Octoblock shows massive potential for traders and investors

Ethereum and Bitcoin are the two most discussed cryptocurrencies in the media. Both have played important roles in the development of the industry and have helped attract maximum trading volume to the cryptocurrency market. However, their operating principles and goals differ. The struggle of Ethereum against Bitcoin underscores the inherent volatility and complexity of the crypto market. On the other hand, investors are seeking new projects that have a chance to outperform in other sectors.

Ethereum Struggle against Bitcoin

Bitcoin operates as a digital currency, while Ethereum is primarily a platform for decentralized applications (dApps). To achieve consensus, Bitcoin uses a proof-of-work model, which typically requires more computing power and energy, while Ethereum uses a proof-of-stake model, which makes mining more affordable for participants. Ethereum transactions are powered by smart contracts, and Bitcoin will receive this feature at the end of 2021.

Bitcoin (BTC), according to the TradingView resource, started Friday with a fall. The cryptocurrency is trading at $67,710. The 24-hour minimum for Bitcoin is $65,103, the maximum is $69,291. Moreover, the second-largest cryptocurrency by capitalization, Ethereum, also started the day with a fall. As of the time of writing the review, the coin is trading at $3,276. However, in the top 10 most capitalized cryptocurrencies, the best result for the day (+3.40%) and week (+5.50%) was demonstrated by Toncoin. The largest losses over the last week were recorded for Dogecoin, which lost its price more actively than others (-17.86%).

BlackRock Clients Favor Bitcoin Over Ethereum

Robert Mitchnick, head of digital assets at investment giant BlackRock, reported weak client interest in the potential launch of an ETF on Ethereum (ETH), which stands in stark contrast to the growing demand for Bitcoin. The statement came during the Bitcoin Investor Day conference in New York, where Mitchnick shared information about BlackRock’s cryptocurrency strategy.

Despite the growing interest in various cryptocurrencies, BlackRock clients have a clear preference for Bitcoin. Mitchnick’s comments reflect a critical assessment of demand in the cryptocurrency market, suggesting that appetite for other cryptocurrencies, including Ethereum, remains sluggish at best. “I can say that for our customer base, Bitcoin is overwhelmingly the number one priority,” Mitchnick said.

Will Ethereum Price Go Up?

The second-largest cryptocurrency by capitalization, Ethereum, also started the day with a fall. As of the time of writing the review, the coin is trading at $3,276. In other words, Ethereum’s price is trading below two major support levels after a sustained decline over the past week. At the same time, bearish activity is likely to increase in the coming days, since ETH is currently forming a market top.

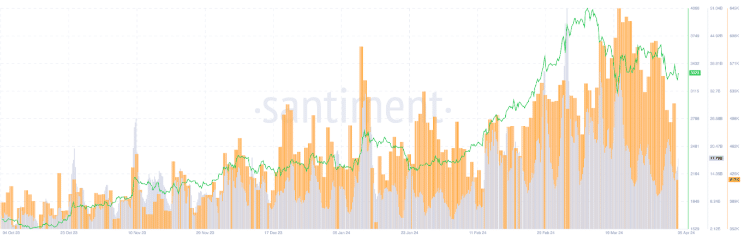

Image source: santiment

In addition, Ethereum remains under sustained selling pressure, with the supply of the token on exchanges increasing over the past couple of months. This resulted in more than 2.31 million Ethereum entering exchanges, worth over $7.6 billion. If the selling continues amid bearish sentiment, the price will find it difficult to recover, causing ETH to fall further.

New Projects Show Massive Potential

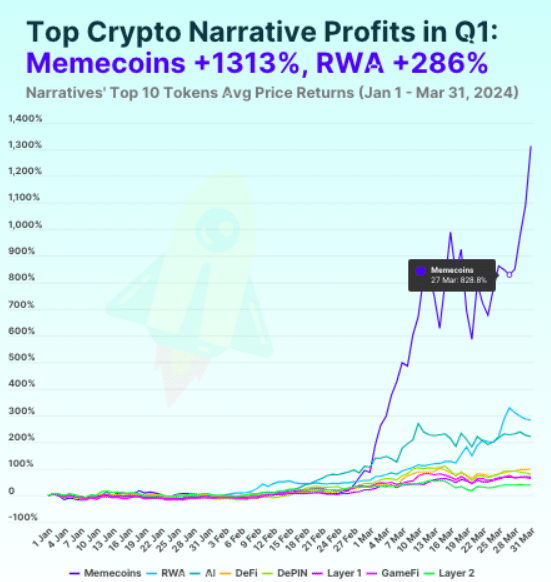

Profits earned from memecoins in the first quarter of 2024 surpassed those of Bitcoin (BTC) and many altcoins. The memecoin sector has become the most profitable in the cryptocurrency industry over the past three months. According to coingecko, since the beginning of the year, memecoins have shown the highest average return of 1,312%.

In the first quarter, the profitability of the memecoin sector increased by 1,300%. According to the report, among the ten largest “meme” coins by capitalization, three tokens were launched only in March: Brett (BRETT), BOOK OF MEME (BOME), Cat in a Dog’s World (MEW).

By the end of the first quarter, BRETT returned 7,727%. It is followed by another super popular Solana (SOL) based asset, dogwifhat (WIF). Since the beginning of the year, the coin has jumped 2,721%.

The growth in user activity of decentralized applications (dApps) in the 1st quarter of 2024 amounted to 77% – up to 7 million daily active users. Over the same period, the volume of funds blocked for the needs of DeFi projects (TVL) increased by 70%. DappRadar analysts came to these conclusions in their new study.

What about the Other Sectors?

The second most profitable narrative is RWA. In the first quarter of this year, its profitability increased by 285%, and the most profitable were Mantra (OM) and TokenFi (TOKEN). Over three months, they rose in price by 1,074% and 419%, respectively.

Image source: coingecko

Another sector that showed triple-digit growth was artificial intelligence (AI). All large-cap AI tokens posted an impressive performance in the first quarter. The leaders were AIOZ Network (AIOZ) and Fetch.ai (FET), rising 480% and 378%, respectively.

The profitability of the remaining narratives was as follows:

- Decentralized finance (DeFi) – 98.9%;

- Decentralized physical infrastructure networks (DePIN) – 81;

- L1 networks – 70%;

- Gaming sector (GameFi) – 64.4%;

- L2 networks – 39.5%.

On the other hand, according to TradingView, the price of Bitcoin (BTC) has risen by 49.8% in three months. This is 2,600% lower than memecoins.

Octoblock Presale: Could It Be The New Big Thing?

The Octoblock’s initial coin offering (ICO) kicked off with a $0.035 price in phase number one, presenting a prime opportunity for potential investors seeking to enter at an advantageous stage and capitalize on significant first-mover benefits.

Holders of the OCTO token will be rewarded with generous 15% bonuses on top of their completed purchases. To safeguard sustained growth for the OCTO token, Octoblock has meticulously crafted a comprehensive strategy that incorporates a Token Taxation System designed to disincentivize impulsive selling and promote stability in the DeFi realm.

Octoblock: A Perfect Combination Between Memecoins & DeFi Protocol

Octoblock is a comprehensive package of groundbreaking financial and social responsibility services. Encompassing pioneering DeFi and GameFi products and services that guarantee profitability, expansion, and charitable giving, Octoblock spearheads initiatives such as the Tentacle Trust, Nautilus Trove, Coral Cove, Treasure Tesla, and Saltwater Sweepstake.

The OCTO platform relies on Crowd-Funded Yield Farming (cFyF), offering amplified yield rates, enhanced governance rights, and eligibility for airdrops. Not only that, Octoblock focuses on environmental sustainability through a collaborative effort with The Tentacle Trust. It aspires to combat climate change through endeavors including the Tesla Giveaway, which is available exclusively to ICO participants.

To learn more about Octoblock here: https://octoblock.io/

Buy Octoblock: https://reef.octoblock.io/register