No activity in Bitcoin Options market – What next?

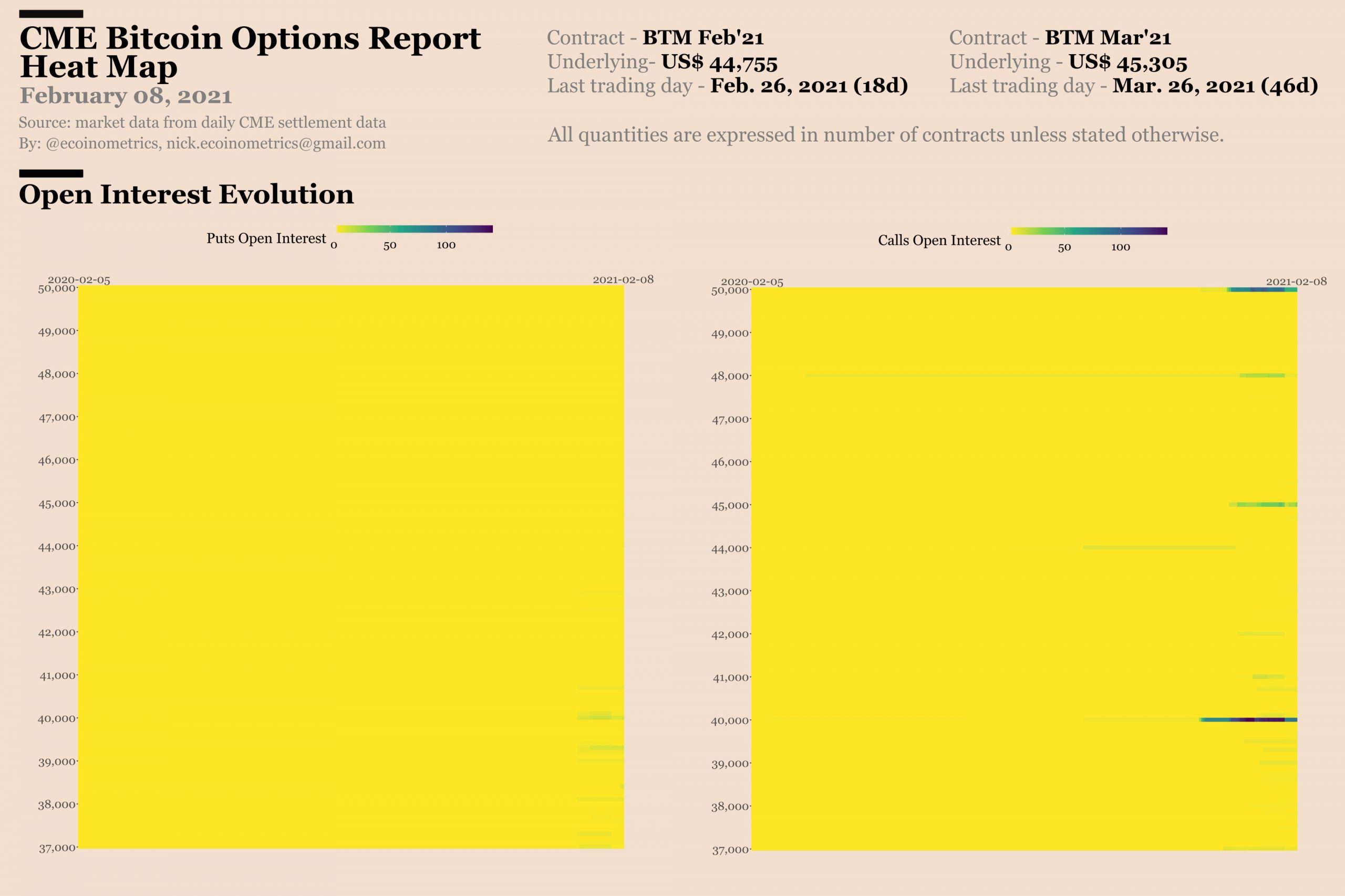

While Ethereum Futures are making noise on the CME, Bitcoin Options have been rather quiet. This is interesting, especially since Bitcoin hit a new ATH after crossing $48,000 for the first time in its history, Elon Musk decided to watch what he says about Bitcoin, and Tesla bought $1.5 billion worth of Bitcoin. Additionally, Open Interest in Bitcoin hit a new ATH too.

However, despite so much activity in Bitcoin, the Options market remains the quietest. Nobody wants to sell calls and nobody needs to buy puts.

Source: Ecoinometrics

Based on the attached chart, the situation can be best described as being “hung.” Simply put, there is nothing going on in the Options market.

The activity is missing, even as the price rally continues. So, what does this inactivity mean? Does it signal an extended price rally or will it herald the anticipated price correction? Founder and CIO of Valishire Capital Management LLC Jeff Ross recently tweeted about the current state of the Bitcoin price rally, stating,

“We are in the third and final Trimester of Bitcoin’s bull market, which officially began in mid-December 2018.

My 3rd Trimester playbook (not investment advice!):

Blow-off parabolic top to $400k-500k before Dec. 2021.

Followed by huge drawdown to $80k-100k in 2022.”

If Ross’s analysis is on point, the current state of quietude may take a downward turn, and the Options market may reflect the bearish sentiment of retail traders. The retail traders who are currently unwilling to sell calls and buy puts may be more than willing later, and some form of impact may be seen on the prices on spot and derivatives exchanges in the form of cascading and rapid corrections.

Institutional interest in Bitcoin has increased lately post Bitcoin’s price rally and post Musk’s tweets. However, demand can only push the price so far, especially since retail traders are still booking unrealized profits on spot exchanges.

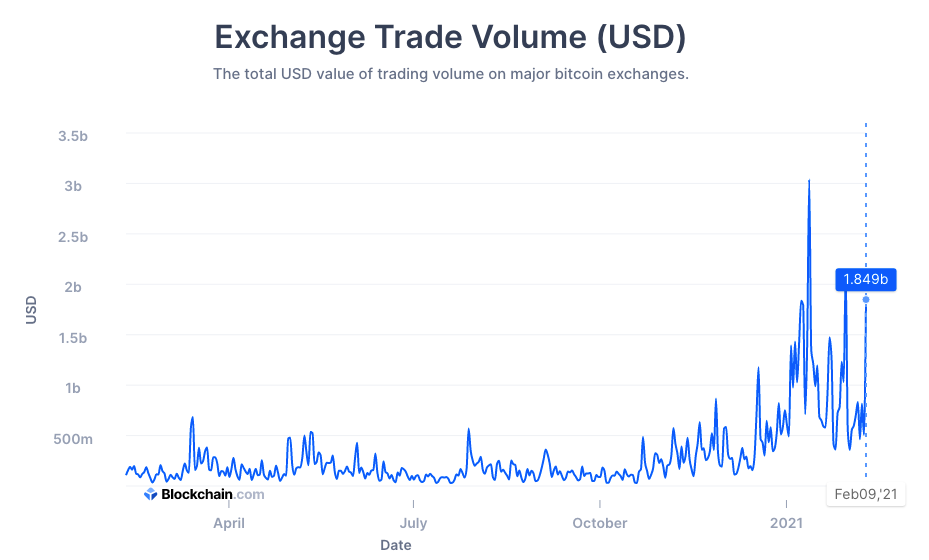

Source: Blockchain.com

Here, it is worth noting that the exchange trade volume is well shy when compared to its ATH, with the same recorded to be $1.84 billion at the time of writing, based on info from blockchain.com.

Despite hitting a new ATH, low trade volume signals a lack of activity in the market, with the same also implying that the present price rally may move in either direction depending on the inflows to exchanges and to the demand.