Analyst claims MATIC might see ‘extreme’ price hikes once…

- An analyst posted that MATIC could continue to rally.

- Active addresses and volume jumped, indicating a bullish sentiment.

According to crypto trader Rekt Capital, Polygon [MATIC] has the potential to rise higher than it has. However, the analyst posted that predicted upswing depends on the $1.34 resistance.

In his post, Rekt Capital mentioned that the Polygon native token could experience extreme volatility once it flips the resistance. If volatility is high, then it means the price of MATIC might extend above $2 if the momentum is bullish.

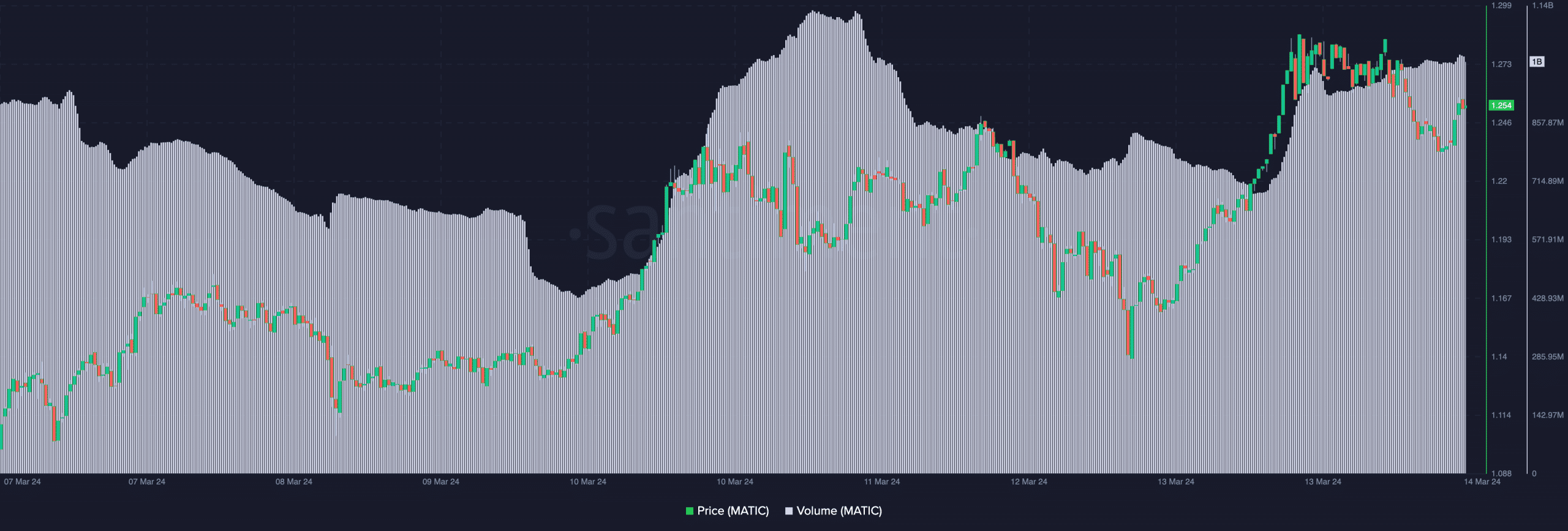

At press time, MATIC changed hands at $1.25, representing a 10% increase in the last seven days. AMBCrypto checked Polygon’s on-chain volume and observed that it has been increasing.

As of this writing, the volume was one billion. When placed with the rising price action, the inference was that MATIC could trend higher.

However, traders might need to watch out for possible changes. If the volume decreases while price climbs, the bullish trend might weaken.

Should this be the case, MATIC’s northward movement could be grounded to a halt. On the other hand, if the volume continues to rise alongside the price, then the token could break through the $1.34 resistance.

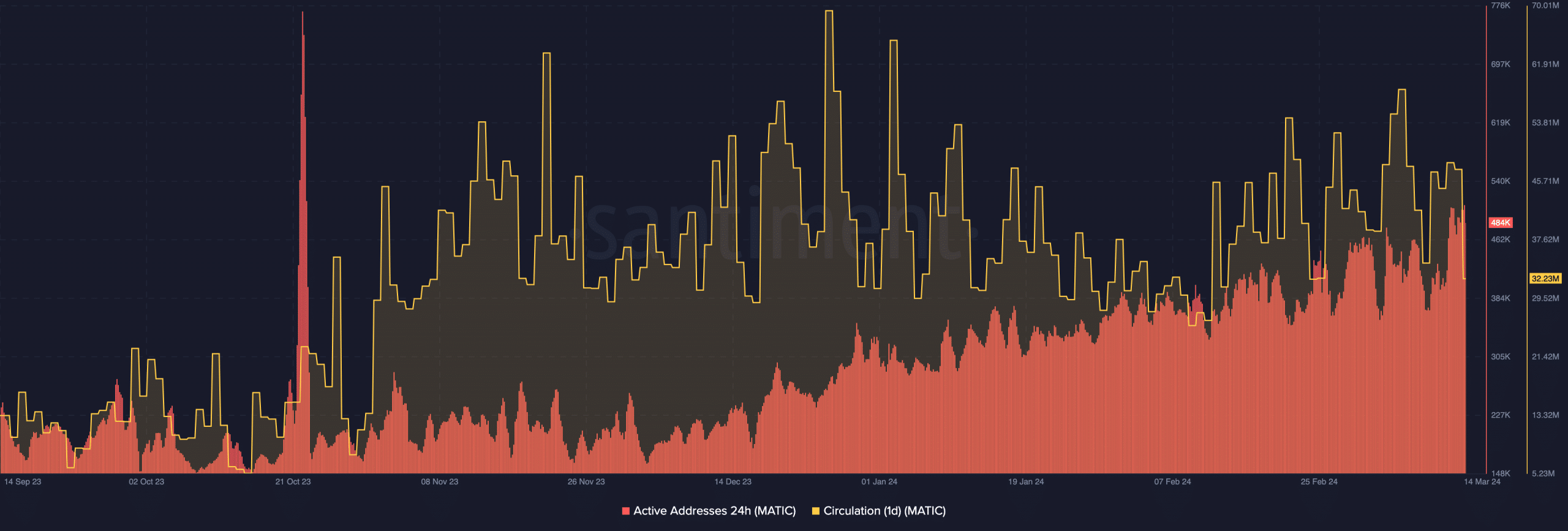

In terms of the circulation, AMBCrypto found that the metric has decreased. At press time, Polygon’s one-day circulation was down to 32.23 million. Circulation tracks the number of token engaged in transactions within a given period.

It also plays a role in evaluating the potential price of a cryptocurrency. If circulation increases, then the possibility of sell-offs also jump. This implies that the price of the token might decrease. However, a decrease in circulation could be bullish as selling pressure might be less.

For MATIC, this was the case. If the number of tokens used continue to decline, then the price might appreciate. Another metric we looked at was the active addresses. But this time, it was on the 24-hour timeframe.

At the time of writing, active addresses on the Polygon network had increased to 484,000. The rise in the 24-hour active addresses imply that many users of the Polygon network have been present in interacting.

Concerning the price, this climb could be considered a bullish signal.

As mentioned above, MATIC’s price has the potential to soar from a technical perspective. Furthermore, the on-chain analysis here also suggests the same. Despite the agreement on both sides, it might be important to be wary.

A situation where market participants decide to take profits could send MATIC into a steep correction. But the good part is that the market condition currently experienced does not allow corrections to last.

Read Polygon’s [MATIC] Price Prediction 2024-2025

Should the price drop below $1.25, it could be a good opportunity to purchase at a discount. However, traders should not get too excited about the upside potential.

While the value could rise much higher, it could also stall at some point.