Polygon [MATIC] sellers dominant: Is a drop below $1 imminent

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

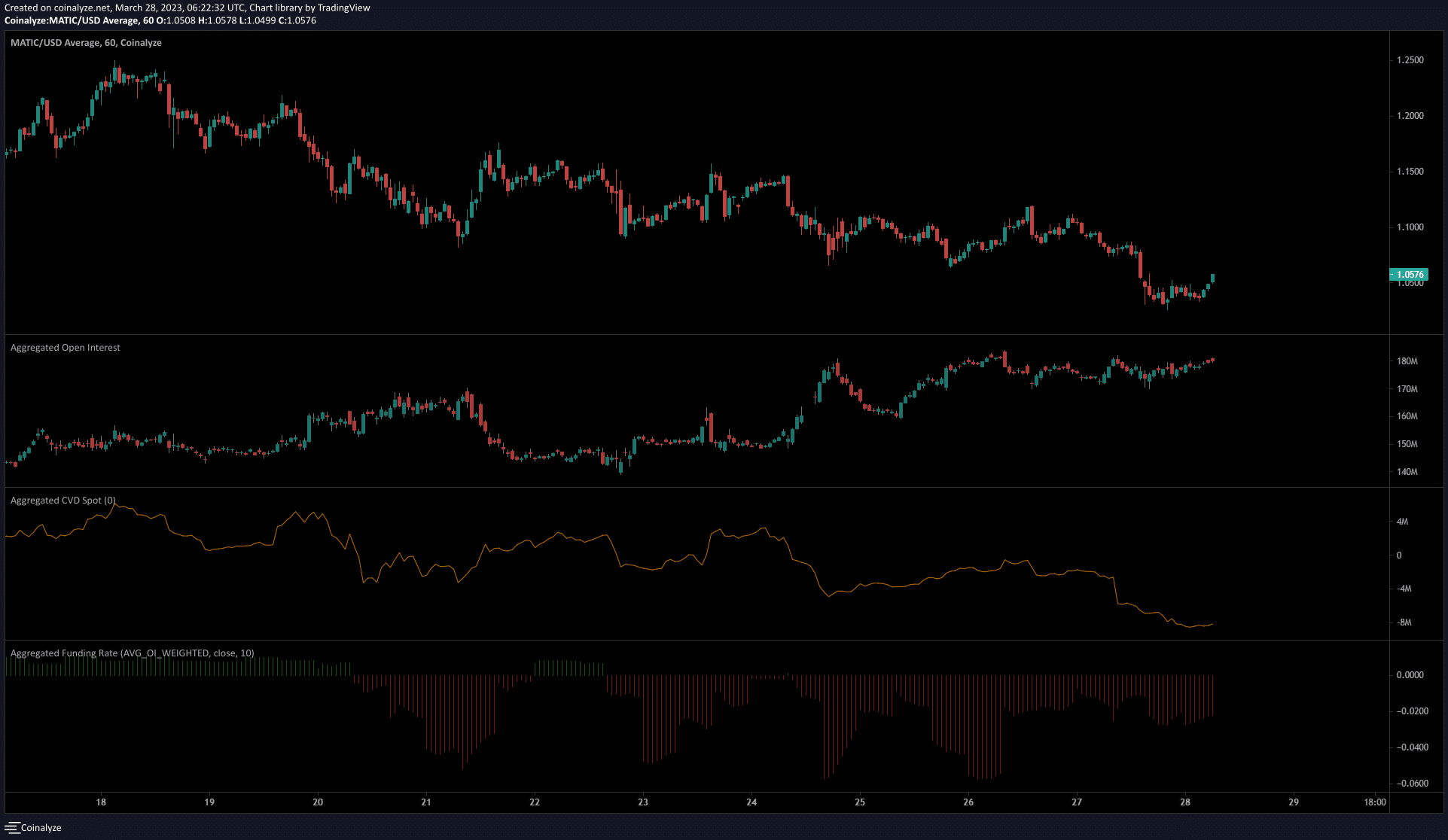

- The market structure and Open Interest signified strong bearish sentiment.

- The confluence of the breaker block and imbalance could see rejection.

Polygon [MATIC] has been strongly bearish on the charts after it formed a double top at $1.24 in mid-March. The subsequent descent beneath $1.17 gave sellers impetus, and the buyers did not look strong enough yet to stem the tide.

How much is 1,10,100 MATIC worth today?

On 24 March, MATIC shed close to 4% on the charts. It was also the day when Polygon witnessed a massive surge in transactions, and data revealed some accumulation by the whales. Despite good metrics, the price action remained bearish.

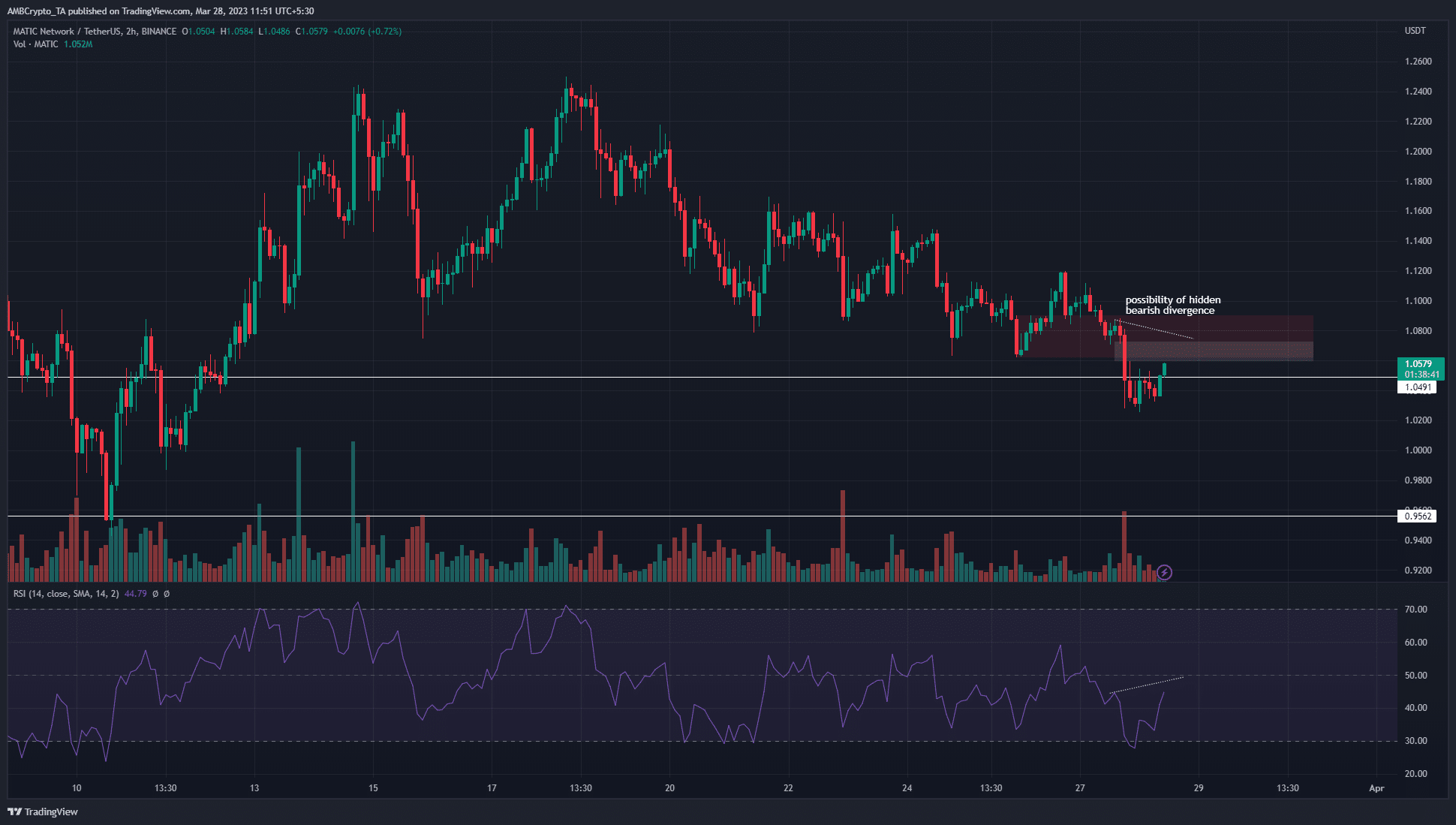

The possibility of divergence at an important resistance was worth watching

The former two-hour bullish order block was highlighted in red. It was broken on Monday and thereafter became a bearish breaker block. It was significant on the lower timeframes because it saw the bulls attempt to recover above the $1.1 mark on Sunday but fail, and the move below this area left behind a fair value gap as well.

This was a sign of strength from the bears. The FVG was marked by the white box and has confluence with the breaker, and sat just beneath the short-term resistance at $1.1. The RSI showed a reading of 44.8, which was neutral after some recovery from strong bearish momentum in the past couple of days.

The dotted white lines highlight the possibility of MATIC forming a hidden bearish divergence between the price and its momentum indicator. This would be a signal that the previous bearish trend would continue. Therefore, the $1.08-$1.1 area was highly likely to reject MATIC and force it toward $1 and $0.95.

Is your portfolio green? Check the Polygon Profit Calculator

Bearish sentiment dominated the futures market as well

Source: Coinalyze

The funding rate remained negative at press time. It shifted on 22 March and underlined the dominance of short sellers since then. The Open Interest on the one-hour chart has trended upward even though the price was in decline. Short-term losses for MATIC prices such as on 24 March, from $1.13 to $1.07 were accompanied by a rise in OI.

This was another strong indication of bearish dominance. The spot CVD was also in a downtrend over the past two weeks, indicating steady selling pressure.

![Cardano's [ADA] rally hinges on ONE condition - Will the whales follow or flee?](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-60-min-400x240.png)

![Ripple [XRP] has drawn increased investor optimism as both crowd and smart money sentiment indicators have turned bullish.](https://ambcrypto.com/wp-content/uploads/2025/05/Erastus-2025-05-15T132209.200-min-400x240.png)