PEPE whale shifts 2.7T tokens; Should you panic? Well…

- Withdrawals from exchanges outpaced deposits.

- Money flow was low and could hinder a quick pump.

On the 27th of March, a whale transferred Pepe [PEPE], valued at $21.10 million from the KuCoin exchange. According to Whale Alert, this value was equivalent to 2.63 trillion tokens. Moments after the transaction, the price of PEPE dropped.

At press time, PEPE’s price was $0.000007, representing a 1.12% increase in the last hours. But before that, the value of the token declined to $0.000073, indicating that the memecoin felt the impact of the transfer.

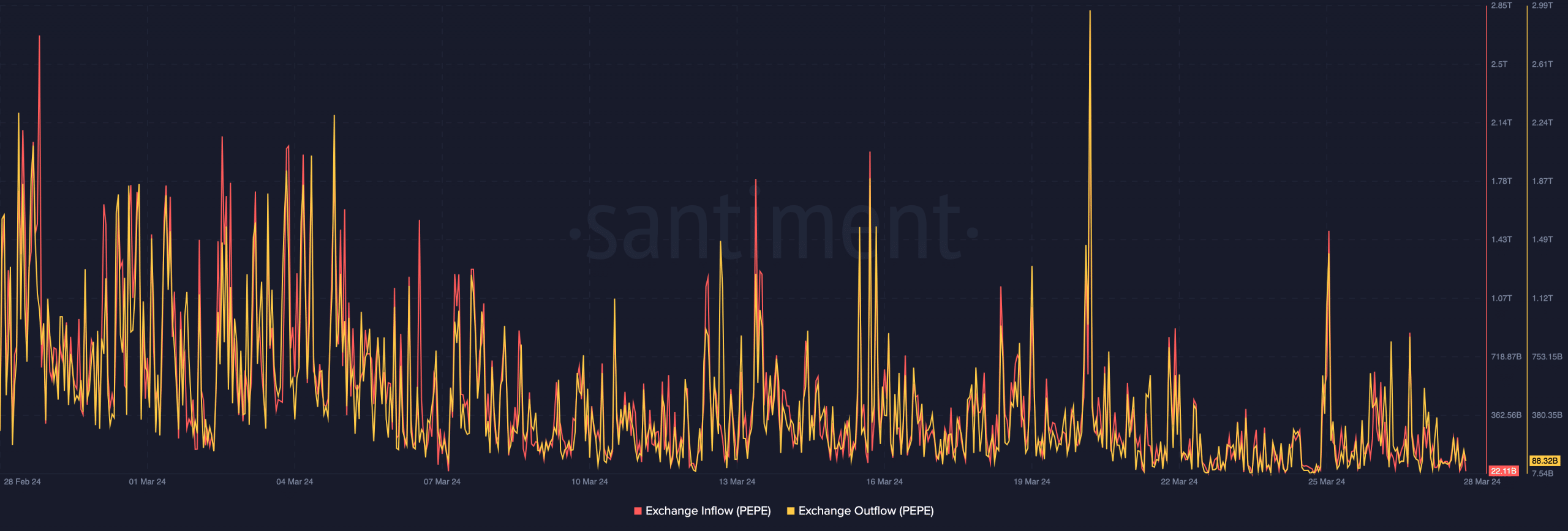

However, on-chain data AMBCrypto analyzed showed that significant respite. To do this, we checked the exchange inflow and outflow.

From the information we got, exchange inflow was 22.11 billion. For the uninitiated, this metric tracks the number of tokens sent from external sources to exchanges.

Price set to be stable

On the other hand, exchange outflow gauges the number flowing out of exchanges. As of this writing, the metric was higher at 88.30 billion. The difference between the metrics suggests that more participants withdrew PEPE to hold for the long term than those cashing out.

Should this remain the case as we head into the weekend, PEPE might stabilize. There is also a possibility that the value of the cryptocurrency might increase toward $0.0000081 in the short term.

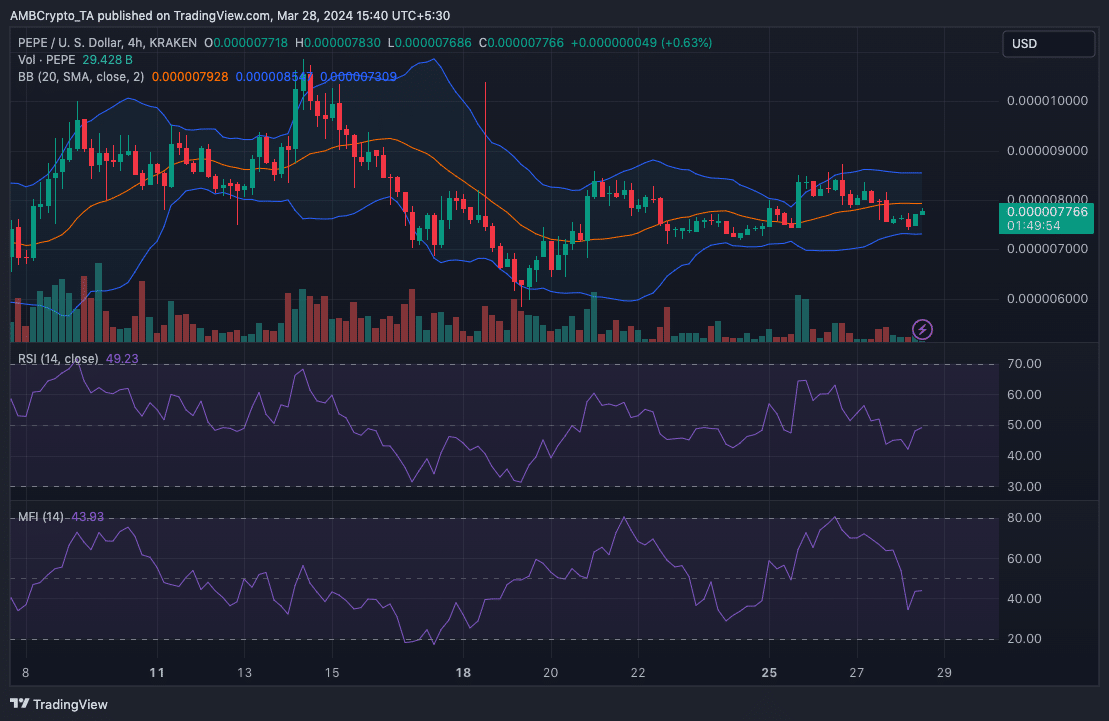

At press time, the Bollinger Bands (BB) showed that volatility around PEP has begun to increase. From a bullish perspective, high volatility and buying pressure could send the price toward $0.0000085.

However, if bulls fail to provide the much-needed strength, PEPE might decline to $0.0000073. Indications from the Relative Strength Index (RSI) showed that the reading was about to cross the neutral area.

A further increase in the RSI might validate the bullish bias and suggest that buying momentum has increased. However, the Money Flow Index (MFI) showed that lots of capital has not flowed into PEPE yet.

No more selling pressure

With position, bulls were not yet armed with the right liquidity to trigger a significant jump. Hence, the price of the token might swing sideways for a while before the predicted rally comes into play.

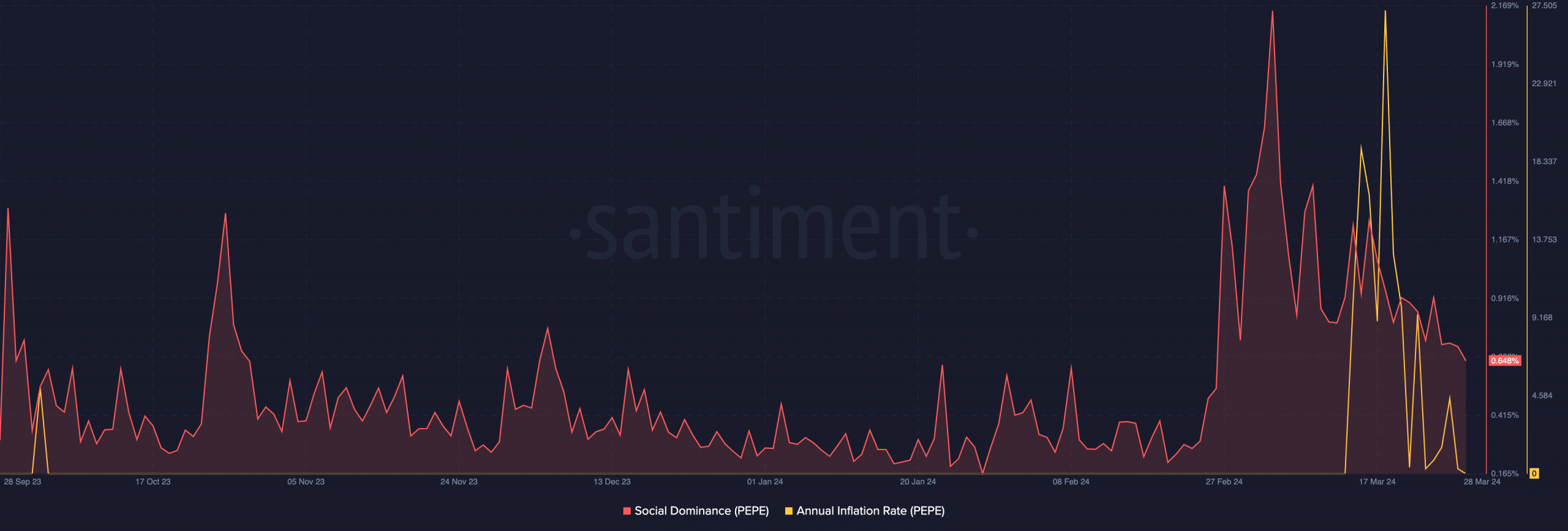

Concerning social dominance, AMBCrypto observed that the metric dropped. The decline in the metric, suggests that discussions around PEPE have decreased.

The social dominance decrease is a positive sign when placed with the price action, as it could imply that the value was close to its bottom. Another indicator we analyzed was the annual inflation rate.

On the 27th of March, the annual inflation rate jumped, indicating that sellers were “dealing” with PEPE. However, the metric declined at press time, suggesting that the selling pressure on the token had reduced.

Read Pepe’s [PEPE] Price Prediction 2024-2025

Moving on, PEPE might experience a surge soon. However, market participants might need to watch out for changes in the market.

Should sentiment flip bearish, the potential increase might be invalidated.