Polkadot’s recent price pump and everything you should know about it

- DOT was behind Ethereum in terms of weekly development activity contributors.

- Growth in the NFT space was witnessed but the other metrics were bearish.

Polkadot’s [DOT] Moonbeam network recently announced a few notable integrations that looked promising for the Polkadot ecosystem. For instance, Bifrost partnered with Moonbeam to leverage its underlying infrastructure to gain quick market access. The partnership will allow Bifrost to use familiar Ethereum tools, allowing them to enter the market smoothly.

1/3

An exciting integration in the Dotsama ecosystem! ?@bifrost_finance provides something unique for @MoonbeamNetwork and @MoonriverNW parachains! ?The Liquid Staking for $GLMR and $MOVR Tokens. ?

Watch the video to learn more: ⬇️https://t.co/PNDCVBWJ1f pic.twitter.com/Hr3Zk6tyX1— Polkadot Ecosystem PromoTeam (@PromoTeamPD) November 22, 2022

Read Polkadot’s [DOT] Price Prediction 2023-24

Polkadot has been in the news for several weeks now regarding its development activity. Even recently, DOT was on the list of popular chains based on weekly development activity contributors, only behind Ethereum.

POPULAR CHAINS RANKED BY WEEKLY DEV ACTIVITY CONTRIBUTORS

? Ethereum: 165

? @polkadot: 139 ??

? Cardano: 126

4. Near Protocol: 60

5. Solana: 58

6. Bitcoin: 41

7. Avalanche: 37

8. Algorand: 30

9. Tron: 20

10. Fantom: 10#Polkadot $DOT #Blockchain #Relaychain #Layer0 #BTC pic.twitter.com/MeTbSKkmK3— Polkadot Insider (@PolkadotInsider) November 23, 2022

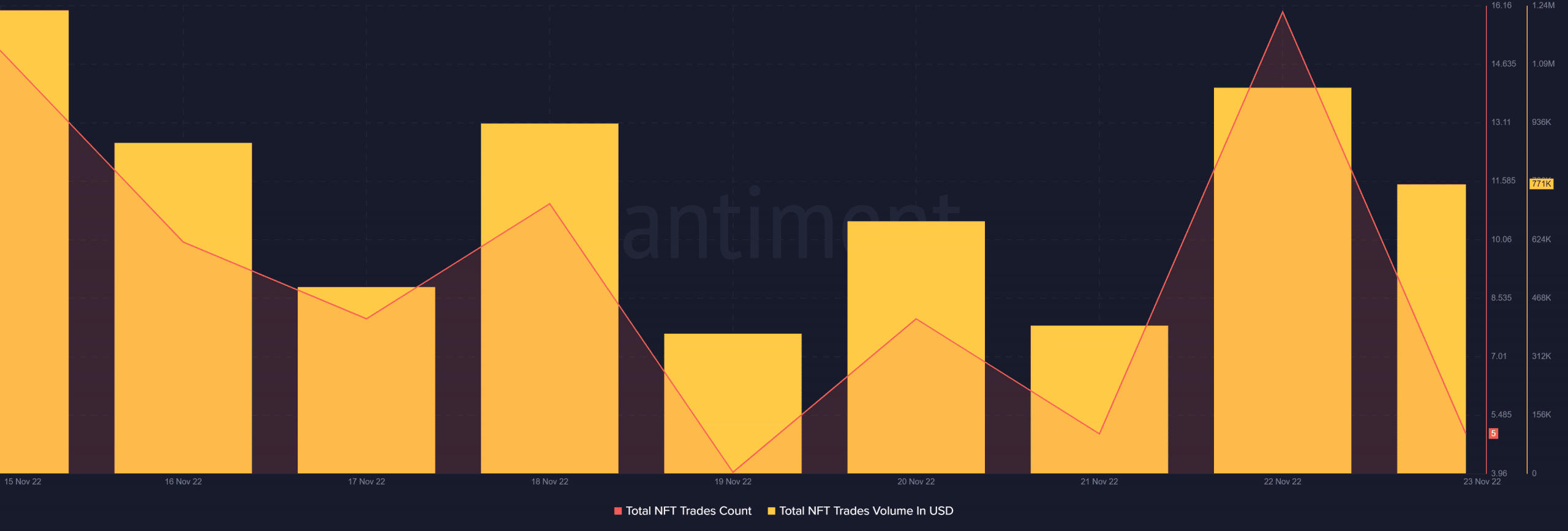

Interestingly, Santiment’s chart revealed that Polkadot also witnessed growth in its NFT ecosystem. Polkadot’s total NFT trade count and NFRT trade volume in USD both spiked last week.

All these positive developments actually reflected on DOT’s price chart, as its price increased by more than 7% in the last 24 hours. As per CoinMarketCap, at press time, DOT was trading at $5.41 with a market capitalization of over $6.1 billion.

However, can DOT sustain this uptrend, or was this just an aftereffect of the current bullish trend, which most of the cryptos were showing?

Trouble around the corner?

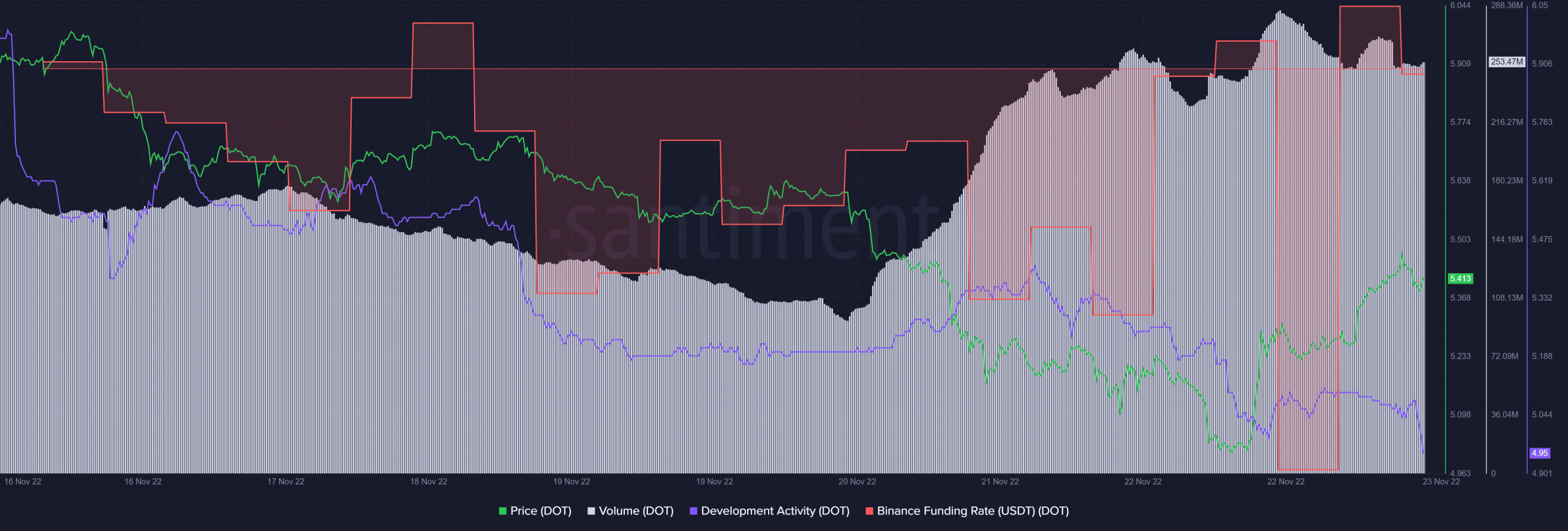

A look at DOT’s on-chain metrics provided some clarity regarding what to expect from the token in the days to come. Despite being only behind Ethereum in terms of development activity contributors, DOT’s development activity decreased considerably over the past week. This is, by and large, a negative signal for the network.

DOT’s Binance funding rate also marked a sharp decline, reflecting less interest from the derivatives market. Nonetheless, at the time of writing, DOT’s Binance funding rate did show signs of recovery by registering an uptick. In fact, DOT’s volume also increased substantially, which reduces the chances of an unprecedented price fall in the coming days.

The indicators looked better

Though most of the metrics were not supporting DOT, a few of the market indicators were in favor of the buyers as they suggested a price hike. DOT’s Relative Strength Index (RSI) registered an uptick and was heading toward the neutral mark, which might be bullish.

DOT’s On-Balance-Volume (OBV) also followed a similar route and went slightly up. According to the MACD’s finding, the bears still had an advantage in the market, but things could take a U-turn as there was a possibility of a bullish crossover soon.