PancakeSwap’s momentum slowed- Will CAKE form a plateau or go south?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- CAKE formed a bearish rising wedge channel pattern.

- PancakeSwap saw an increase in total value locked (TVL).

PancakeSwap [CAKE] posted about 9% gains after the FOMC announcement. However, its price action in the same period chalked a bearish pattern which could suggest a possible drop in the next few hours/days.

Read PancakeSwap [CAKE] Price Prediction 2023-24

At press time, CAKE traded at $4.305 while Bitcoin [BTC] was below the crucial $23.5K price level. If BTC fails to reclaim the $23.5K zone, bears could continue to devalue CAKE.

CAKE formed a rising wedge pattern: Is a bearish breakout likely?

Is your portfolio green? Check out the CAKE Profit Calculator

CAKE’s price action in the past few days chalked a rising wedge pattern – a typical bearish formation. It means there was a high possibility of a bearish breakout or price reversal. In such a case, bears could break below the wedge and settle at $3.845 in the next few hours/days.

However, such a drop must break key support levels like $4.236, 26-period EMA, $4.144, and $3.950. So, bears can be cautious of the above levels.

Alternatively, bulls could gain influence, given CAKE’s bullish structure at press time, as indicated by the Relative Strength Index (RSI) and On Balance Volume (OBV).

The bulls could inflict a breakout above the wedge and aim at $4.722. Such an upswing would invalidate the bearish bias described above.

PancakeSwap recorded an uptick in TVL in the past few days

According to DefiLlama, PancakeSwap saw an uptick in the total value locked (TVL) in the past few days. On January 31, the TVL was approximately $2.45B, as shown by Token Terminal data. However, the TVL rose to $2.57B at press time.

The uptick in TVL could boost investors’ confidence in the native token, CAKE, which could boost an uptrend rally in the long run.

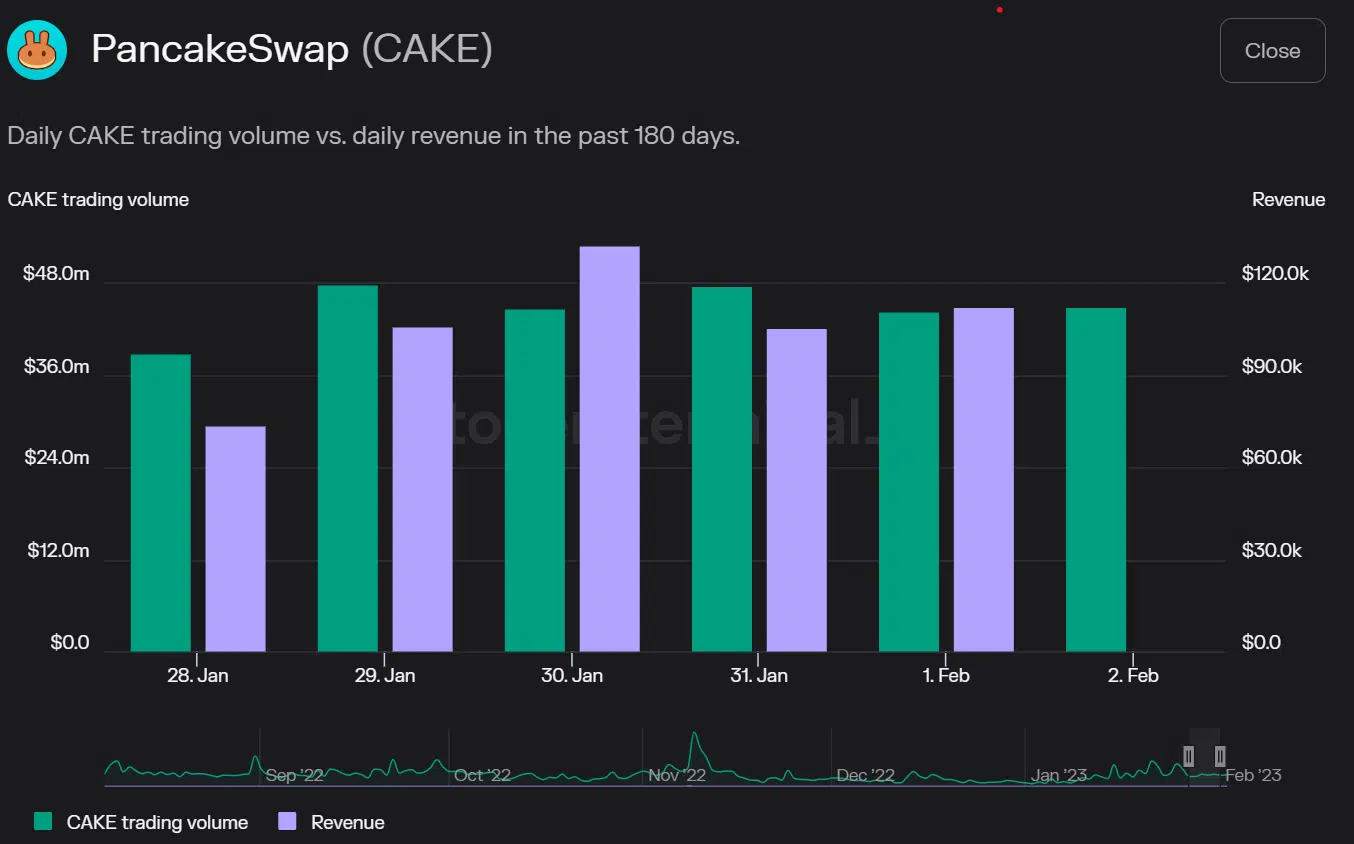

In addition, CAKE recorded an increase in revenue towards the end of January. A similar trend was recorded in the early days of February.

The above-rising revenue and TVL could ultimately boost CAKE to attempt a break above the wedge, invalidating the bearish forecast.

However, a convincing bullish breakout may happen if BTC regains the $23.5K and surges above it. Therefore, investors should track BTC price action before making moves.