Polygon whale alights from staking trip, will MATIC be affected

- About 13.36 million MATIC was sent out of a staking wallet.

- Transactions on the Polygon network increased, while circulation decreased.

According to Whale Alert, a Polygon [MATIC] whale transferred 13.36 million worth of the token out of a staking wallet to an unknown destination. The move, which indicates a possible capital plus rewards withdrawal, sent speculation around the crypto community that a possible sell-off may be imminent.

How much are 1,10,100 MATICs worth today?

With a 4.95% Current Reward Percentage (CRP), the total MATIC staked on the Polygon network reached 3.69. This number, also worth $2.02 million, ensured that the 103 validators involved have earned about 815.41 million MATIC.

? 13,369,995 #MATIC (7,289,368 USD) transferred from Polygon Staking to unknown wallethttps://t.co/ADBEu8m5RS

— Whale Alert (@whale_alert) September 4, 2023

No intent to capitulate

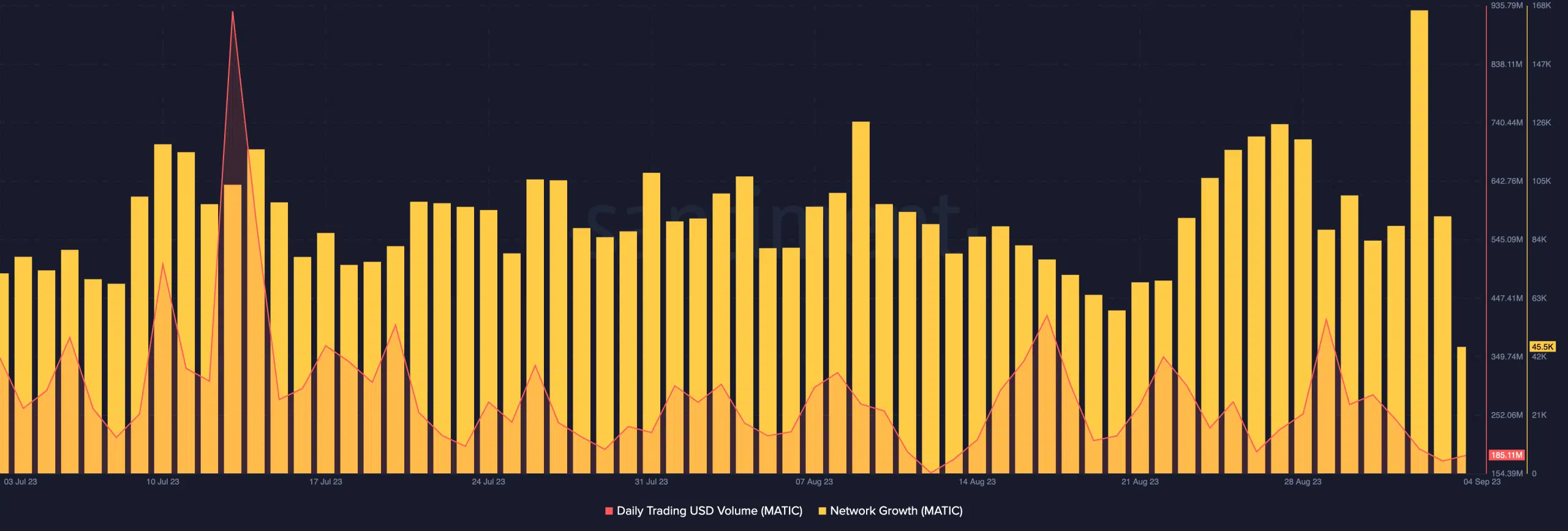

However, it seems that the whole motive behind the whale withdrawal may not be to sell. This was because of the state of the daily trading volume on exchanges. According to Santiment, the MATIC trading volume on exchanges was down to 185.11 million.

Typically, a decrease in exchange volume depicts a drop in buying and selling of a token. Therefore, it is likely that market participants were rarely involved in letting go of their MATIC holdings.

Meanwhile, Polygon also suffered a downtrend in terms of network growth. Before the sharp plunge, Polygon’s network growth had increased to 165,00. Network growth shows the number of new addresses involved in transactions for the first time.

So, an increase in the network growth suggested a hike in traction and adoption of a project. But as of press time, Polygon’s network growth decreased to 45,500. This drop meant that new addresses who joined the network lately have refrained from making transfers or interacting with the project.

Network activity rises, circulation falls

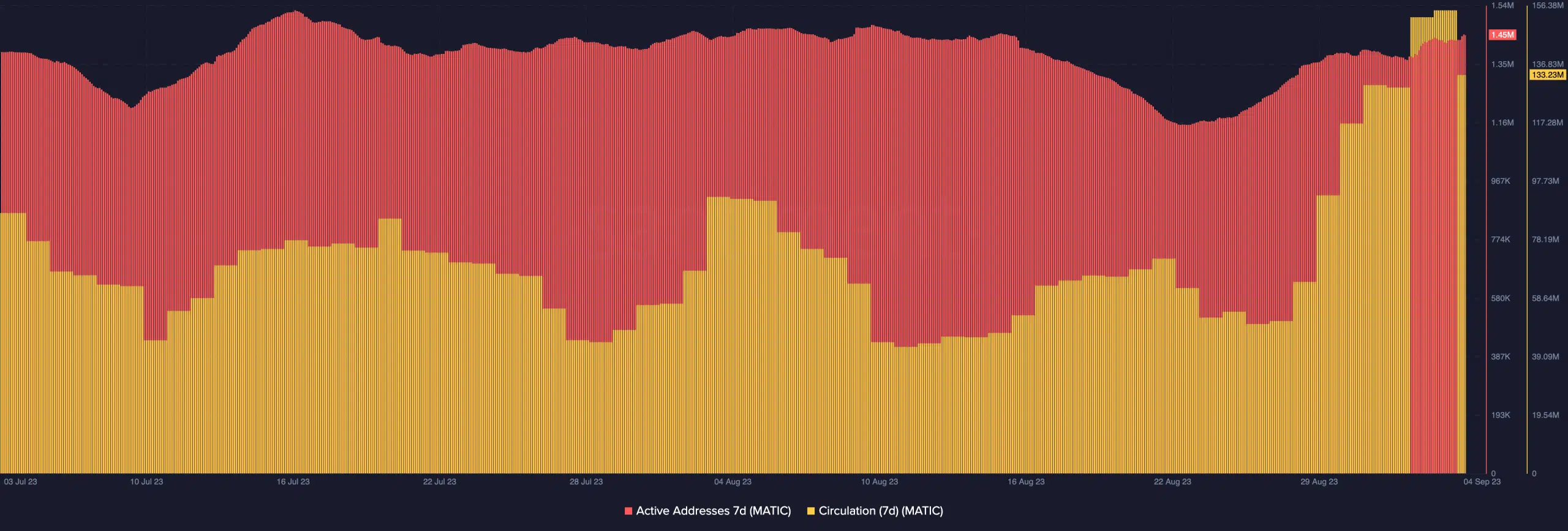

While the network growth trended downwards, the last seven days have been interesting for the active addresses on Polygon’s network. At the time of writing, the seven-day active addresses rose to 1.45 million.

An address is considered active once it becomes a sender or receiver in a successful transaction. So, whenever there is an increase in the metric, it means that unique transactions have been incredibly impressive.

Conversely, when active addresses decrease, it means market participants are losing interest in the token. But in MATIC’s case, it was not to be. Like the active addresses, the seven-day circulation also increased for a while. But the metric later fell.

The circulation of cryptocurrency measures the number of unique tokens used during a particular period. Spikes in this metric may indicate a rise in short-term sell pressure. On the other hand, a decline suggests otherwise.

Realistic or not, here’s MATIC’s market cap in ETH terms

Therefore, an overview of the metrics assessed indicated that MATIC may not feel a negative impact from the whale’s action.

However, traders may need to watch out for the broader market direction to determine where next the token moves.