Optimism DeFi TVL drops by 11% in 2024 – Here’s why

- Optimism has recorded an 11% decline in its TVL this year.

- Arbitrum, on the other hand, has recorded TVL growth in the last month.

Leading Layer 2 (L2) network Optimism [OP] has witnessed an 11% decline in its decentralized finance (DeFi) total value locked (TVL) since the year began.

This has been due to the modest retreat in the broader market’s TVL, caused by the dip in the values of most crypto assets in the last month.

According to data from CoinGecko, the global cryptocurrency market capitalization was $1.73 trillion at press time, having logged a 2% decline since the 1st of January.

This followed a 30% surge in general market cap during the bull market run between the 1st of October and the 31st of December 2023.

Optimism versus Arbitrum in the last month

While Optimism has seen a TVL decline in the last month, rival L2 network Arbitrum [ARB] has witnessed its DeFi TVL grow by 4% during the same period, data from DefiLlama revealed.

Optimism’s TVL was $795 million at the time of writing, while Arbitrum’s was $3 billion.

An on-chain assessment of network activity on both platforms showed that Optimism’s TVL decline seemed directly tied to a sharp drop in its user activity since the year began.

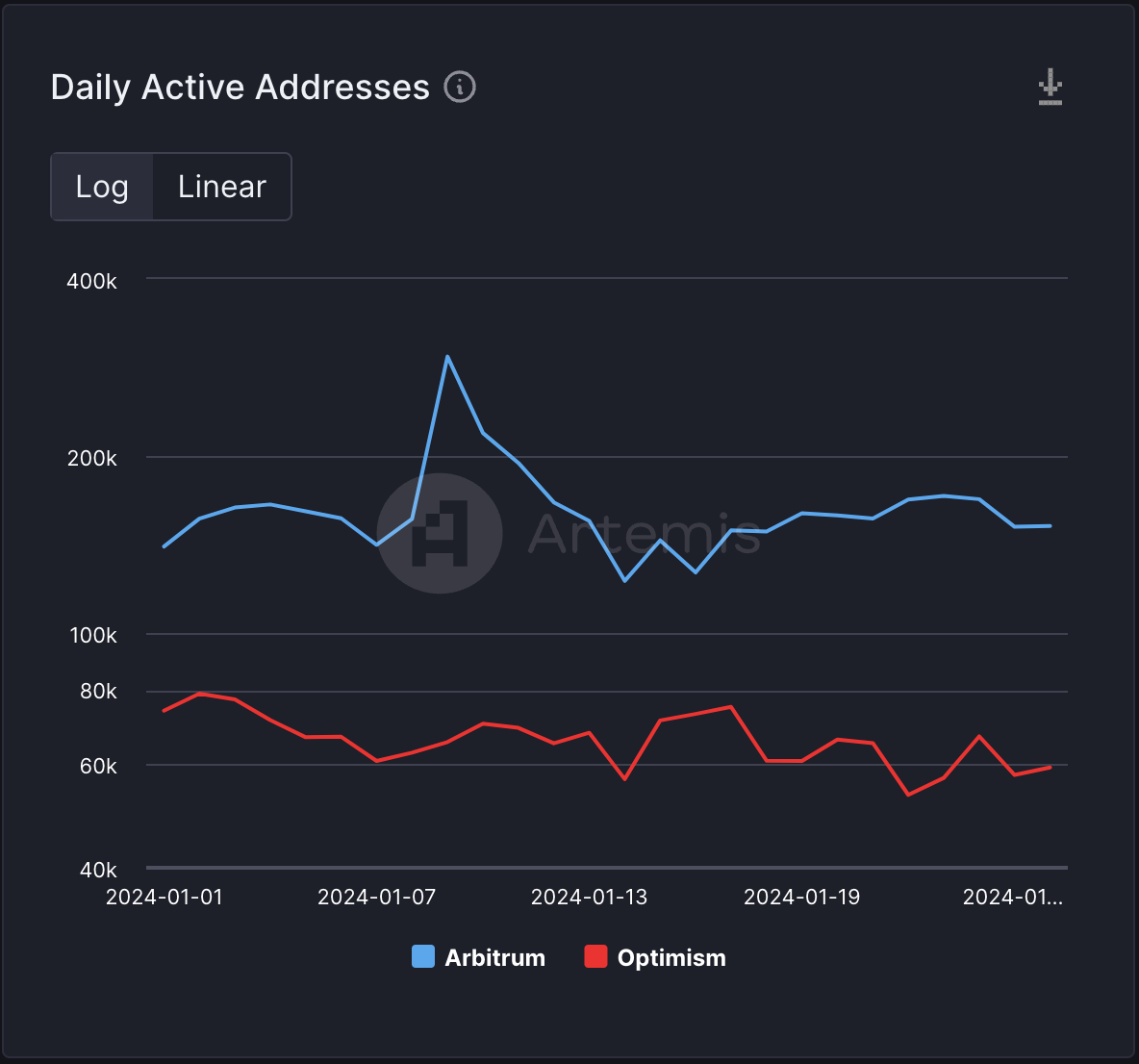

According to data from Artemis, the number of unique wallet addresses that complete at least one transaction on Optimism daily has dropped by 20% since the year began.

For context, as of the 1st of January, the daily active address count on the L2 totaled 74,000. By the 26th of January, it had plunged to 59,000.

In comparison, user activity on Arbitrum has climbed during the same period. Per data from Artemis, the number of daily active addresses recorded on the chain has increased by almost 10% since the year began.

However, despite the uptick in daily active address count, Arbitrum has recorded a drop in its total number of registered on-chain transactions since the year began.

On the 1st of January, the daily transaction count on the L2 was 1.1 million. By the 26th of January, this had dropped below 450,000.

OP holders remain bullish

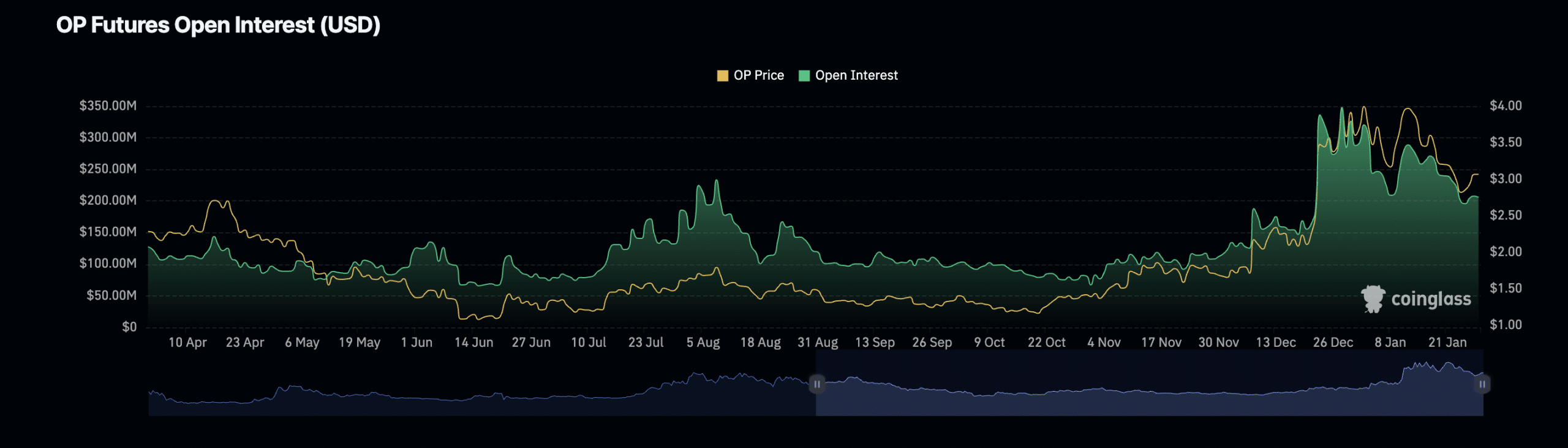

At press time, OP exchanged hands at $3.14. The 17% price decline recorded in the last month has led to a significant decrease in the token’s Futures Open Interest.

How much are 1,10,100 OPs worth today?

According to data from Coinglass, OP’s open interest decline began on the 2nd of January and has since fallen by 36%.

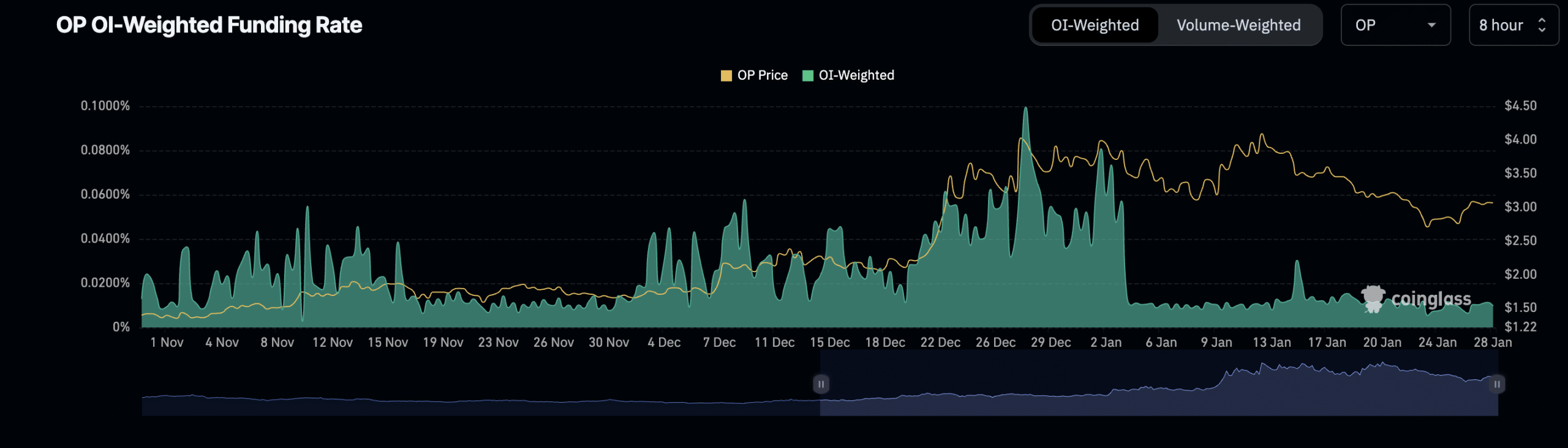

However, despite the persistent price decline, OP’s Funding Rates across crypto exchanges remain positive. This suggested that investors continue to place bets in favor of a price rally.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)