‘Overheated’ Bitcoin market is cooling – Time to bet on BTC’s price again?

- Drops in funding rates, OI indicated a shakeout of over-leveraged bullish traders

- Market mood changed from one of extreme greed to greed

Bitcoin [BTC] retreated from its previous all-time highs (ATH) this week, dropping by 3.23% to the $67k zone, according to CoinMarketCap. Right now, bullish market participants are eagerly awaiting a rebound to $73k – A level last hit in mid-March.

However, while the king coin languishes on the charts, some of its market indicators are still flashing green.

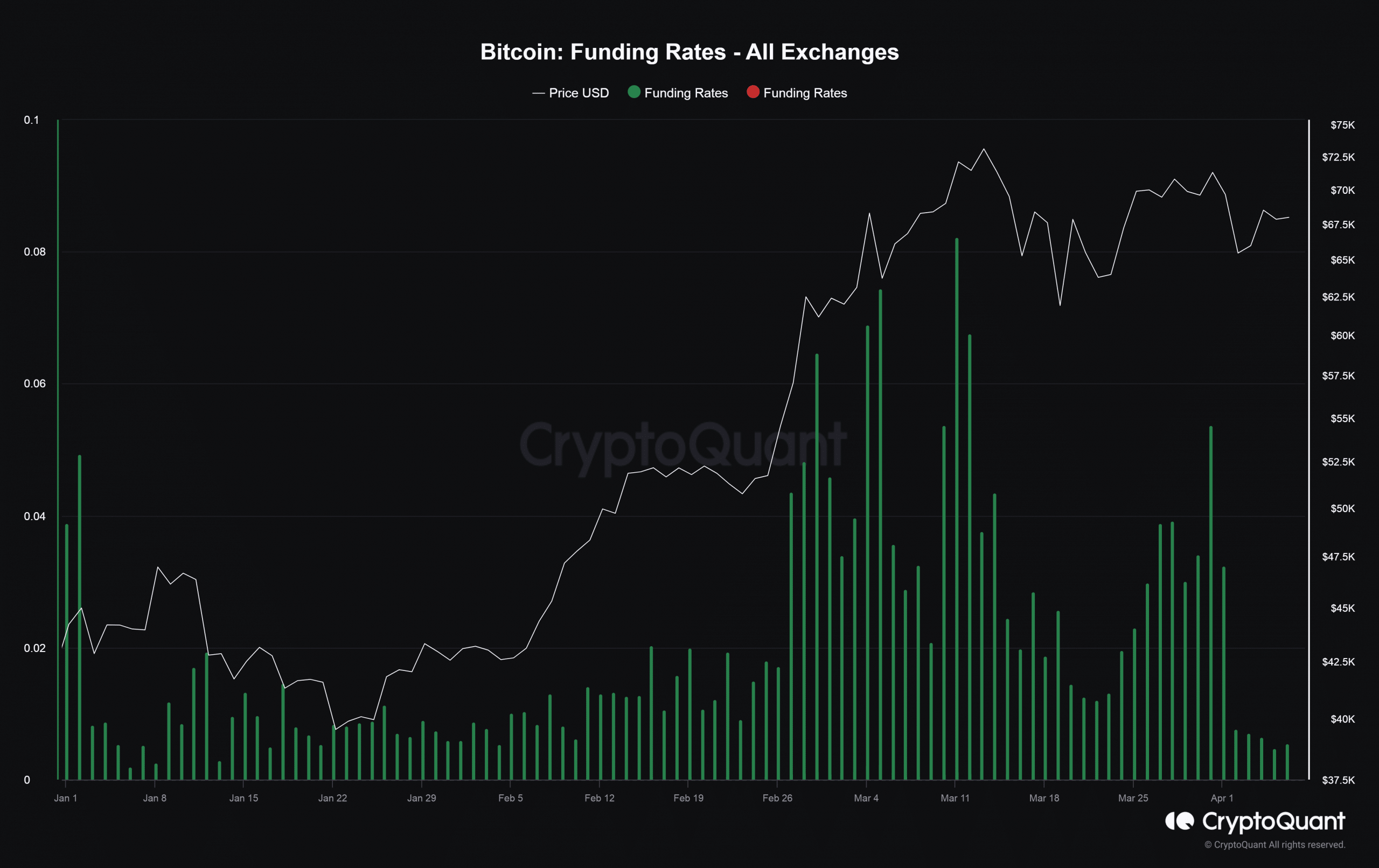

Funding rates normalize

According to J. A. Maartunn, a contributor at on-chain analytics platform CryptoQuant, Bitcoin’s funding rates dropped sharply over the week. In fact, at press time, it was at levels which he deemed as “neutral.”

Typically, drops in funding rates indicate a shakeout of over-leveraged bullish traders. The funding rates soared when BTC hit its new ATH mid-March, a sign of an overheated market. However, with funding rates normalizing, and prices still around $67k, there is now scope for fresh longs entering the market, paving the way for a sustained push north.

The 11% decline in Open Interest (OI) in Bitcoin futures over the week, as per AMBCrypto’s analysis of Coinglass‘ data, also reflected the exit of over-leveraged long positions.

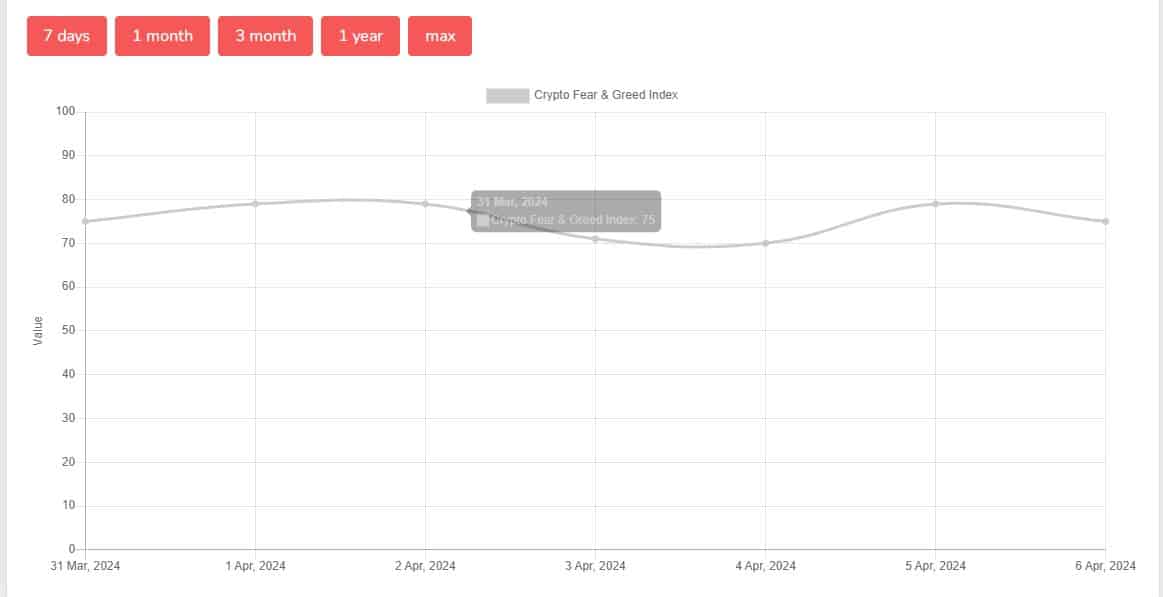

Euphoria starts to subside

The cool-off was further demonstrated by the shift in market mood from “extreme greed” to ” greed” over the week, as per the Crypto Fear and Greed Index. Typically, when the market becomes extremely greedy, it means it’s due for a correction.

Read BTC’s Price Prediction 2024-25

Another bullish trigger for Bitcoin?

What could work in Bitcoin’s favor is that bankrupt crypto-lender Genesis finished selling more than $2 billion of its Grayscale Bitcoin ETF (GBTC) shares. Genesis was primarily driving outflows from GBTC in recent weeks, resulting in Bitcoin’s correction.

However, with reprieve from Genesis’ end, GBTC outflows could slow down significantly, allowing other ETFs to offset this with high inflows, potentially leading to Bitcoin’s rise again.