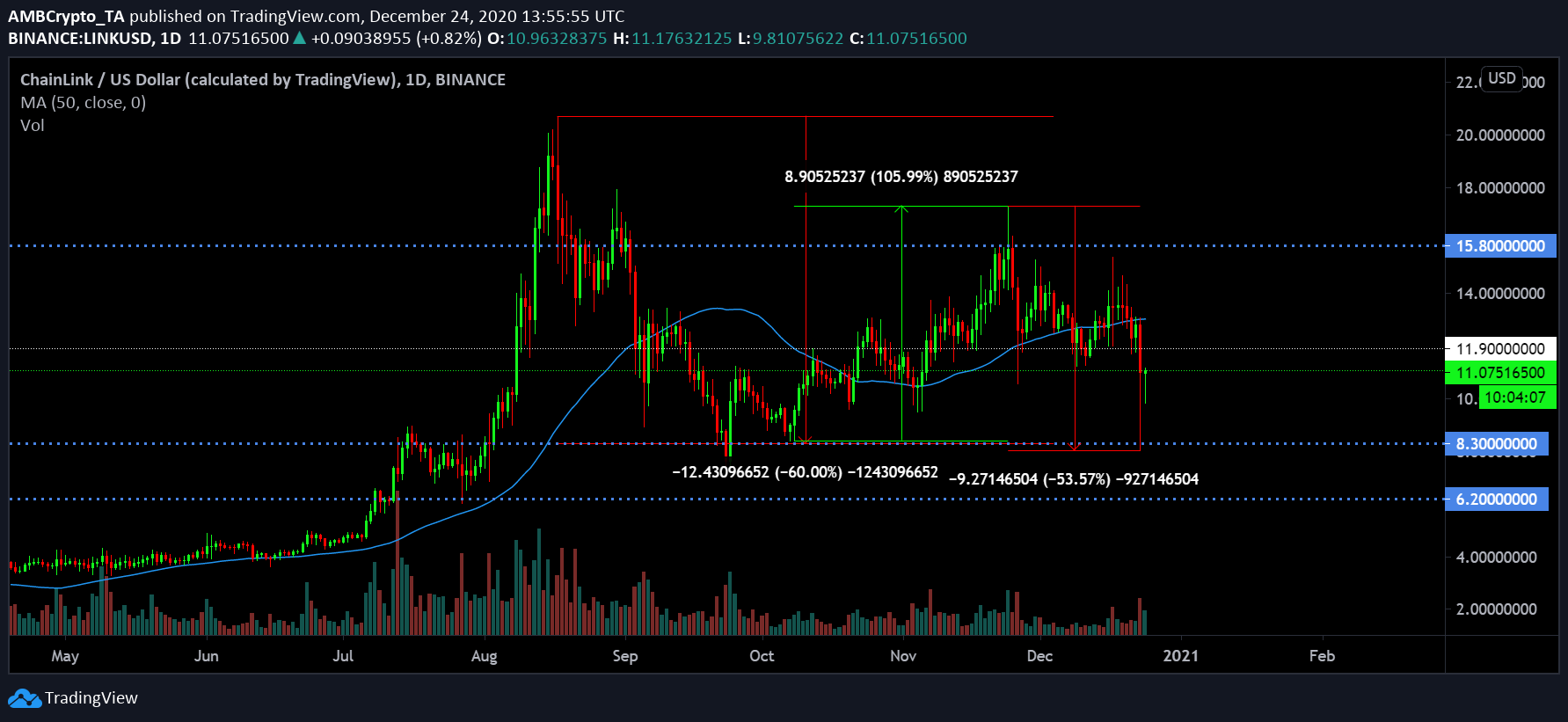

Chainlink’s performance in the 2nd half of 2020 can only be described as turbulent. While the asset recorded a new high of $20, it fell down by 60% over the next 30-days. The price began to rally yet again and a 105% hike between October and November re-opened fresh bullish prospects. Sadly, due to its strong de-correlation with Bitcoin, it did not attain new heights in December.

LINK/USD on Trading View

However, it might not be all lost for the asset, as it remains fairly in bullish territory, unlike other major altcoins.

LINK chained down by DeFi?

While being one of the poster assets for DeFi universe, Chainlink’s recent lack of price growth could be traced to the stagnancy of DeFi. Bitcoin has absorbed all the market attention over the past few weeks, and DeFi interest has expectedly gone down.

However, from a development standpoint, Chainlink continues to be active as it recently entered a partnership with the World Economic Forum to release Industry-Wide Oracle Standards.

On-Chain metrics remain on the Chainlink side

The amount of LINK sitting on exchanges is currently down to 6.67% after registering its largest outflow in 6 weeks. This is also the lowest amount sitting on exchanges since its ICO back in May 2017. Such a trend is an extremely bullish sign considering moving LINK tokens off-exchange means that holders were not looking to sell their allocations.

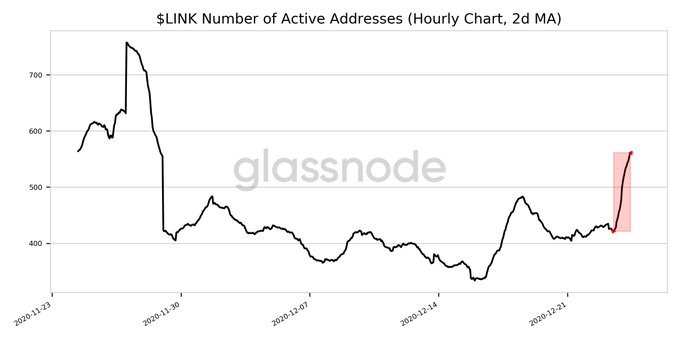

Additionally, number of active addresses had also registered a change in the past 24-hours.

According to glassnode, the number of LINK addresses was significantly up over the past day, suggesting that its market remains active in terms of transactions. Overall, red flags were not evident in Chainlink’s current market but a particular asset management firm is currently of a different opinion.

SEC is coming after you too LINK! says Zeus Capital

XRP’s reputation and value are possibly damaged beyond repair at the moment after the SEC decided to take action against ripple. XRP dropped more than 30% over the past couple of days, and Zeus Capital believes Chainlink’s number will be next in the list of victims.

Zeus Capital has been a consistent critic of Chainlink and Sergey Nazarov and suggested that Nazarov is the direct beneficiary of the Flash Loan phenomenon in DeFi.

Calling Chainlink and Nazarov ‘outright frauds’, if any of these allegations catch any kind of momentum, things may turn extremely sour for Chainlink as well.

XRP’s fate is undecided yet, and only time will tell if Chainlink has to face the same fire, or not.