Polygon traders may be in for a pleasant surprise after MATIC’s bear season

Polygon [MATIC] rested its short-term support last week but failed to garner enough buy pressure to support a healthy bounce. Instead, the bulls lost the battle to the bears, leading to a 24% crash in the last 10 days.

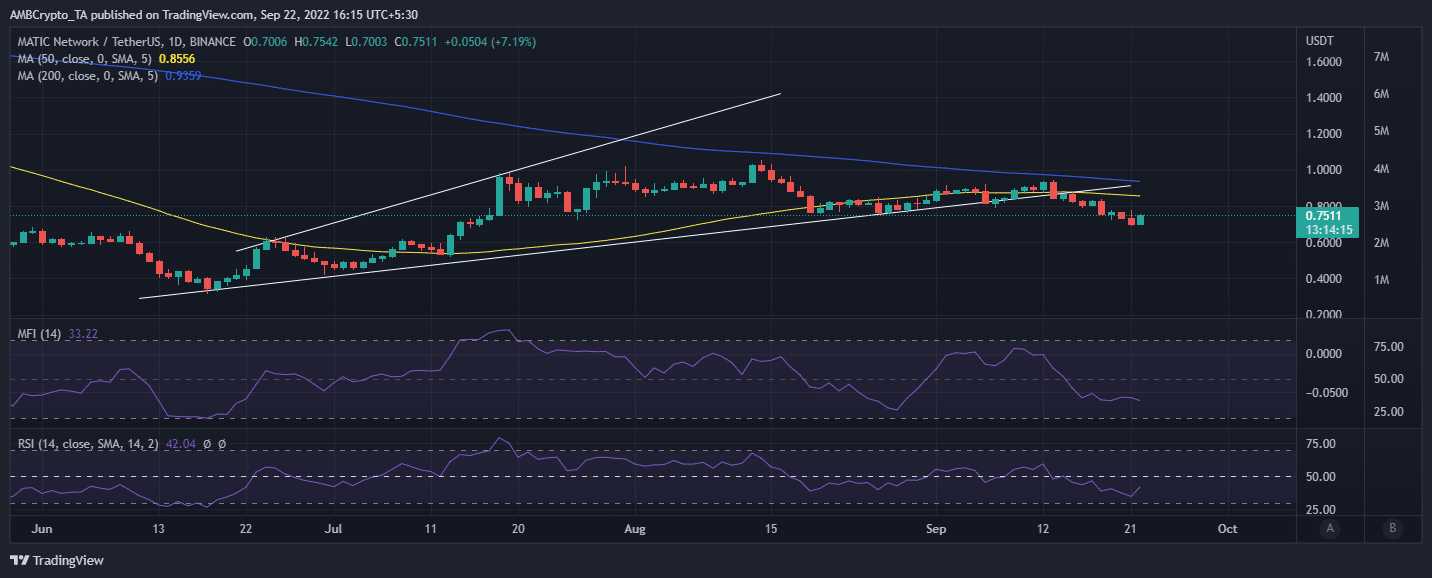

MATIC had been trading within a megaphone pattern prior to the bearish performance since mid-June. It failed to garner enough bullish momentum towards mid-month, and investors took this as a cue to sell.

As a consequence, MATIC dropped by as much as 24% from 13 September.

A 7.16% uptick after recovering from a weekly low of $0.69 indicates that MATIC might already be headed for a bullish relief. MATIC’s Money Flow Index (MFI) tapered out after recording outflows since last week. The lower sell pressure also favored an RSI pivot, indicating that the bulls were regaining some strength.

Although MATIC’s chart looks bullish, it does not necessarily guarantee that its price action was on the verge of a bullish pivot. On-chain metrics did provide a compelling outlook. For example, we observed a sharp uptick in MATIC’s social volume on 21 September. This marked the highest weekly social volume in the last seven days.

Furthermore, the price since then adopted a bullish performance, indicating that the spike may have been a buy signal. If the opposite were true, then MATIC’s downside would have gotten stronger.

In addition to the metrics mentioned above, MATIC’s velocity also registered a sharp spike. This confirmed that there was notable activity on 21 September. Its network growth metric pivoted in favor of an upward trajectory just a day prior. Its overall weekly performance also indicated that the network growth was recovering.

Positive network growth and a strong velocity uptick further supported the probability of a bullish outcome. Thus, MATIC may deliver more bullishness as the weekend rolls in. Or this could also be the case if investor sentiment transitions in favor of the bulls.

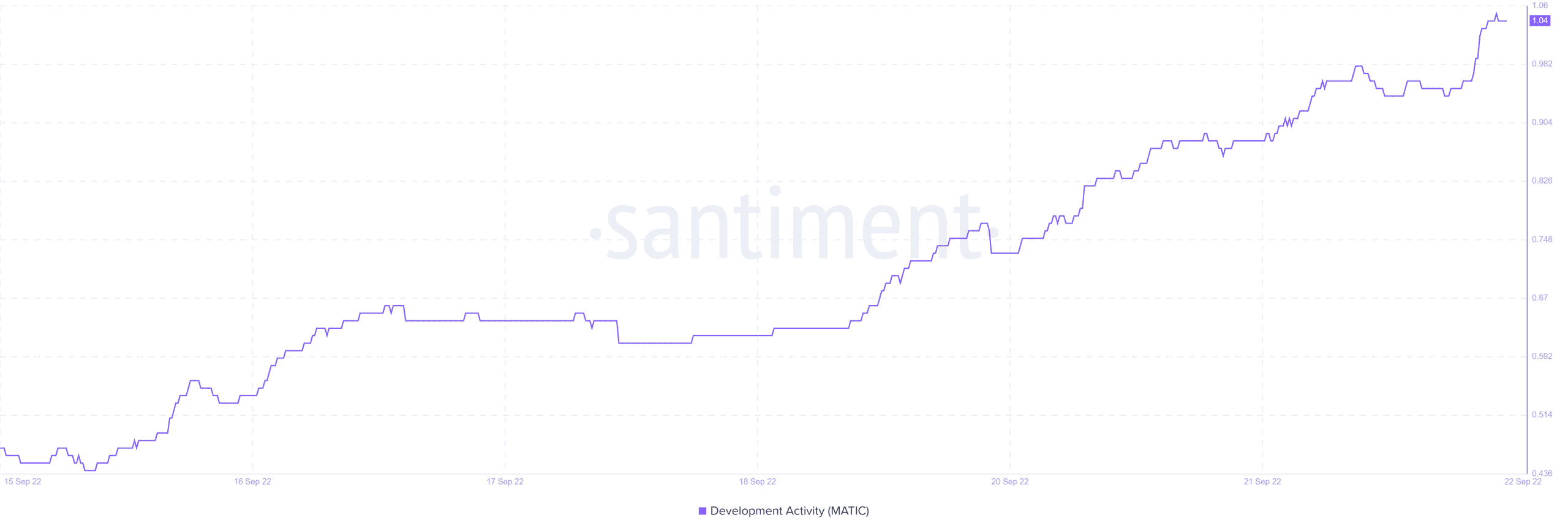

The Polygon network’s developer activity metric achieved a strong uptick in the last seven days. MATIC investors may thus see this as a healthy sign especially coming off a bearish week.

Is this the start of MATIC’s next bullish wave?

The best time for a substantial bullish uptick is often after a bit of a pullback. MATIC fits this criteria and the aforementioned on-chain metrics further hammered down the bullish short-term outlook. Although investors might shift their outlook, it is worth noting that other market factors also played a role in MATIC’s performance.

MATIC might pull off a healthy uptick if the rest of the crypto market recovers after the recent bearish performance. Such an outcome would boost investor confidence. The opposite is also likely, where FUD prevalence may dampen all bullish expectations.