PawnHouse completes $2 million financing round to power NFT pricing solutions

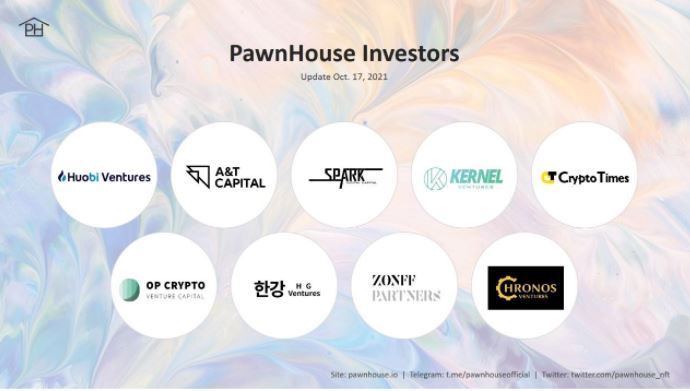

NFT pricing solutions company PawnHouse announced the completion of a $2 million fundraising round. The investors included HG Ventures, Zonff Partners, Crypto Times, Chronos Ventures, and other strategic partners.

The capital will be used to solidify the company’s NFT pricing infrastructure, with the broader goal of improving NFT market liquidity. At the same time, PawnHouse will continue to build its multi-chain and cross-ecosystem NFT structure, and strengthen its operations and development in global markets such as Japan, South Korea, and Russia.

The strategic investors in this round will be crucial partners of PawnHouse going forward. For example, Zonff Partners’ art fund, called VulcanDao, recently purchased CryptoPunks, Meebits, Artblocks, and emerging Asian artists’ digital work. The art fund may cooperate with Pawnhouse in terms of asset borrowing and lending.

HG Ventures from Korea and Cryptotimes from Japan have worked with PawnHouse to host AMAs and build local communities in those respective countries. Chronos Ventures based in Russia will also assist with community building and branding in European markets.

PawnHouse’s non-standard asset pricing model is built on blockchain technology and based on the Simultaneous Multiple Round Auctions (SMRA) theory that won the founders the 2020 Nobel Prize in Economics.

The project offers an asset pricing model that traditional oracle price transfer models cannot price. Under this model, PawnHouse provides a large amount of bidding and quotation information to help assess “private value”, in order to complete transactions and settle on a “common value”.

This model is highly applicable to NFTs because of the unique nature of their assets. With NFTs, they are typically sold through auctions which means their inherent value depends on bidders’ subjectivity.

Transaction prices are dependent on whatever is the “highest bid”. However, for bidders, difficulties settling on a reasonable price point and assessing future liquidity hinder them from making a purchasing decision. This is the bottleneck that is slowing market adoption, particularly amongst institutions.

SMRA theory believes that more information can lead to higher asset values for sellers, where bids are an essential part of asset information. Therefore, more people need to participate in bidding to have more efficient pricing. Although these bids do not affect the final auction transaction price, they can be used as a reference for market consensus.

PawnHouse‘s NFT pricing solution uses SMRA theory and bid information to reduce uncertainty for NFT auctions and make transactions for parties fairer。

In 2020, Peter Frederickson, Chairman of the Nobel Economics Committee, commented: “This year’s economics laureates began with basic theories, applied their results to real-life scenarios, and scaled their operations globally. Their findings have been of great benefit to society.”

PawnHouse believes that better NFT pricing models will enable the market to mature and improve adoption. More individuals and institutions will become comfortable with NFT creation, collection, and investment, leading to ecosystem growth and better liquidity.

Disclaimer: This is a paid post and should not be treated as news/advice.