PancakeSwap: Contrasting metrics and the curious case of CAKE’s future

![PancakeSwap [CAKE]: Contrasting metrics and the curious case of the token's future](https://ambcrypto.com/wp-content/uploads/2023/05/cake-dip.png)

- PancakeSwap v3’s transaction count increased on BNB Chain but declined on Ethereum.

- Though the RSI and stochastic were oversold, metrics remained bearish on CAKE.

PancakeSwap [CAKE] v3’s performance has been decent since its launch, as it registered growth on multiple fronts. Notably, on 9 May, PancakeSwap tweeted that to enable an orderly transition of TVL from v2 to v3, it reduced v2 BNB Chain Farm emissions by 35% as scheduled.

? Farm Emissions Update:

To enable an orderly transition of TVL from v2 to v3, we just reduced v2 BNB Chain farm emissions by 35% as scheduled.

? As we expected, more TVL are shifting to v3, v3 on BNB Chain has successfully attracted $258.73M since launch!

? For TVL info:… pic.twitter.com/LD9YPKKukn

— PancakeSwap?Ev3ryone's Favourite D3X (@PancakeSwap) May 9, 2023

Read PancakeSwap’s [CAKE] Price Prediction 2023-24

Though v3’s state was looking healthy, the same can’t be said for CAKE, whose price has declined by 25% in the last seven days. However, as per CryptoQuant’s data, the tables could turn in the token’s favor soon.

PancakeSwap v3 performing well on BNB, but…

CAKE v3’s performance was on par for quite a few weeks. However, it was interesting to note that while v3 continued to grow on BNB Chain [BNB], it registered a decline on Ethereum [ETH].

CAKE investors were struggling as the token’s price remained low. According to CoinMarketCap, CAKE’s price has fallen substantially over the last week. At press time, CAKE was trading at $1.90 with a market capitalization of over $177 million.

Nonetheless, CryptoQuant’s data gave hope for better days, as the token’s Relative Strength Index (RSI) and stochastic were both in oversold positions, suggesting a trend reversal.

Is a trend reversal possible?

A look at PancakeSwap’s daily chart indicated that investors could expect CAKE’s price chart to turn green over the coming days. CAKE’s Money Flow Index (MFI), after entering the oversold zone, registered an uptick.

Though the Chaikin Money Flow (CMF) was below the neutral mark, it went up slightly, further increasing the chances of a trend reversal. However, the MACD showed that the bears were still ahead in the market, which can be troublesome.

Realistic or not, here’s CAKE’s market cap in BTC’s terms

Metrics are still bearish

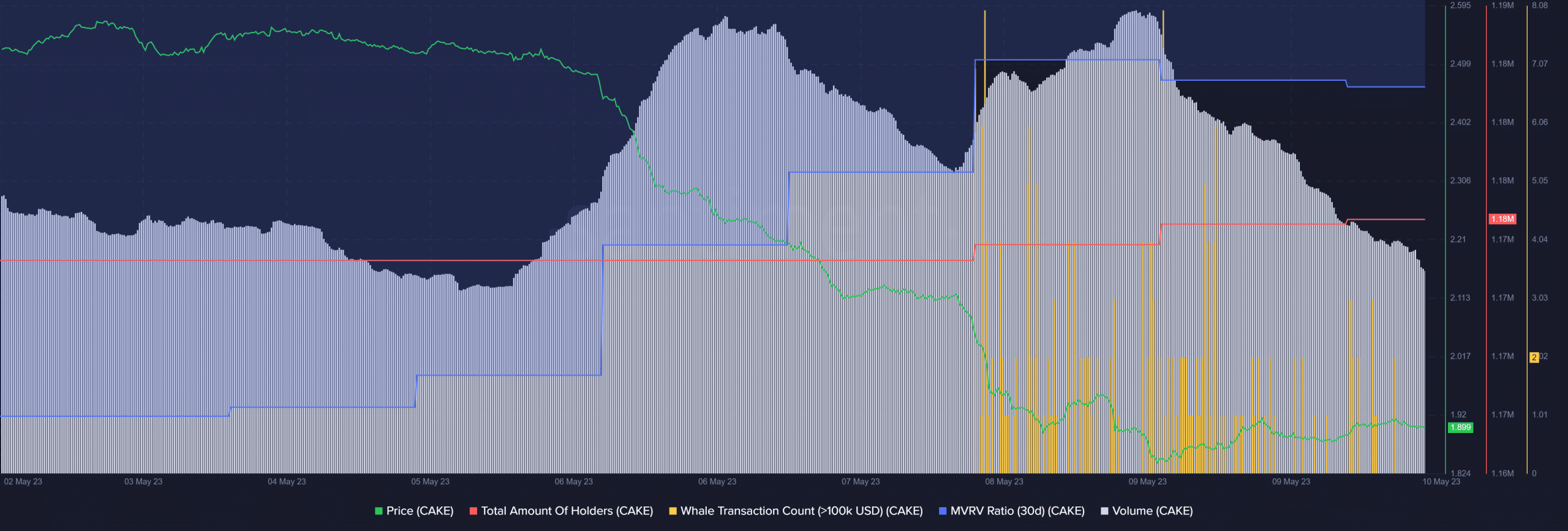

As per Santiment’s chart, while CAKE’s price dropped, it was accompanied by a massive surge in volume, which is typically bearish. Not only that, but whale activity also increased during that period as well.

However, CAKE’s total number of holders increased slightly over the last week. The token’s MVRV Ratio also improved during the past seven days, which was a positive signal.