PEPE or FLOKI – Which memecoin’s price should you keep an eye on?

- Technical analysis showed that PEPE and FLOKI were very similar in their price action in March.

- The NVT metric underlined a potentially pivotal difference between the two tokens.

Pepe [PEPE] and FLOKI [FLOKI] were retracing their gains earlier this month. In the past 48 hours, PEPE shed 12.6%. Meanwhile, FLOKI fell by 15.2% from 21st March highs. AMBCrypto reported earlier that social sentiment weakened behind PEPE as well despite the strong bounce earlier this week.

Bitcoin [BTC] continued to struggle around the $65k mark, with market participants unable or unwilling to enforce a new trend. This retracement could continue as we approach the halving event, leaving altcoins and meme coins vulnerable to bearish pressure.

Comparison of the two meme coins- which is more bullish?

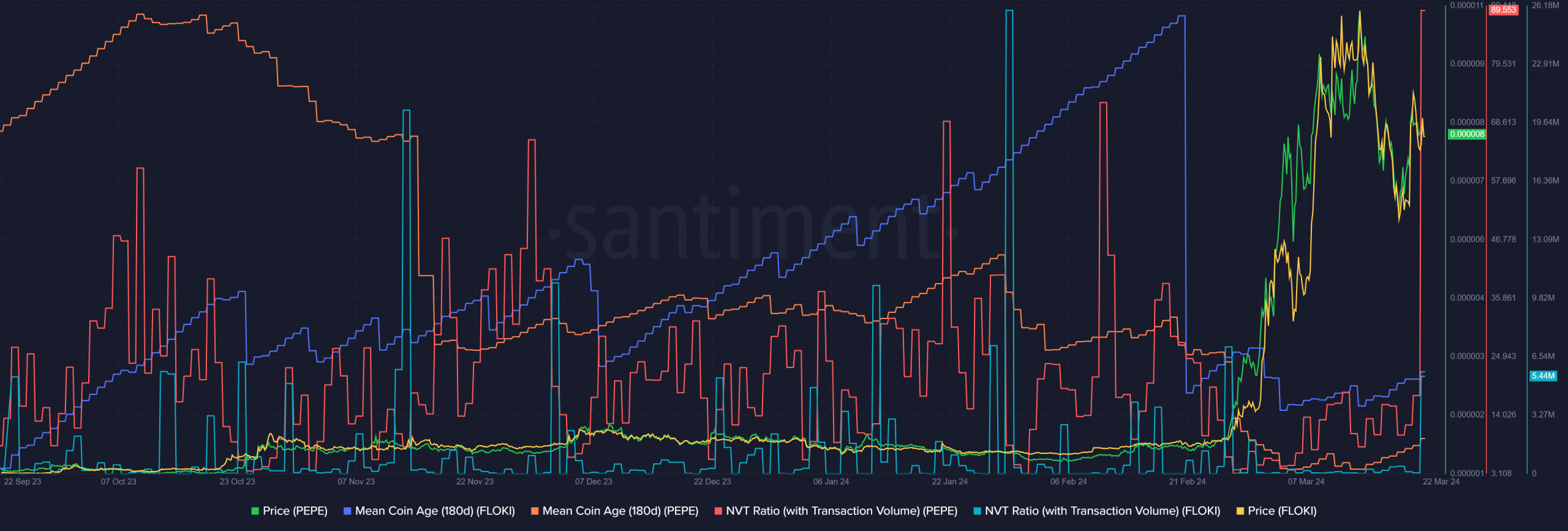

Source: Santiment

AMBCrypto decided to combine the NVT ratio with mean coin age data from Santiment to understand whether the meme coins were overvalued. It could also help determine if network-wide accumulation has resumed after the pullback.

The Network Value-to-Transaction (NVT) metric lets the user relate how much value is moved on the network compared to the network’s valuation. It is calculated by dividing the daily market capitalization by the daily transaction volume.

Meanwhile, the mean coin age is the average age of tokens on the chain. It is a bullish sign when it trends upward, reflecting increased accumulation amongst holders.

For both the meme coins, the mean coin age has only begun to trend higher in the past ten days. It had fallen dramatically even as prices rallied, signaling profit-taking activity. The combination with the NVT gave further insights.

For PEPE, the NVT shot wildly higher on 22nd March while the mean coin age trended higher but was still quite low. This meant that the network was likely overvalued and witnessed increased trading activity and short-term holders.

On the other hand, the NVT of FLOKI was low compared to its late January high. Its mean coin age, while trending upward, was also relatively low.

Therefore, the inference was that the FLOKI market was more undervalued and had the more bullish potential.

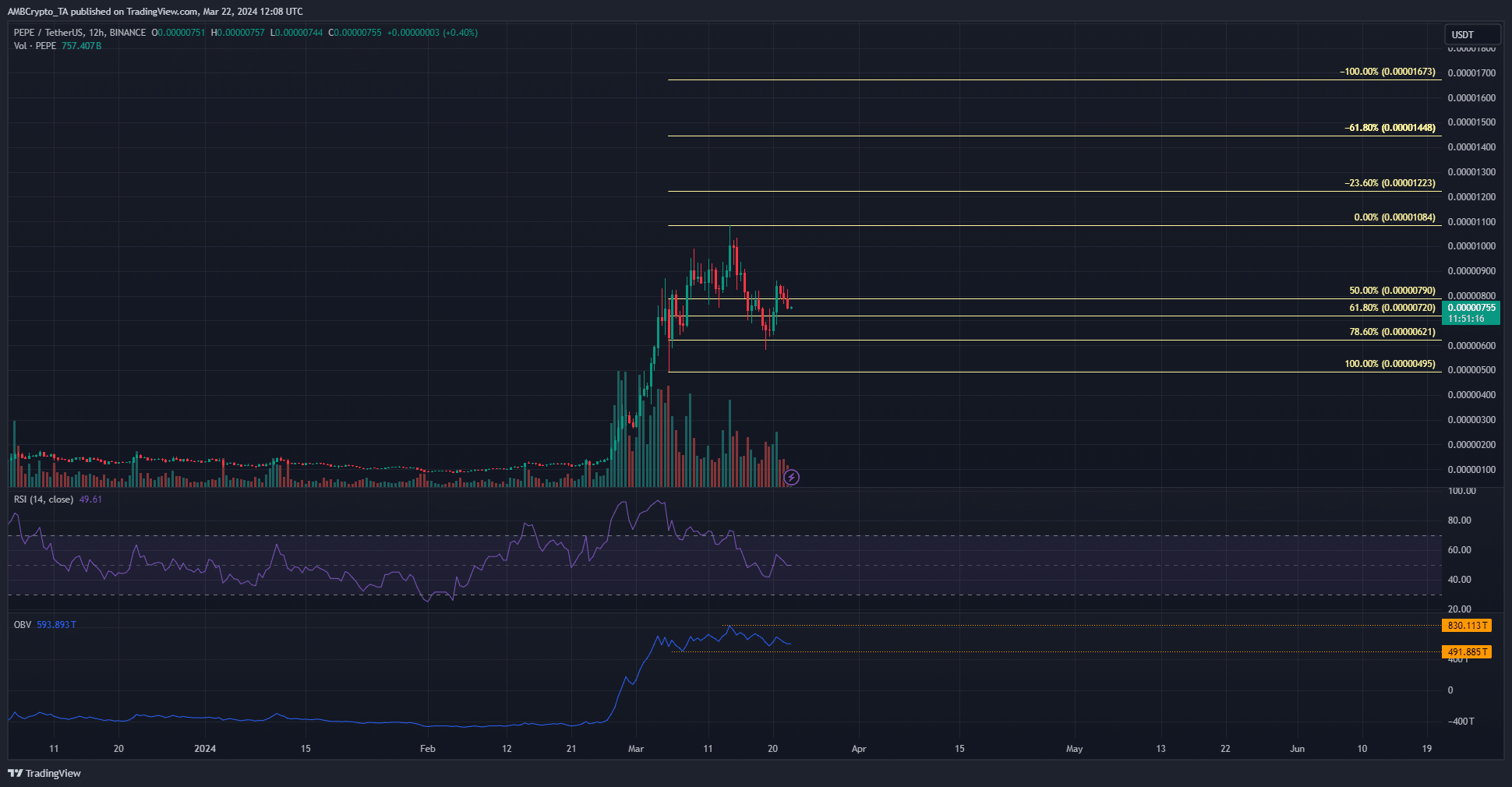

Fibonacci levels mapped out the areas of interest

The 12-hour chart of PEPE showed that prices had retested the $0.00000621 key support level. It bounced by close to 40% just a day later, which underlined that bulls still had some strength.

The market structure in this timeframe remained bullish. However, the RSI was at 49.6, and was an early sign that momentum was shifting in favor of the sellers.

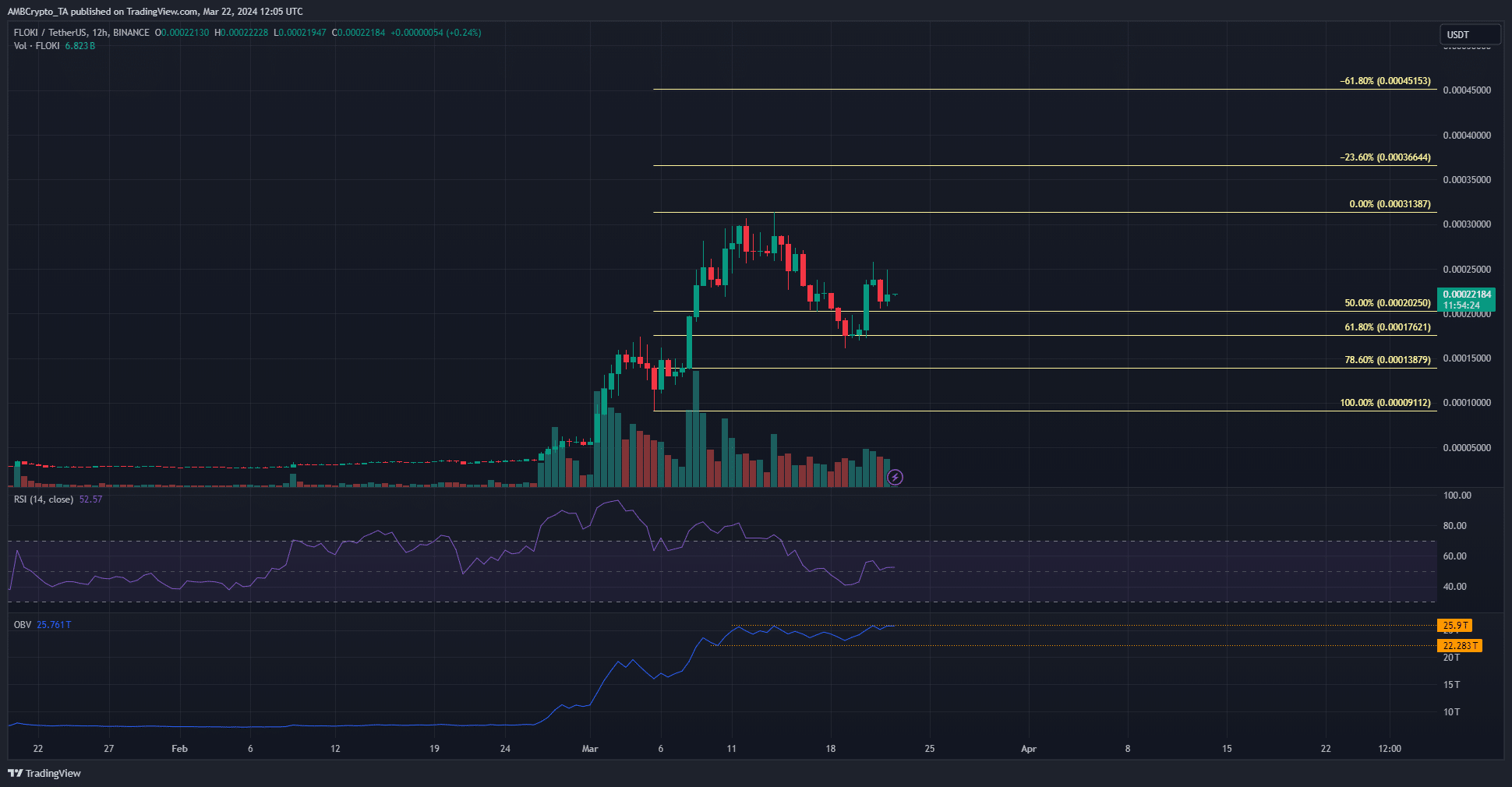

Meanwhile, FLOKI bulls halted last week’s retracement at $0.000176, the 61.8% retracement level. Here too, the 12-hour market structure was bullish. Yet the RSI was at 52.17 and signaled neutral to bearish momentum.

Is your portfolio green? Check the Pepe Profit Calculator

Additionally, the OBV of both the meme coins was trapped within a range over the past ten days. Overall, FLOKI saw a shallower retracement. The on-chain metrics also showed it could be undervalued.

Hence, FLOKI could be a better bet for the coming weeks, but the meme coin market is severely unpredictable.