Poised for a breakout, is a 50%-100% rally possible for LRC

Loopring has emerged to become one of the most promising projects in the cryptocurrency sphere today. In fact, it was one of those coins that gained by over 10x in early November 2021, going from $0.4 to hitting an all-time high of $3.86. However, since December 2021, its performance has been somewhat lacklustre.

With Bitcoin falling by nearly 50% from its own ATH, nearly 75% of LRC’s market cap has been wiped out. However, it seems it has finally bottomed out and may be a very attractive option as the broader crypto-market begins to recover.

A close look at LRC’s technical structure and one can clearly make out that the price strongly broke out of a descending triangle pattern a few days ago and attempted to breach the immediate resistance level of $1.2. Despite the fact that it was unable to do so, the technical structure still remains very optimistic and any eventual breakout over $1.2 would result in a minimum 50% rally till around $1.8.

Along with that, the RSI indicator is seeing rising momentum, as indicated by the yellow line.

So overall, it can spend some more time in the accumulation zone as the broader market regains its steam and mount a recovery soon after.

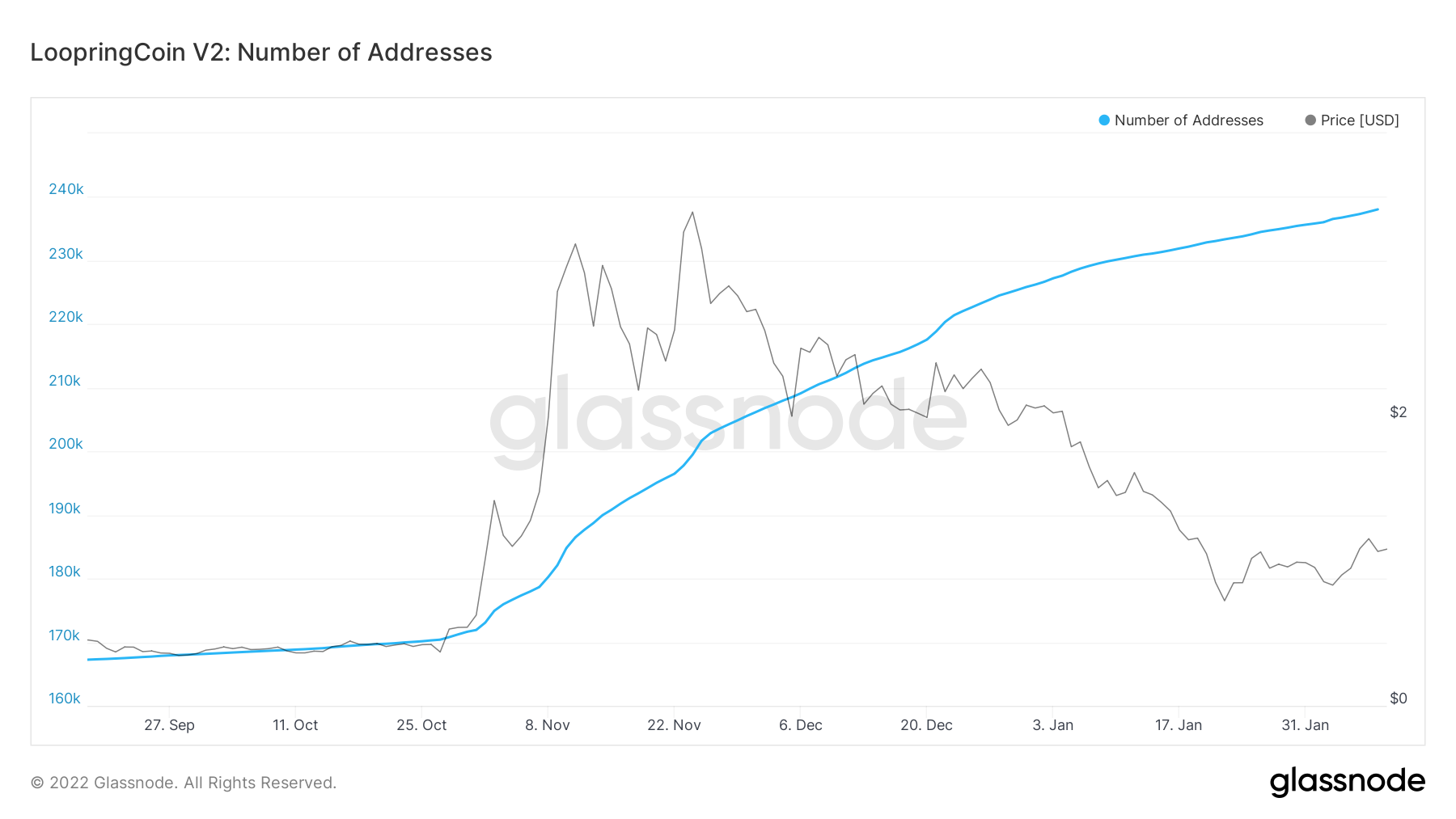

Along with technical indications, on-chain metrics also suggest positivity is on the rise. The total number of addresses holding LRC has managed to remain high, despite the two-month long bearishness. This clearly suggests that despite weak price action, people’s conviction for this project is still at an all-time high.

However, there is another worrying metric related to this.

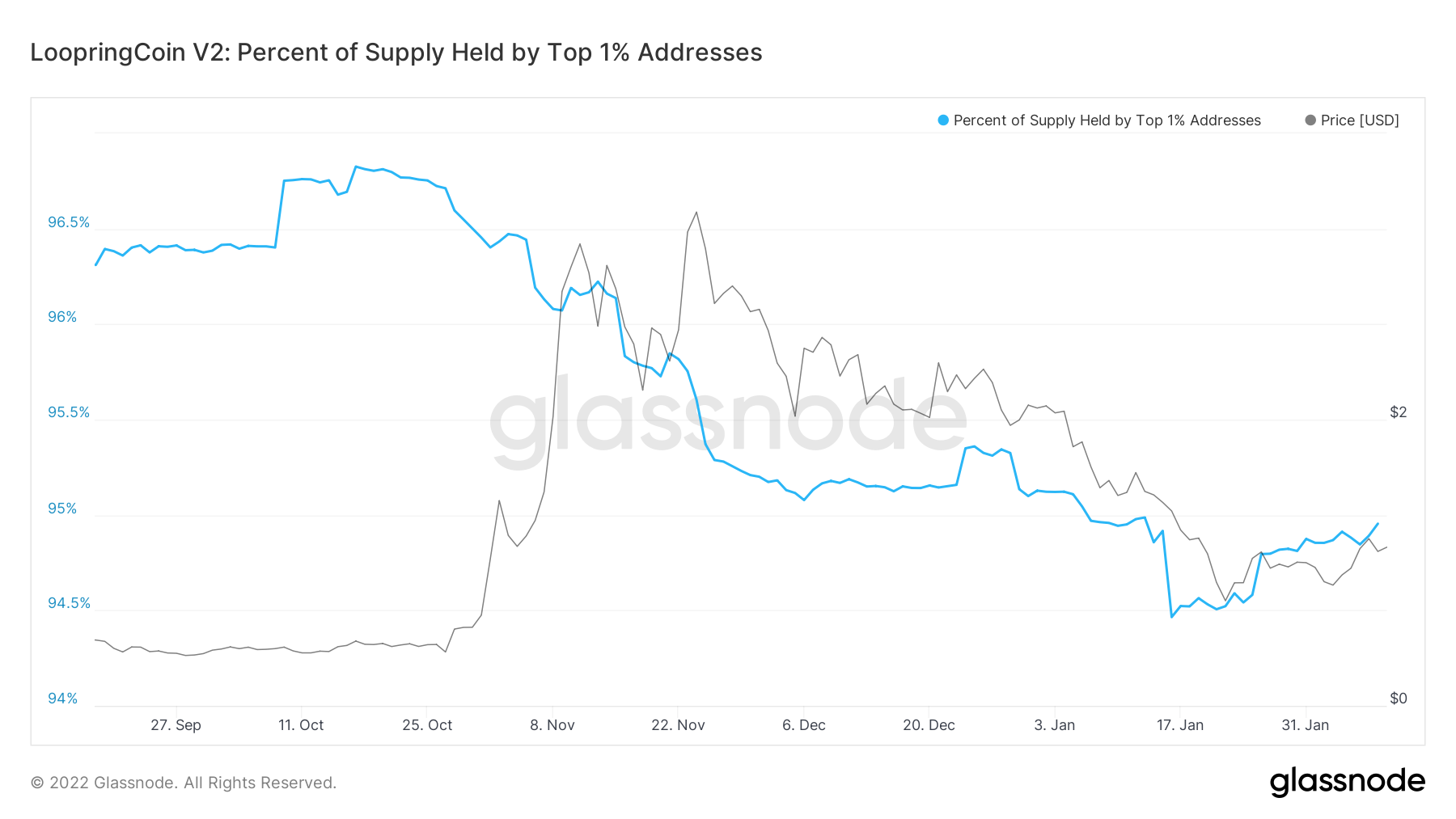

The supply of top 1% of addresses holding LRC has gone down with the price over the past two months. This could mean one of two things – depending on the situation. The first, more worrying one, is the fact that bigger players cashed out of the coin right at the peak of its rally.

But the second inference from this suggests more retail players have bought the dip, keeping the number of addresses holding this coin at its ATH despite the correction.

Back to good news, LRC’s MVRV-Z score is just inches away from breaking into positive territory, suggesting that a price recovery from hereon can bring it back to a properly valued position.

This gives people a unique opportunity to buy into the coin at a lower valuation before the price regains its old status.

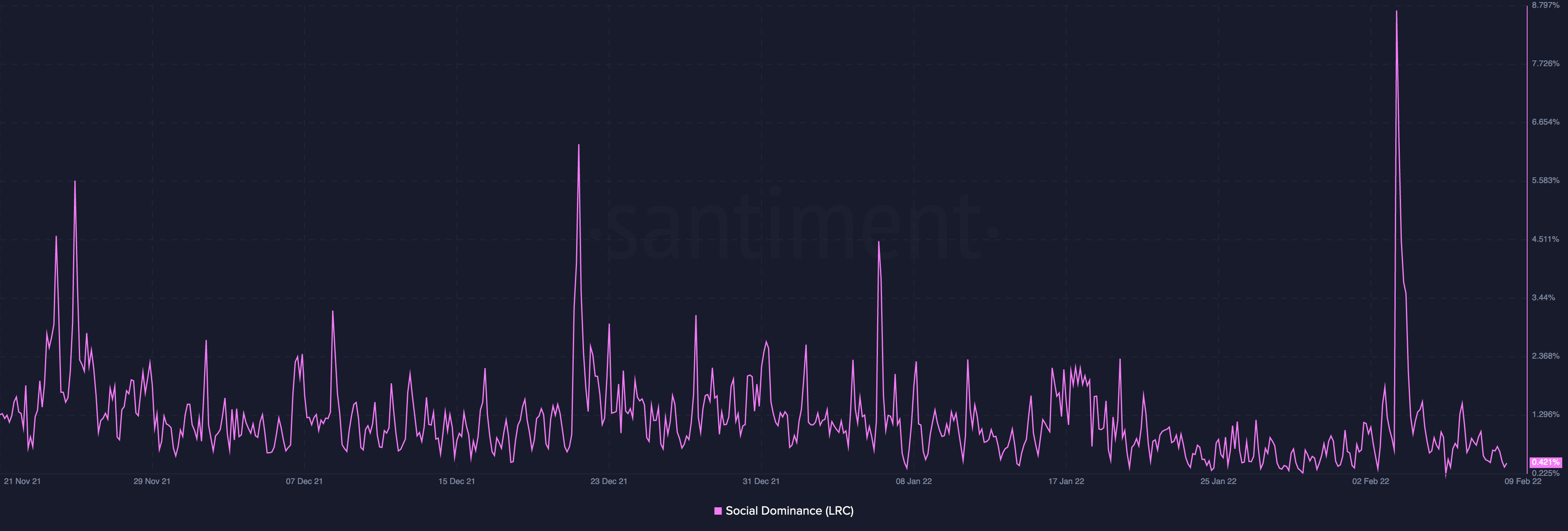

Social dominance has also been on the rise recently, especially with recovery starting to brew in the market. Between 4-5 February, when the price of LRC rose by nearly 50% from $0.8 to $1.2 – social media dominance data from Santiment also projected a major uptick.

Despite some headwinds from the broader market sentiment and sell-offs by the top 1% of LRC holding addresses, it seems the coin is well on its way to mount a recovery. And, investors can potentially bag 50-100% rallies from the coin.