Optimism offered incentives to coax users back to the protocol – Did it pay off?

- Optimism’s recent growth can be attributed to token incentives by various dApps on the protocol.

- Declining activity, falling TVL, and price volatility challenge Optimism’s position in the L2 sector.

Optimism [OP], a prominent layer 2 solution in the crypto world, witnessed substantial growth recently, partly attributable to the token incentives introduced on the protocol.

Is your portfolio green? Check out the OP Profit Calculator

Highly incentivized

Analyst Ryan Holloway highlighted the impact of OP’s incentive program, which led to the protocol’s cumulative trading volume exceeding $3.8 billion. The availability of OP trading rewards and incentives on platforms like Synthetix, Kwenta, and PolynomialFi contributed significantly to this surge in usage metrics.

Just dropped an analysis with @t__norm on the impact of @PolynomialFi's OP incentive program that ultimately led to the protocol's cumulative trading volume surpassing $3.8B

? ? pic.twitter.com/UahucTcVJ0

— Ryan Holloway (@raholloway) September 9, 2023

While these incentives resulted in a remarkable 23-fold increase in trading volume, the growth in daily traders was comparatively modest, indicating a significant rise in power users or potential wash trading activities.

Wash trading refers to the practice of artificially inflating trading volume by repeatedly buying and selling an asset to create a false impression of demand and liquidity.

The sustainability of Polynomial’s retention rates after the incentive program concludes will be a crucial factor in determining its long-term impact on Optimism. It underscores the importance of fostering genuine, organic growth in emerging protocols, rather than relying solely on incentivized trading activity.

State of Optimism

Despite this initial growth, recent data indicated a decline in activity on Optimism. Revenue fell by 37.5% in the last month, and overall activity decreased by 19.7% over the same period.

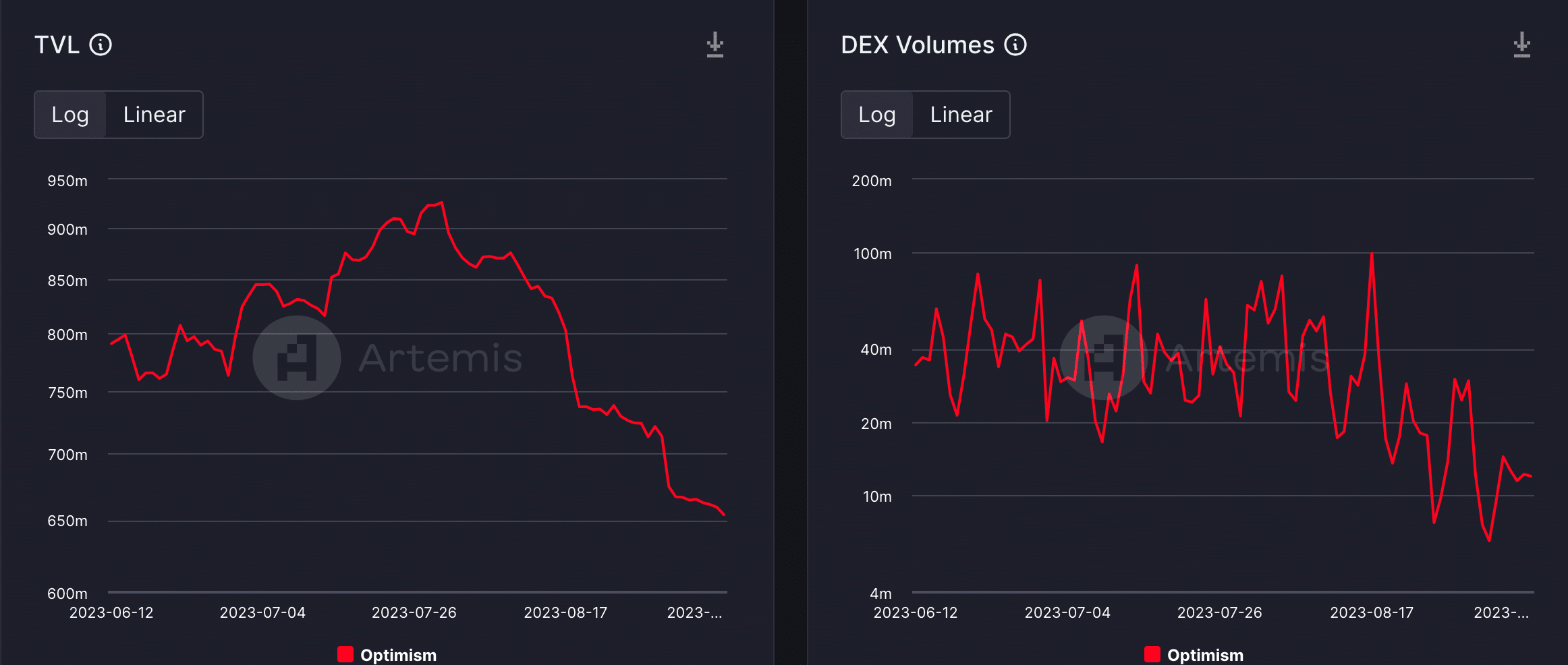

Additionally, Optimism has struggled to gain a foothold in the DeFi sector, which has contributed to its recent challenges. Artemis’ data revealed a significant decrease in total value locked and decentralized exchange volumes on the network in recent weeks.

The optimism protocol would need to improve its state in the DeFi sector to be able to compete with other layer 2 solutions in the crypto sector.

Realistic or not, here’s OP’s market cap in BTC’s terms

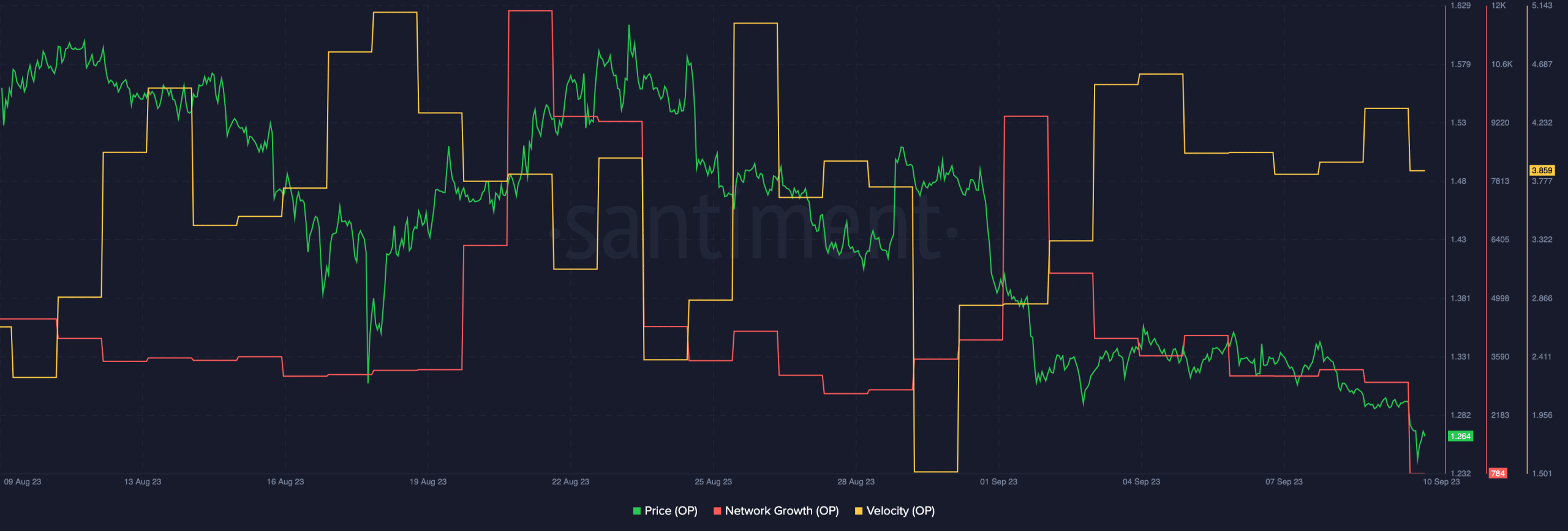

The Optimism token OP has also experienced a decline in price in recent weeks. In terms of network growth, Optimism faced a decrease in activity, suggesting that fewer new addresses were joining the network. This could signal a waning interest in the protocol.

Conversely, velocity, or the speed at which OP tokens were being traded, experienced a significant increase. While this might seem positive, it could indicate more speculative trading rather than long-term adoption. It can potentially contribute to increased volatility in OP token prices.