Optimism [OP] briefs on new upgrade as Arbitrum [ARB] leads in L2 race

![Optimism [OP] briefs on new upgrade as Arbitrum [ARB] leads in L2 race](https://ambcrypto.com/wp-content/uploads/2023/04/AMBCrypto_A_futuristic_and_competitive_scene_representing_the_L_394af78c-0480-4253-9ec6-a13a8ba6bca8-e1682773088145.png)

- Optimism Labs announced that the Optimism Bedrock upgrade entered consensus + feature freeze.

- Optimism’s market share declined to 20.25% in the combined Layer 2 TVL, with Arbitrum now holding 66.58%

Optimism [OP] Labs has announced the latest developments concerning the Optimism Bedrock upgrade. The team announced that Bedrock entered consensus + feature freeze as they prepare for the highly anticipated upgrade. So, what can we expect from this upgrade, and how does Optimism stack up against its rival L2 solution, Arbitrum [ARB]?

– Read Optimism (OP) Price Prediction 2023-24

Optimism Bedrock starts 2-week stability count

The Bedrock upgrade for Optimism, a widely-used Layer 2 blockchain, is almost here. With it comes the exciting promise of lower fees and enhanced compatibility with Ethereum [ETH]. On 29April, OP Labs declared that the Bedrock code was frozen on the Goerli testnet.

On April 27 at 15:13:36 UTC Bedrock entered consensus + feature freeze!

We are committed to achieving 2 weeks of code stability before announcing the date for OP Mainnet's upgrade to Bedrock.

For the most up-to-date info on Bedrock, see Mission Control:https://t.co/StZv3qlbRx

— OP Labs (@OPLabsPBC) April 28, 2023

The team plans to reveal the mainnet launch date for this upgrade once the code proves stable for two weeks. While this news is certainly cause for celebration, it’s worth noting that previous attempts to freeze the code have encountered bugs.

As a result, the team had to extend their stability testing period by another two weeks to ensure a smooth release. Also, according to the site dedicated to tracking progress, the upgrade was currently in internal rehearsals of migration and two weeks stability phase.

Arbitrum trends above Optimism in rollup ranking

Rollups are a Layer 2 scaling solution for Ethereum that bundles transactions together and submits them in batches to the Ethereum mainnet, ultimately resulting in lower user fees.

Optimism and Arbitrum pioneered the optimistic rollup field and became leaders in Layer 2 space. Optimistic rollups are highly compatible with the Ethereum Virtual Machine (EVM), which made them a popular choice.

However, Optimism’s market share was declining as new competitors emerged, including zkEVMs, and the buzz surrounding Arbitrum’s recent ARB airdrop.

According to L2Beat, Optimism registered a record-high Total Value Locked (TVL) of $2.15 billion on 18 March, but currently held only $1.92 billion in assets. Despite this impressive TVL figure, Optimism’s share of the combined Layer 2 TVL declined to 20.25% from a high of over 30% in 2022.

In contrast, Arbitrum currently held $6.32 billion in TVL, roughly two-thirds of the L2 sector.

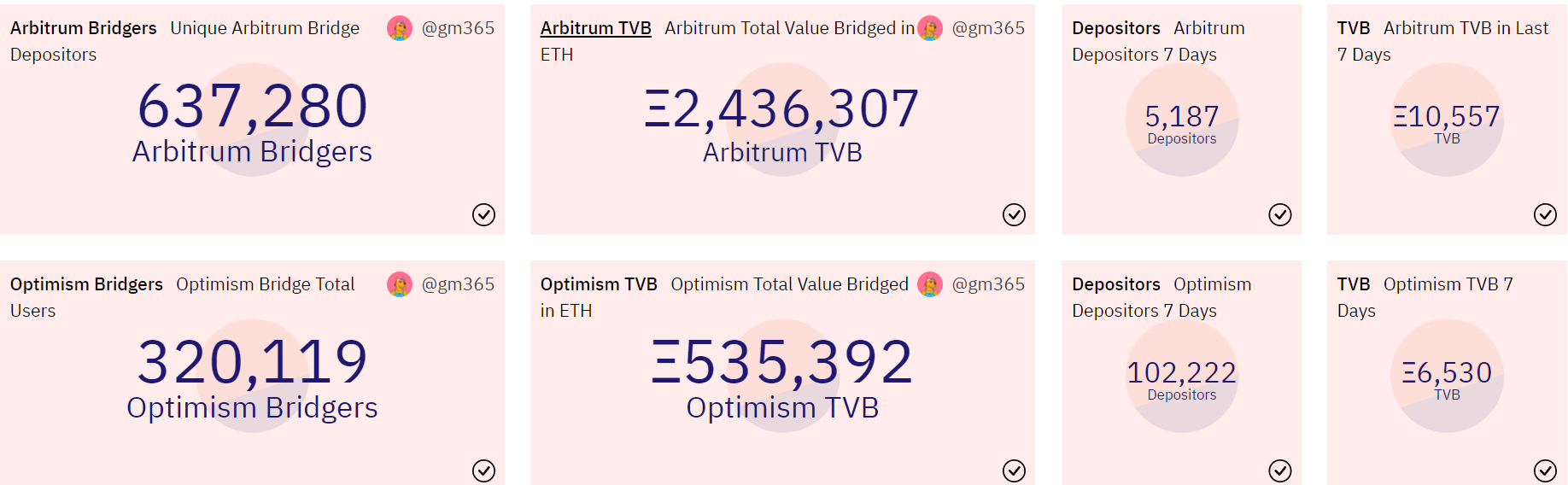

According to Dune Analytics, Arbitrum also surpassed Optimism in several crucial metrics. As of this writing, Arbitrum has over 637,000 bridges, while Optimism has 320,000.

Moreover, the total value bridged on Arbitrum’s platform was more than 2.4 million ETH, while Optimism’s stood at 535,000 ETH. However, Optimism attracted more depositors in the last seven days, with over 102,000, compared to Arbitrum’s 5,000.

– Realistic or not, here’s OP market cap in BTC’s terms

OP on a daily timeframe

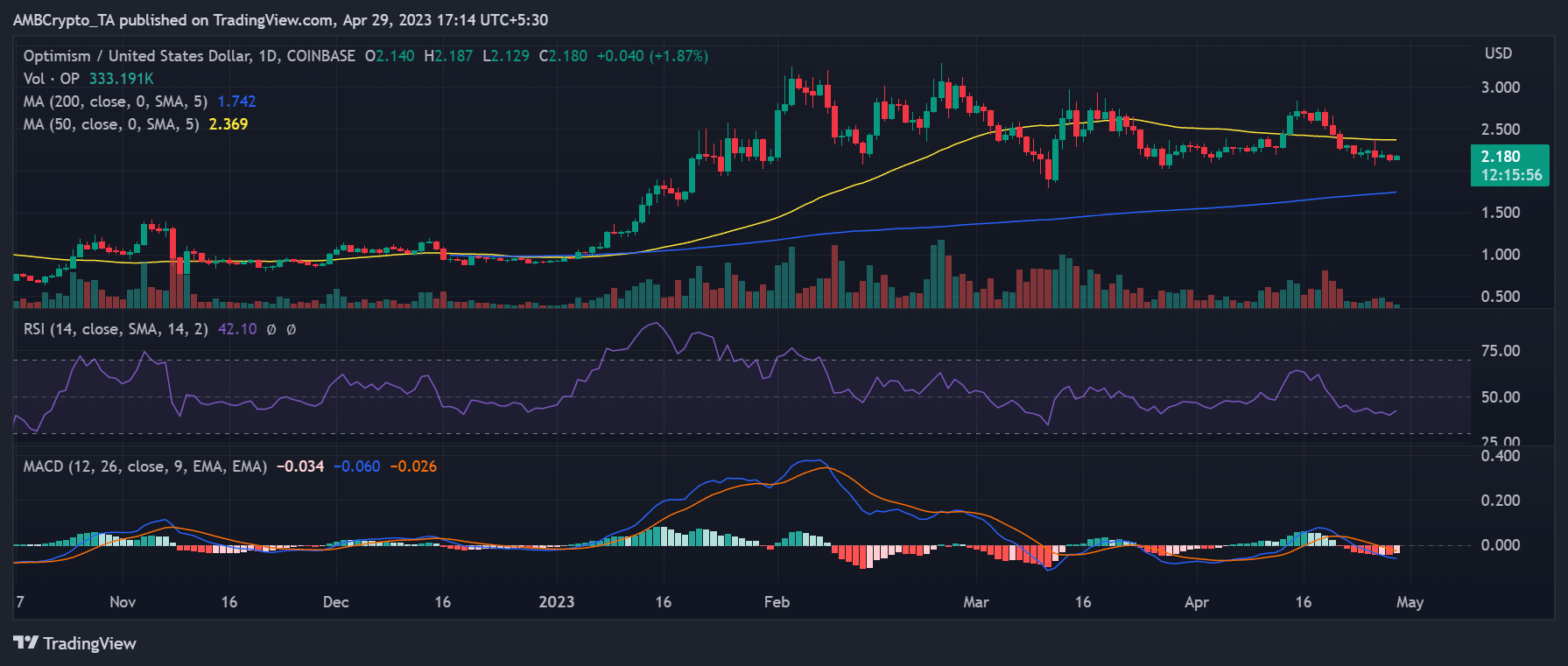

Based on its daily timeframe chart, Optimism’s market has responded positively to the recent developments. At the time of writing, it was trading at around $2.1, registering a gain of nearly 2%.

However, in the previous trading period, it experienced a loss of 1.97%, which offset some of its earlier gains. The token’s overall trend appeared bearish, as indicated by the Moving Average Convergence Divergence, which was below zero.