Polkadot: Can soaring revenue impact DOT price predictions?

- DOT was up by nearly 5% in the last 24 hours, along with a rise in volume.

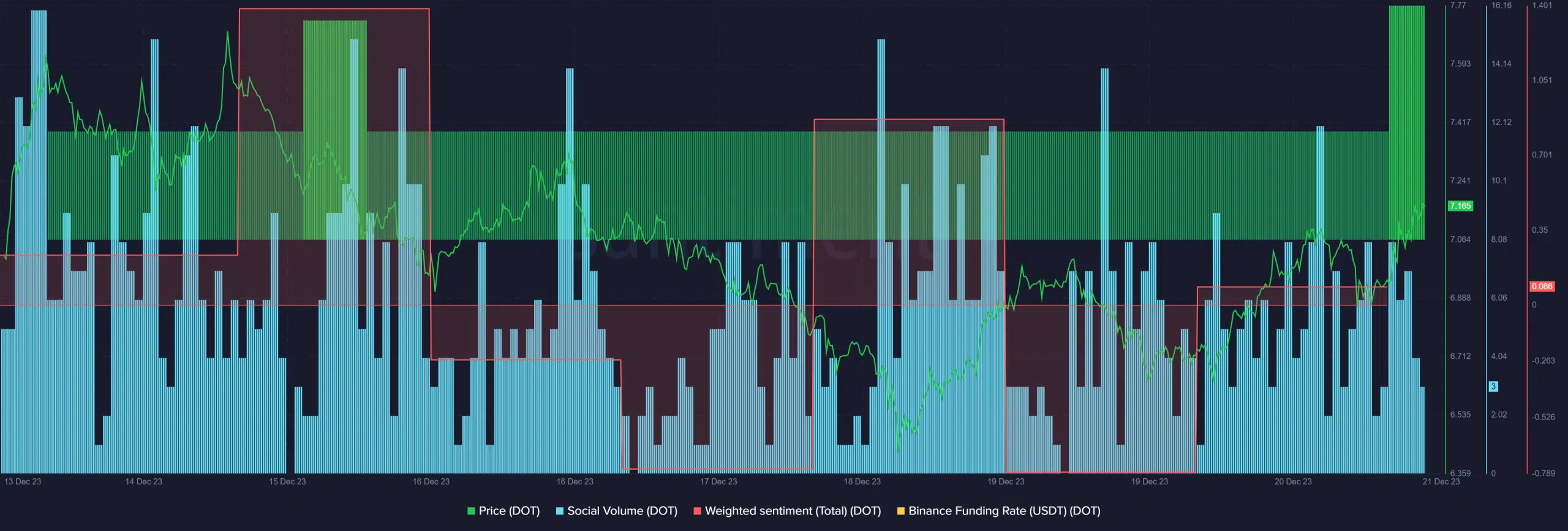

- Social metrics remained high, but a few indicators turned bearish.

Polakdot [DOT] recently witnessed a major hike in its revenue, which meant that the blockchain’s usage increased. Interestingly, Avalanche [AVAX] also registered a similar increase not long ago, after which the token’s price skyrocketed. Will DOT follow a similar trend?

Polkadot’s captured value is rising

Polkadot Insider posted a tweet on 20th December highlighting the fact that Polkadot ranked second on the list of blockchains with highest revenue rate in the last seven days.

Kusama [KSM], Polygon [MATIC], and Solana [SOL] also made it to the top 5.

While DOT sat in the second spot, AVAX took the top position on the list. A hike in revenue also means that there must have been a rise in network’s fees.

AMBCrypto reported previously that AVAX witnessed a surge in its generated fees, as the value touched $3.5 million. Soon after that, AVAX became one of the only top coins that registered double-digit gains as its price rallied by over 30% at the time.

Therefore, AMBCrypto checked Polkadot’s status to see whether it was also following a similar trend. Our analysis of Token Terminal’s data revealed that DOT’s revenue and fees spiked sharply on 16th December.

DOT’s price is rising

Like AVAX, DOT’s value also registered an uptick. According to CoinMarketCap, DOT was up by more than 5% in the last 24 hours alone. At the time of writing, Polkadot was trading at $7.16 with a market capitalization of over $9.3 billion.

The token’s trading volume also surged along with its value, which was bullish.

Sentiment around the token remained broadly positive as its weighted sentiment spiked a few times last week. DOT’s social volume also remained high.

Additionally, DOT remained in demand in the derivatives market, as evident from its green Binance funding rate.

To understand whether DOT will be able to sustain this price uptick, AMBCrypto checked the token’s daily chart. As per our analysis, DOT’s MACD displayed a bearish crossover, despite the price uptrend.

Read Polkadot’s [DOT] Price Prediction 2023-24

Its Money Flow Index (MFI) went down from the overbought zone and was headed towards the neutral mark, increasing the chances of a price downtick in the days to follow.

Nonetheless, Polkadot’s Chaikin Money Flow (CMF) rested well above the neutral mark, suggesting that the northbound price movement might continue further.