ONDO sees 7% increase: Will the token reach an ATH in Q4 2024?

- ONDO has seen a 7% price increase, with analysts predicting a major rally by Q4 2024.

- Whale transactions and Open Interest show mixed signals, suggesting cautious optimism.

Ondo [ONDO], the native token of a decentralized finance (DeFi) protocol, designed to offer fixed yield loans backed by yield-generating crypto-assets, is showing signs of recovery after a sharp price decline.

On the 5th of August, ONDO hit a low of $0.52, but over the past week, the token has increased by 7%, with a further 4.3% surge in just the past 24 hours.

This recovery comes amid growing interest from traders and analysts alike, signaling potential upward momentum for ONDO in the near future.

ONDO’s falling wedge signals further rally

Renowned crypto analyst Captain Faibik has recently offered a bullish outlook for ONDO, suggesting that the asset could be gearing up for a major rally by the end of Q4 2024.

In a recent post on X (formerly Twitter), Faibik shared a technical analysis of ONDO, pointing to a falling wedge pattern in the token’s price chart. He stated,

“Keep accumulating ONDO and hold with patience, you’ll thank me later. New all-time high incoming in Q4 2024.”

This prediction has sparked further interest in ONDO, as traders speculate on its potential to break previous price records.

The upcoming weeks could be crucial in determining whether ONDO will experience a breakout.

What do fundamentals suggest?

However, technical analysis alone does not paint the full picture. It is worth also examining ONDO’s underlying fundamentals to determine if actual market conditions support the bullish outlook.

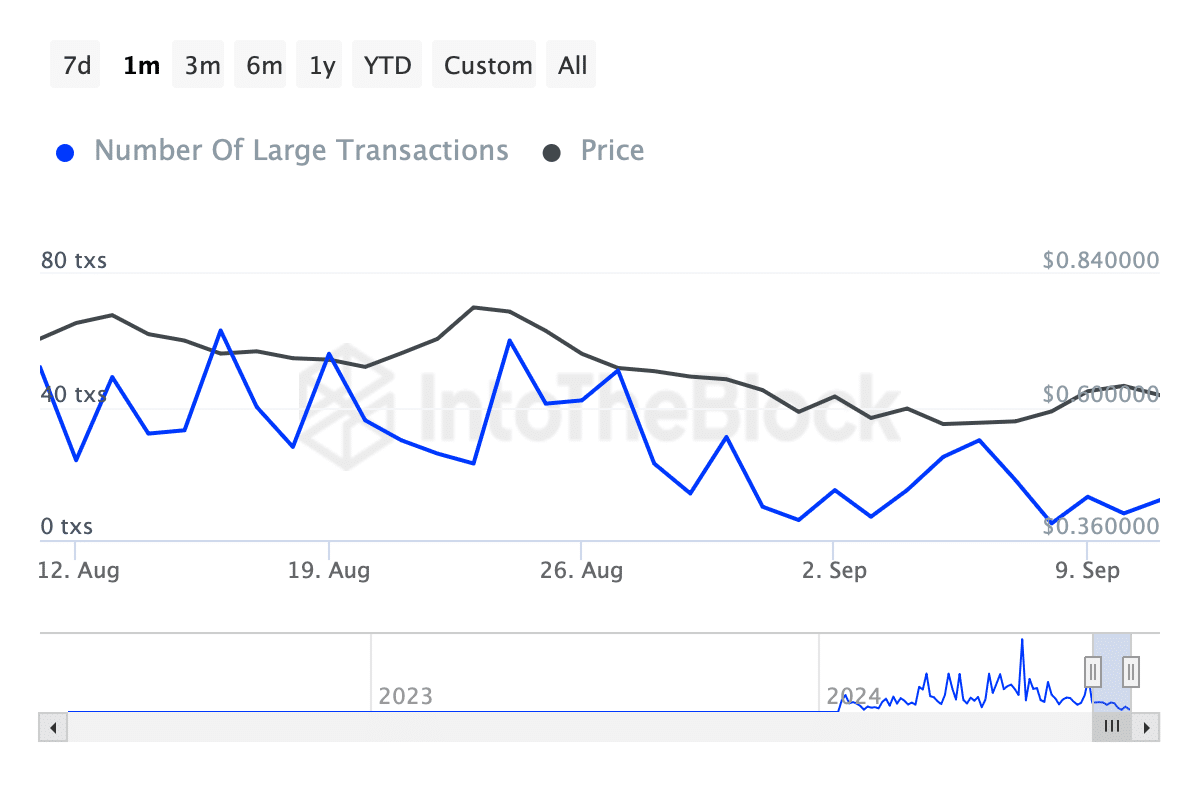

One key dataset to watch is whale activity—transactions involving $100,000 or more. According to data from IntoTheBlock, ONDO’s whale transactions have drastically decreased in recent weeks.

After peaking at over 60 transactions in late August, the number has dropped to just 12 transactions as of press time.

This indicated a decrease in high-volume trades, which could signal lower demand from large investors and may temper expectations of a near-term rally.

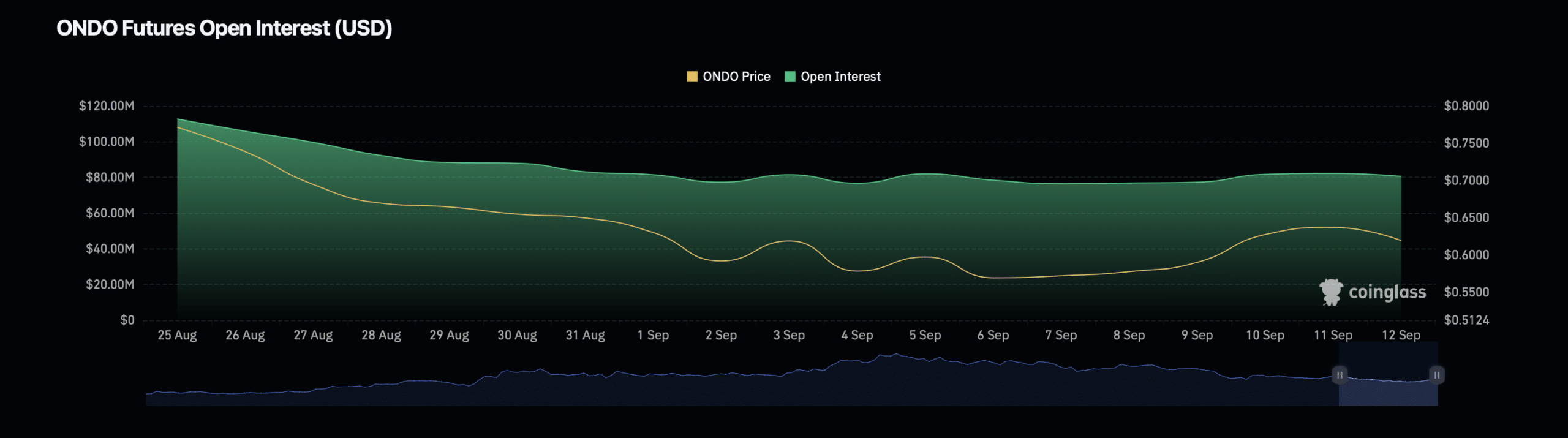

In addition to whale activity, Open Interest also assessed market sentiment. Open Interest refers to the total number of open contracts in Futures and Options markets, which can help gauge the strength of a trend.

According to data from Coinglass, ONDO’s Open Interest has increased by 4.69%, with a press time valuation of $83.12 million.

This rise suggested growing interest in the token, potentially indicating that traders were positioning for a possible price increase.

However, there is a counterpoint to this optimistic outlook. While Open Interest increased, its volume saw a 17.91% decline, dropping to $86.67 million at the time of writing.

Read Ondo’s [ONDO] Price Prediction 2024–2025

This indicated that although more contracts were being opened, the volume of those contracts had decreased, which may imply uncertainty or a lack of conviction among traders.

This divergence between Open Interest and volume could suggest mixed signals in the market, leaving ONDO’s future price action uncertain.