ONDO price prediction: Checking why recovery is not yet here

- A higher number of addresses held ONDO at a loss at $1..23, suggesting that price could fall again.

- Network activity and open interest decrease, hence, the price could drop to $1.15.

After hitting an all-time high on the 3rd of June, Ondo’s [ONDO] price has now lost 7.11% of its value in the last 24 hours. At press time, ONDO’s price was $1.22 The price decrease could be linked to profit-taking from token holders.

However, this is not the first time that ONDO’s price has decreased, and rallied afterward. Hence, this analysis would focus on ONDO price prediction in the short term.

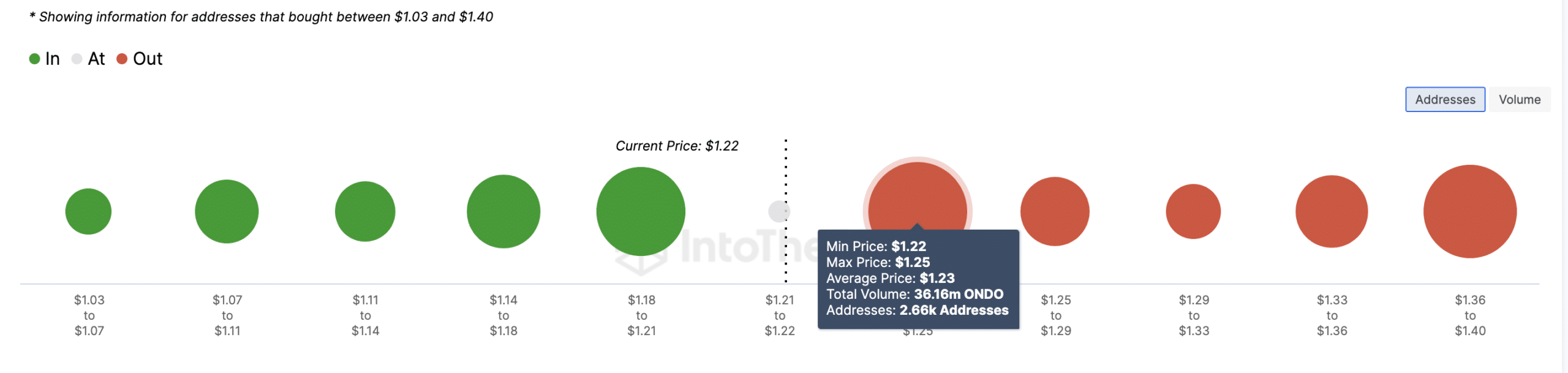

To start with, AMBCrypto looked at the In and Out of Money At Price (OIMAP) indicator. Blockchain analytics platform provides insights into the indicator.

No way out of the decline

The IOMAP shows the number of addresses holding a token at a loss and those holding in profit. It also gives an idea of the average price these addresses bought the cryptocurrency.

If a large number of addresses are in the profit and are more than those in loss, the price could act as support. Thus, it would be difficult for the price to decrease. However if a larger number are in loss, the average price purchased could act as resistance.

At press time we observed that 2,000 addresses bought 76.50 million ONDO tokens at an weighted price purchase of $1.20. On the other hand, 2,660 addresses purchased 36.16 million tokens at an average price of $1.23

Despite buying more tokens at a lower price, the upper region at $1.23 could force ONDO’s price backward. This is because of the higher number of addresses at that point.

If that happens, ONDO’s price prediction could be a decline to $1.15 in the short term. Another metric fueling the potential price decrease is the active addresses.

Watch out ! $1.15 wants to appear

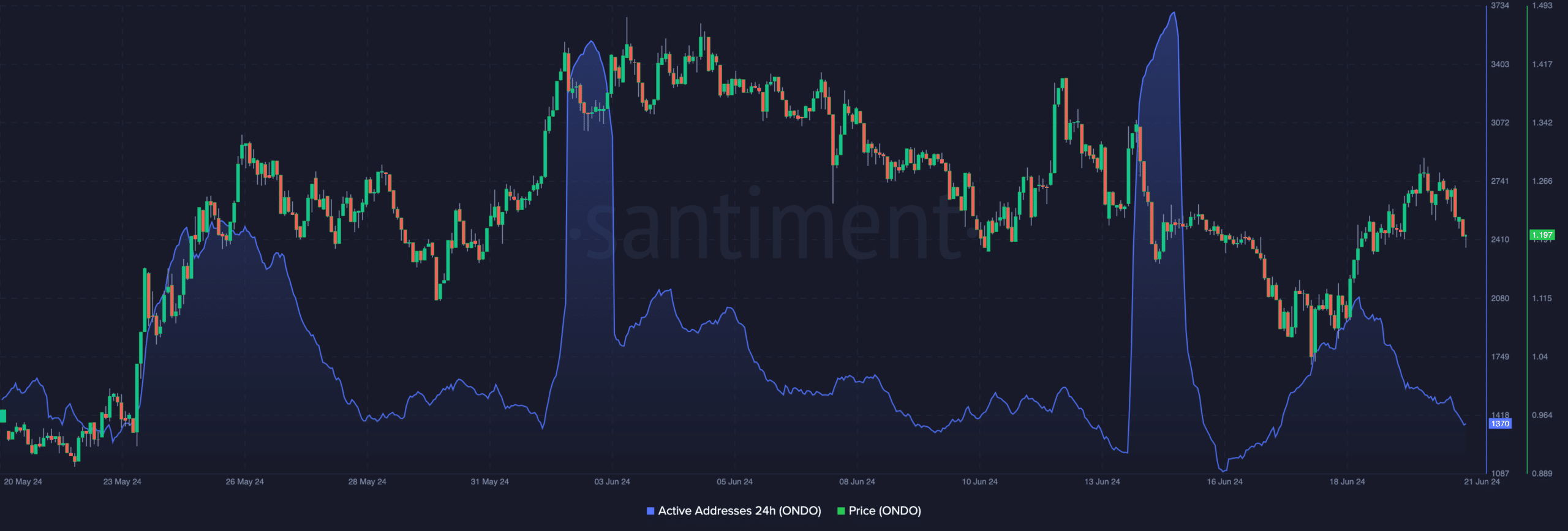

Active addresses show the number of users transacting on a blockchain. An increase in the metric denotes a surge in user activity. On the other hand, a decrease implies that users are refraining from active transactions.

AMBCrypto observed that ONDO’s price increased anytime activity on the network picks up. At press time, the 24-hour active addresses had decreased to 1370. Therefore, considering the correlation between price and the metric, the token could be set for another fall.

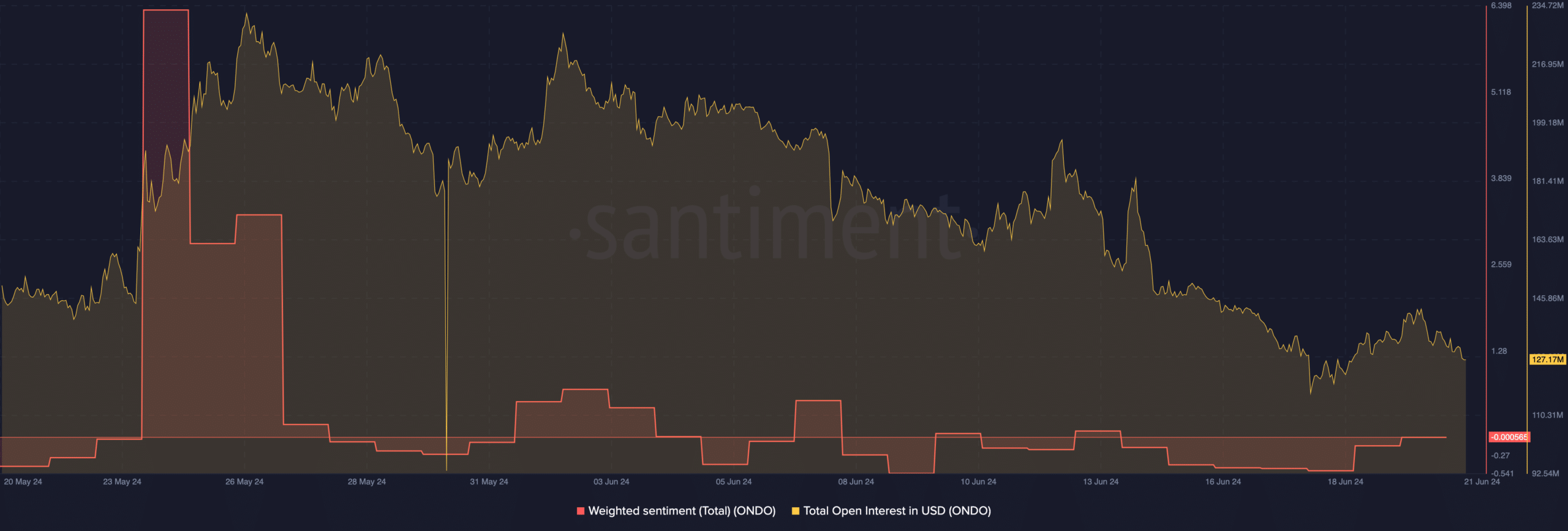

Apart from network activity, AMBCrypto checked the Weighted Sentiment. Weighted Sentiment uses the social volume to measure the comments about a project online. A positive reading of the metric implies that the perception is bullish.

Conversely, a negative reading suggests that there are more negative comments than positive ones. As of this writing, we noticed that the sentiment was negative. Should this remain the case going forward, ONDO price prediction could be a slide down the charts.

When it comes to the Open Interest (OI), it was not any better. An increase in OI would have meant an increase in speculative activity. If this had been the case, ONDO could be looking at recovery.

Realistic or not, here’s ONDO’s market cap in ETH terms

However, the OI at press time, was down to $121.17 million. A. further decrease in the indicator means less liquidity inflows for the token.

Therefore, ONDO’s price prediction in the short could be a decline $1.15 as mentioned earlier.