How Polkadot [DOT] traders can time their entries to remain profitable

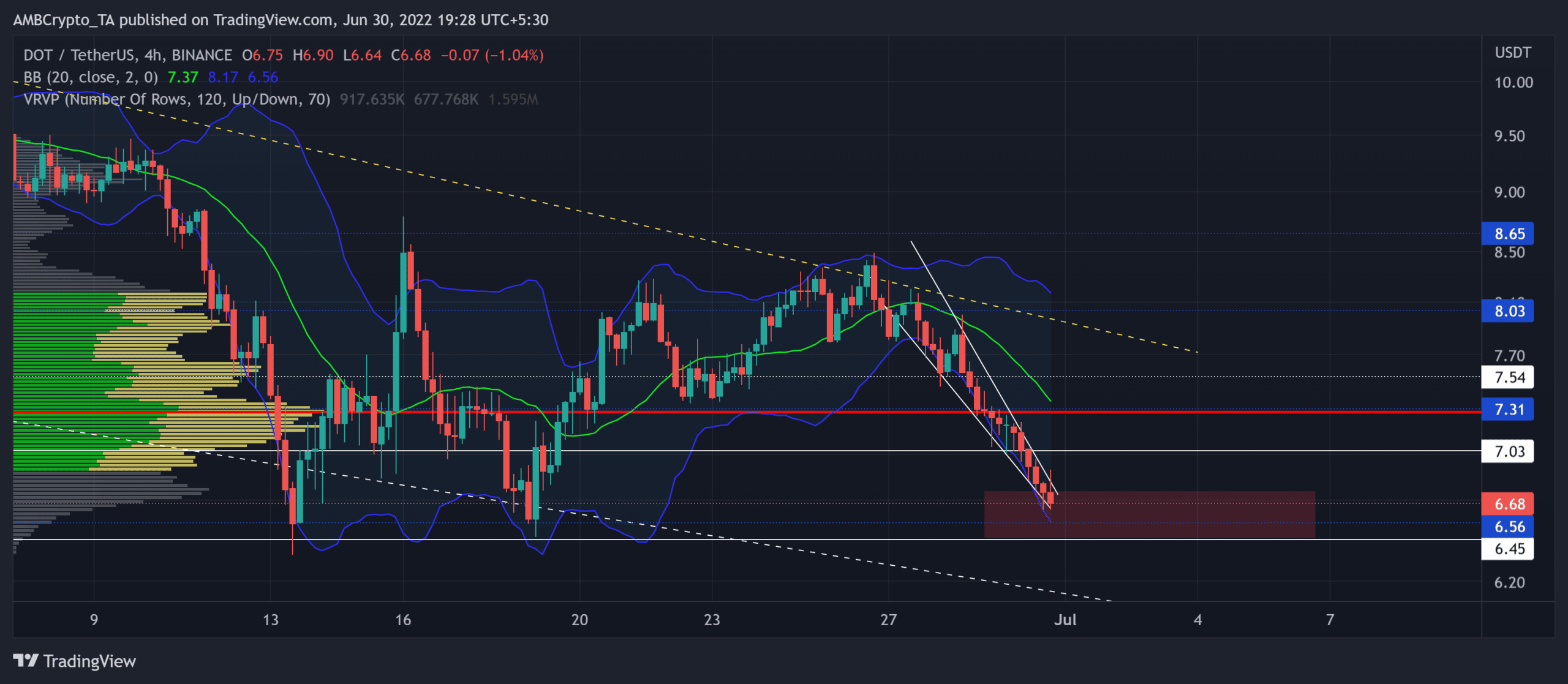

Correlating with the broader market, Polkadot [DOT] has been on a solid slump for the last few months. This decline chalked out a two-month trendline resistance (yellow, dashed).

This resistance level has curbed recent bullish revival attempts while the alt consolidates in the $6.5-$8 range. The buyers have defended the $6.5-support for over 17 months while the sellers kept finding fresher lows.

Any rebound could help the alt break out of its falling-wedge-like structure. At press time, DOT was trading at $6.68, down by 6.7% in the last 24 hours.

DOT 4-hour Chart

Since dropping toward its 17-month low on 13 June, DOT buyers stepped in to propel a short-term bull run. But with the two-month trendline resistance standing sturdy, DOT reversed into a falling wedge-like structure.

Meanwhile, the price also fell below the basis line (green) of the Bollinger Bands (BB) to reflect a robust bearish vigor. Also, with the recent uptick in selling volumes, the bears have further reiterated their intentions.

Given the possibility of a bounce-back from the $6.5-mark support level, DOT could find some buying pressure in the coming sessions. In such a case, traders/investors need to look for a compelling close above the pattern. Potential targets would lie near the Point of control in the $7.3 zone. An inability to break above the current pattern could extend the sluggish phase on the chart.

Rationale

The RSI took a sharp plunge deep into the oversold region after declining below the midline. A potential revival in the coming days could give the buyers a much-needed push to test the POC.

While the CMF also projected a strong bearish edge. Due to its higher peaks over the last day, any revival can affirm a near-term bullish divergence.

Conclusion

Given the market dynamics, the altcoin could face difficulties in triggering a trend-altering bull run. Considering the oversold readings on the BB and the RSI and the sturdiness of the $6.5 support, DOT could aim to test its POC.

However, an overall market sentiment analysis becomes vital to complement the technical factors to make a profitable move.

![Ethereum [ETH] recently regained the $2,700 level, a price it last traded at on the 24th of February. This followed a notable 5.63% rally in the past 24 hours.](https://ambcrypto.com/wp-content/uploads/2025/05/50E1EECB-207E-4DD6-B7B4-ECF1489870E9-400x240.webp)

![Will Ethena [ENA] crack the $0.60 ceiling next? 3 signs say yes](https://ambcrypto.com/wp-content/uploads/2025/05/Erastus-2025-05-14T110529.238-min-400x240.png)