Polkadot bounces from $4.32 to…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure remained bearish but high volatility was seen in the past four days.

- Despite Polkadot’s bounce to $4.8, indicators pointed toward a lack of buying pressure.

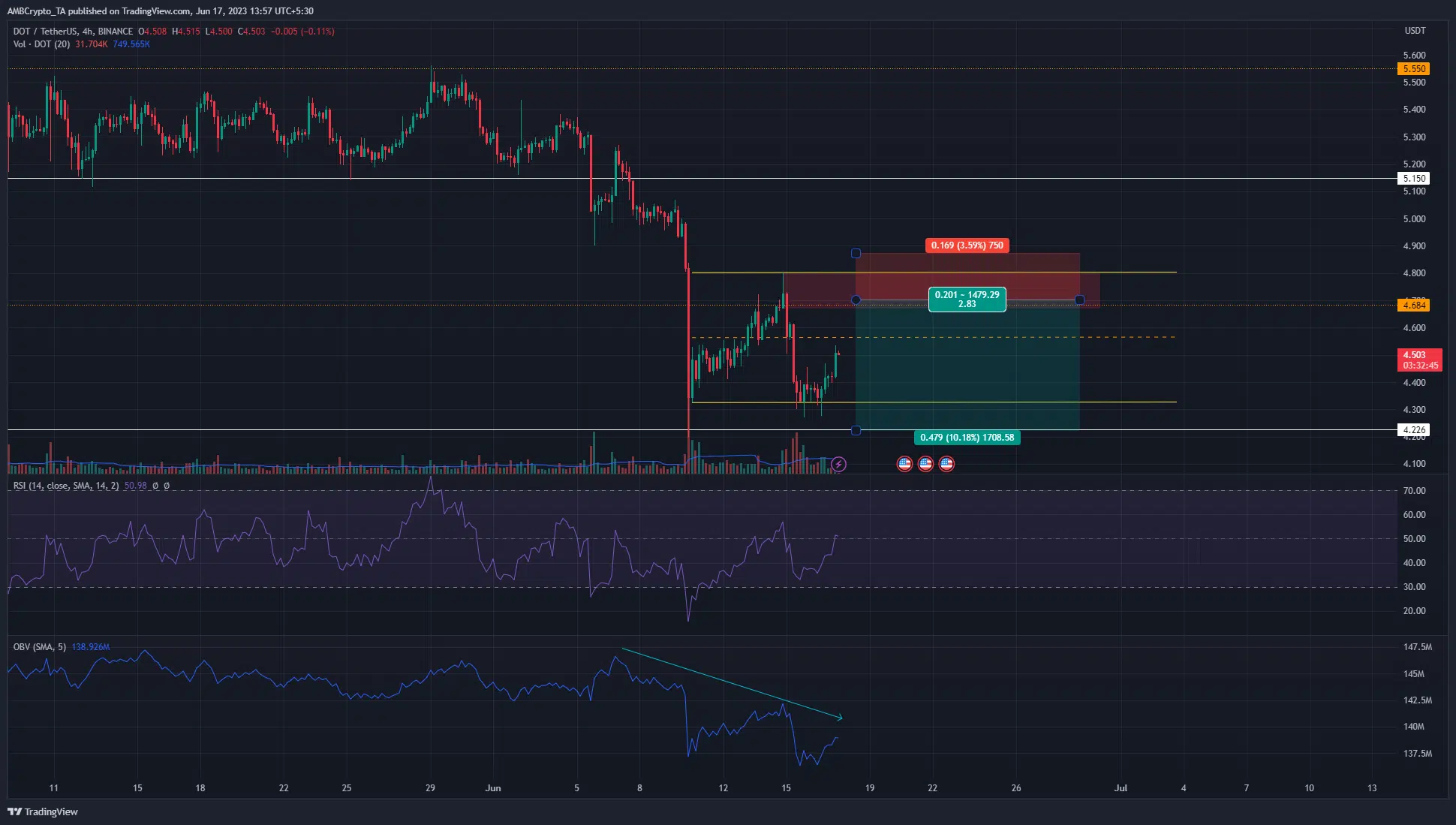

Polkadot’s inability to defend the $5.2 zone from the bears on 5 June was seen as a sign that the market remained strongly bearish. DOT dived much further than the $4.68 support on 10 June, falling as low as $4.2 before bouncing higher.

Read Polkadot’s [DOT] Price Prediction 2023-24

At the time of writing, the bias continued to favor the sellers. The jump to $4.8 on 14 June was followed by a sharp drop to the $4.32 near-term support. In other news, Polkadot users are sure to be excited by the launch of the Polkadot OpenGov.

The possibility of a range formation showed traders what to watch out for

Over the past week, DOT has bounced between the $4.32 and $4.8 levels of support and resistance. Along the way the $4.68 has also been important. Moreover, in the $4.67-$4.8 area we can see a bearish order block on the 4-hour chart as well, highlighted by the red box.

A retest of the bearish OB is likely to be followed by rejection for Polkadot prices. This was because the OBV has been in a downtrend over the past week, reflecting the firm selling pressure.

Combined with the bearish trend that has been dominant since late May, another leg downward appeared likely. Traders can look for a shorting opportunity in the resistance region highlighted above.

The RSI was at the 50 mark and struggled to climb higher. The bulls were putting up a fight but they were likely to be overwhelmed. This could change over the course of the next week if Bitcoin manages to climb past the $27.2k resistance. To the south the $4.32 and $4.22 levels can be used to take profit.

DOT lacked a trend on the lower timeframes but sentiment favored the sellers

Source: Coinalyze

The Open Interest chart from Coinalyze on the 1-hour chart showed that the past two days saw the OI increase by close to $6 million. This influx of capital followed the price’s slow bounce from the $4.3 area. Yet, the spot CVD remained flat after a large move down.

Realistic or not, here’s DOT market cap in BTC terms

Taken together they highlighted strong bearish pressure in the market. Until the spot CVD climbs higher, a revival in DOT prices appeared unlikely. The ADX on the 1-hour chart showed a non-existent trend on the lower timeframes as the price oscillated around the $4.4 mark over the past 24 hours.