PEPE’s bullish week: Prices up 39%, but traders should be careful as…

- PEPE’s price has risen by 39% in the past seven days.

- However, its negative funding rate shows that futures traders anticipate a price decline.

The value of the Solana-based memecoin Pepe [PEPE] has climbed by over 35% a week after leading cryptocurrency exchange Coinbase first announced that it would list the altcoin’s perpetual contracts.

As of this writing, PEPE exchanged hands at $0.000006692 and ranked as the fourth crypto asset with the most gains in the past seven days, according to CoinMarketCap’s data.

The bears say their goodbyes

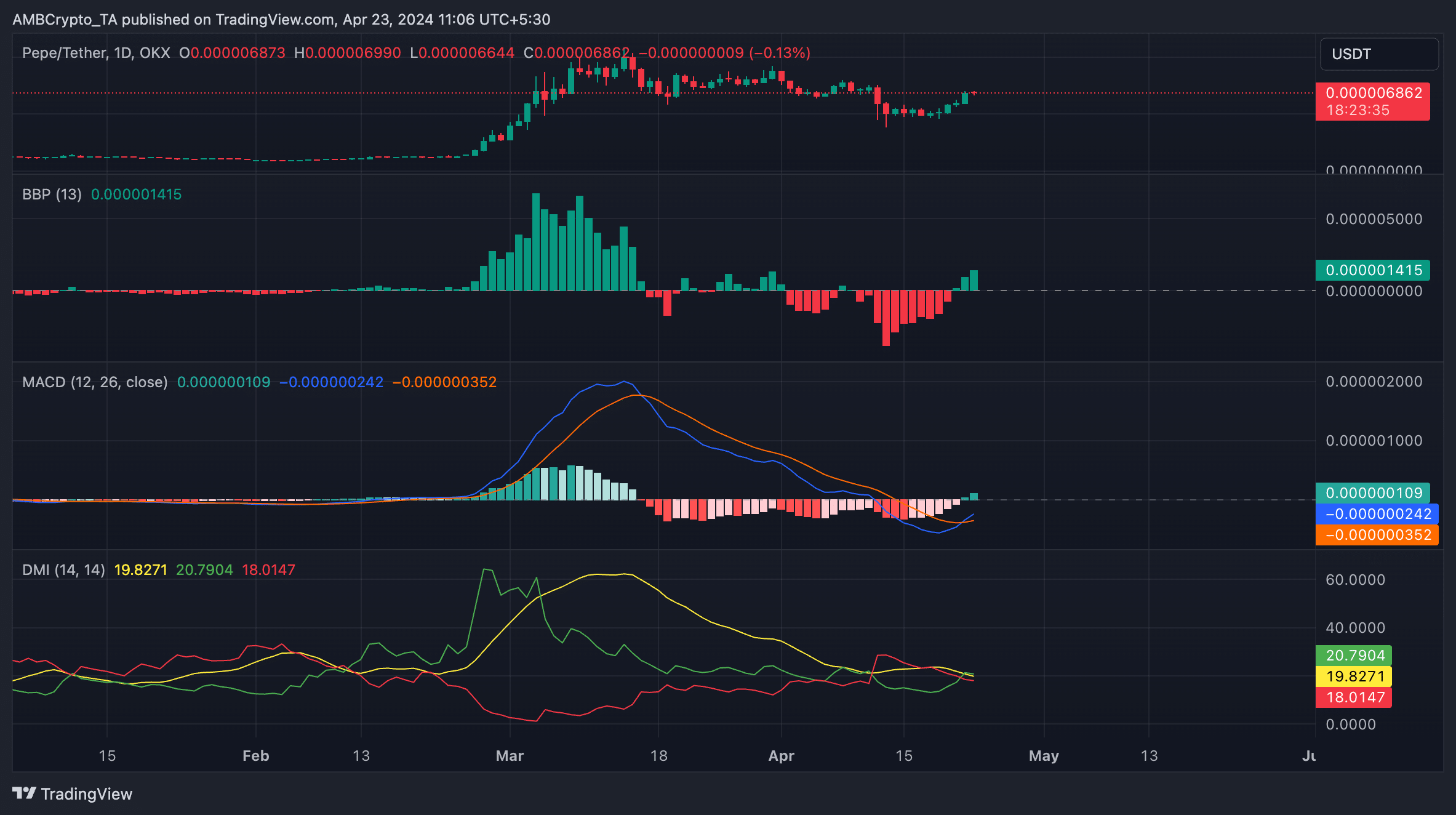

An assessment of PEPE’s price performance on a 1-day chart revealed the re-emergence of the bulls and a significant decline in bearish sentiments.

Signaling the shift in market sentiment from bearish to bullish, PEPE’s MACD line (blue) crossed above its signal line (orange) during the intraday trading session on 22nd April.

This crossover often suggests that an asset’s market momentum is turning more bullish. Market participants usually interpret it as a buy signal to take long positions and exit short ones while they wait for further price increases.

However, it is key to point out that while PEPE’s MACD crossover signaled a shift in market momentum from negative to positive, it remained below the zero line at press time.

This indicated that while bullish pressure might have risen, some bearish elements remained in the market.

Confirming the rise in bullish momentum, PEPE’s Elder-Ray Index returned a positive value at press time.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is positive, it means that bull power dominates the market.

At the time of press, the value of PEPE’s Elder-Ray Index was 0.0000014.

Further, readings from PEPE’s Directional Movement Index (DMI) showed that its positive directional index (green) crossed above its negative index (red) on 22nd April.

This upward intersection of the positive index with the negative index is also regarded as a bullish signal, as it indicated that the market was experiencing a stronger uptrend than a decline.

Why caution may be necessary

In the coin’s derivatives market, its futures open interest has been in an uptrend since 20th April. According to Coinglass, it has since risen by 62%. At press time, PEPE’s futures open interest was $63 million.

Read Pepe’s [PEPE] Price Prediction 2024-25

However, despite the steady rise in the memecoin’s value in the last week and the 3% price gains logged in the last 24 hours, PEPE’s funding rate across crypto exchanges was negative at press time.

This showed that during the early trading hours on 23rd April, futures market participants increasingly opened short positions, betting against the memecoin.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)