Polygon releases zkEVM public testnet as MATIC chooses…

Polygon [MATIC], on 10 October, announced that its ZK roll-ups with EVM compatibility public testnet were now live. Since unveiling the zkEVM in July, Polygon seemed to have been working non-stop to achieve the recently-declared update.

According to its blog post-release, Polygon noted that it was committed to serving the crypto community with the first open-source zkEVM network. The blog post said,

“We proposed to scale Ethereum with performant zero-knowledge (ZK) proofs within an Ethereum Virtual Machine-equivalent environment; This was a major step towards the seamless scaling solution that the community had long been hoping for. Today’s release of the Public Testnet achieves that vision, and we’re proud to say we’re the first zkEVM to reach public testnet with an open-source ZK proving system.”

Ethereum takes credit; sideways for MATIC

In almost all parts of the communique, Polygon did not skip the role Ethereum [ETH] played in helping the blockchain achieve its goal.

The Web3 platform stated that the public testnet was a significant landmark for Polygon and Ethereum. Furthermore, Polygon noted that the testnet version was not for its circle alone but was also open to the Ethereum community.

As for MATIC, the development did not necessarily create a sustained price uptick. While it had increased about 2.86% immediately after the announcement, the ERC-20 token lost hold of the greens. At press time, MATIC was down 3.19% in the last 24 hours.

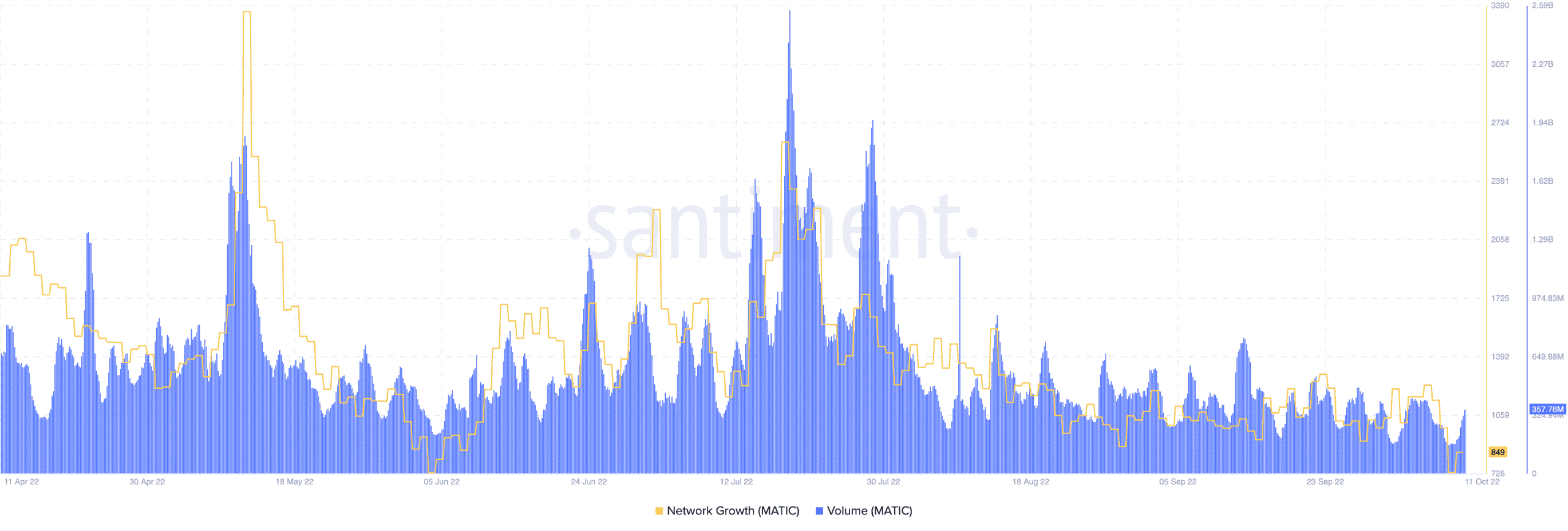

Furthermore, according to CoinMarketCap, the decline led MATIC to trade at $0.80. However, it seemed like there was an increased interest in MATIC as the on-chain analytic platform, Santiment, revealed a 91.04% surge in MATIC’s volume from the previous day.

At the time of this writing, MATIC’s volume was 357.76 million. Also, there was another aspect that preferred an uptick from the update— the network growth.

With the network growth slightly rising to 849, it implied that Polygon gained traction and investors might be adopting more of its token.

Now down

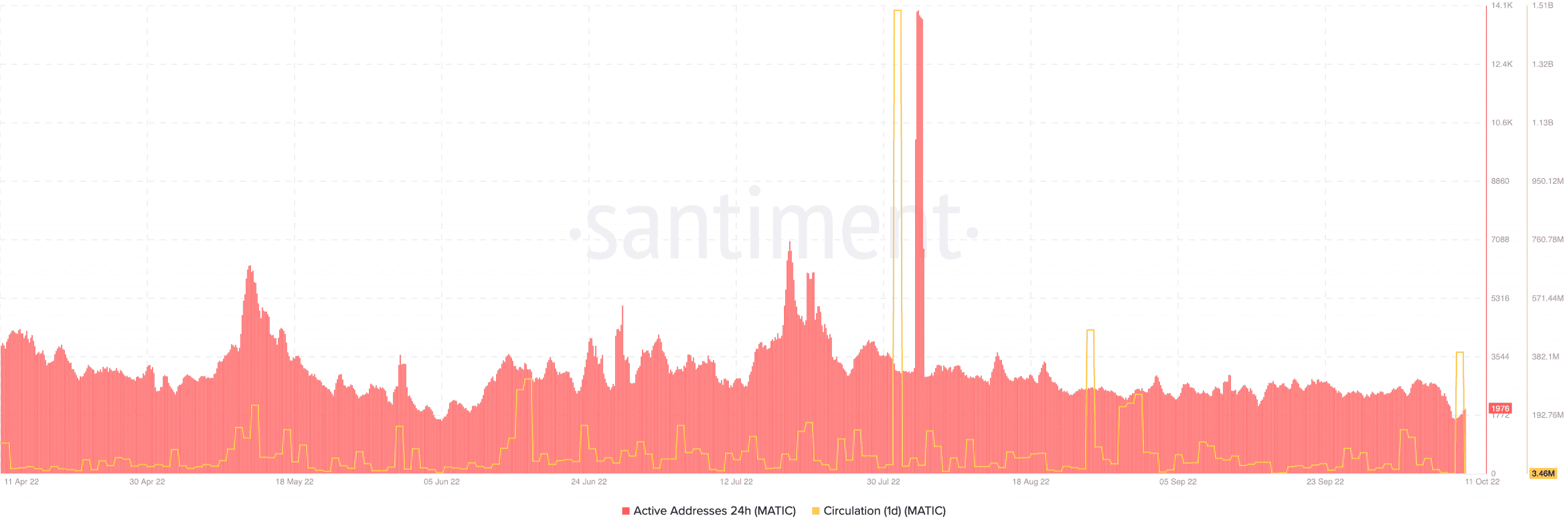

Additionally, the one-day circulation status was not what MATIC investors might have expected. While the circulation spiked to 399.41 million as of 10 October, Santiment showed that it had drastically decreased to 3.46 million at press time.

At this rate, there was likely a “pump and dump” try, which might not have yielded projected results. However, active addresses on the Polygon network increased slightly to 1976, at press time.

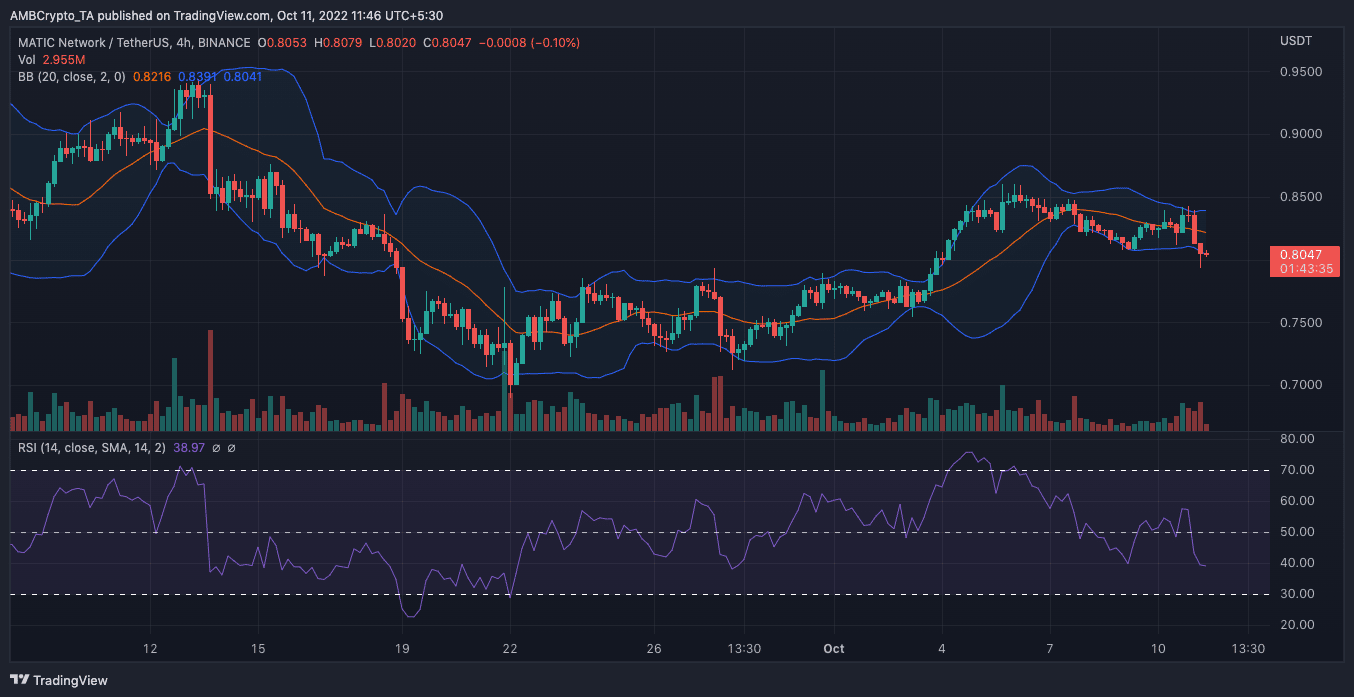

On the charts, MATIC did not seem like it could recover soon. This was shown by the status of the Bollinger Bands (BB). According to the BB, MATIC’s volatility was low and could likely remain around $0.8 in the short term.

As for the Relative Strength Index (RSI), it indicated that MATIC had fallen to selling pressure since 10 October.

With its value at 39.02, there was less likelihood that MATIC would rally. However, a turnaround in the crypto market sentiment could lead it into greens.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)