Oasis Network saw a massive rally, here’s what ROSE holders should expect next

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ROSE’s value and volume surged by over 20% and 200%, respectively, at press time.

- But there was a hidden RSI divergence which could slow down the uptrend.

At the time of writing, Oasis Network [ROSE] hiked by 20% with over 200% trading volume, as per Coinmarketcap. However, the uptrend could be slowed because of a hidden RSI divergence and a crucial resistance level.

Read Oasis Network [ROSE] Price Prediction 2023-24

ROSE hit the resistance level of $0.08047 – Could it face a price rejection?

ROSE managed to reclaim its November level but faced an immediate price rejection, forming a bearish order block at $0.07752.

The rejection led to a correction before bulls found steady ground and launched a massive recovery.

How much are 1,10,100 ROSEs worth?

The rally inflicted a bearish order breaker and mounted over the pre-FTX level. However, the uptrend met another resistance level at $0.08047 and could face price rejection and correction if the previous trend repeats.

Sellers could sell if ROSE fails to close above $0.08047 and buy back at one of the August support levels of $0.07752 or the previous bearish order block of $0.07206.

Similarly, bulls could wait for a daily close above the $0.08047 resistance level and confirmation before entering a long position targeting the $0.01 zone.

Although the RSI was bullish, it has been making lower lows as price made higher highs, thus painting a hidden divergence. In addition, the RSI hit an overbought zone, lending credence to a likely price reversal.

But the OBV (On Balance Volume) rose sharply, denoting the massive demand for the AI-leaning token, which could boost further uptrend if the trend is sustained.

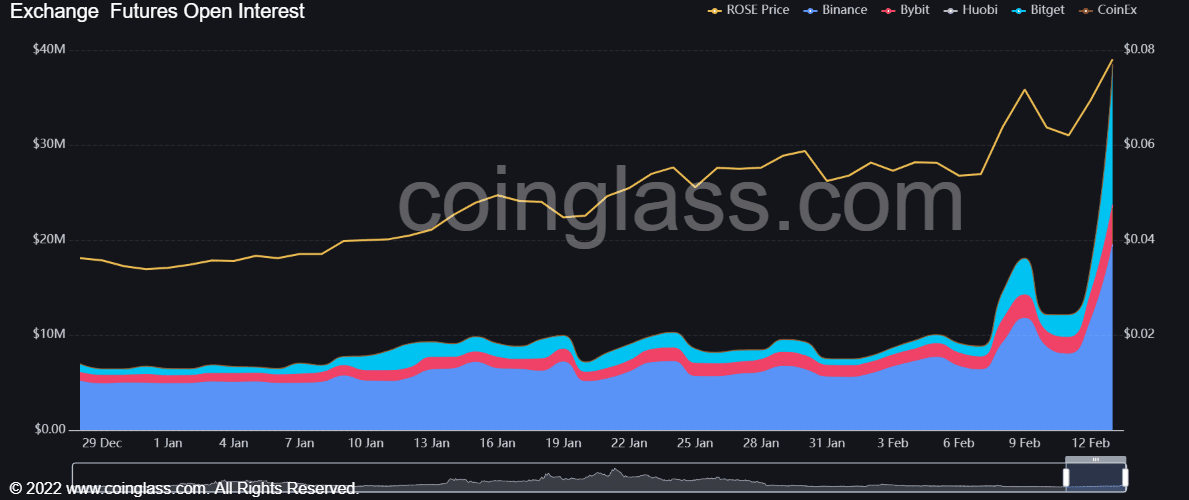

ROSE recorded a sharp rise in Open Interest (OI) over the weekend

As per Coinglass, ROSE saw a sharp increase in the open interest (OI) rate over the weekend. The surge corresponded with the break above the bearish order block of $0.07206, boosting the uptrend.

A price rejection at the $0.08047 resistance level alongside an OI drop could show bearish momentum. However, a continued surge in OI could boost bulls to overcome the $0.08047 hurdle, invalidating the bearish trend prediction.