Polygon’s DeFi space continues to grow; will it reflect on MATIC’s chart

- Polygon’s TVL declined by more than 3% in the last 24 hours.

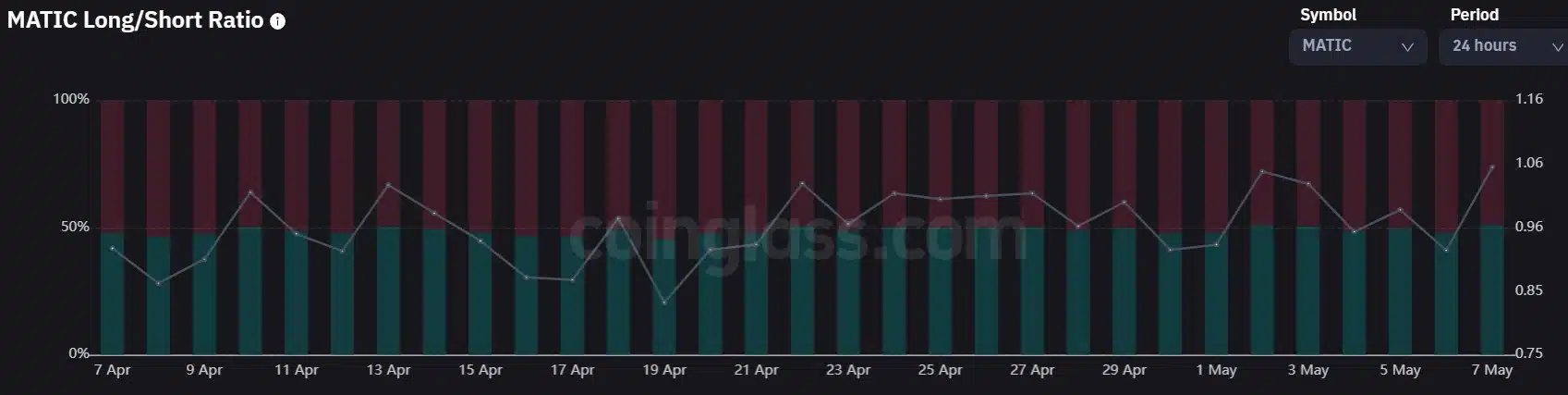

- Though metrics were bearish, MATIC’s long/short ratio increased, suggesting a trend reversal.

Polygon’s [MATIC] DeFi ecosystem has been growing and evolving for several months. As per the latest tweet from Polygon, there are more than $5 million in assets on the network, across over 20 tokens and coins.

DeFi on Polygon zkEVM is growing. And more is coming. More transactions, more users, and more liquidity

But for a full rundown of DeFi on Polygon #zkEVM now, follow the ?

✈️High-level view

?Oracles

?Bridging

?DEXs/lending/LPs

?️What’s coming— Polygon (@0xPolygon) May 5, 2023

Is your portfolio green? Check the Polygon Profit Calculator

A closer look at Polygon’s DeFi performance

Polygon’s tweet also revealed that 90% of wallet addresses use other L2s, and less than 15% of those wallets are new.

Since DeFi performance is the topic, a look at Polygon’s TVL was necessary.

Though the graph has remained pretty consistent for several months, it registered a decline of over 3% in the last 24 hours.

Well, not only did the blockchain’s TVL decline, but Token Terminal’s data pointed out fall on a few other fronts as well.

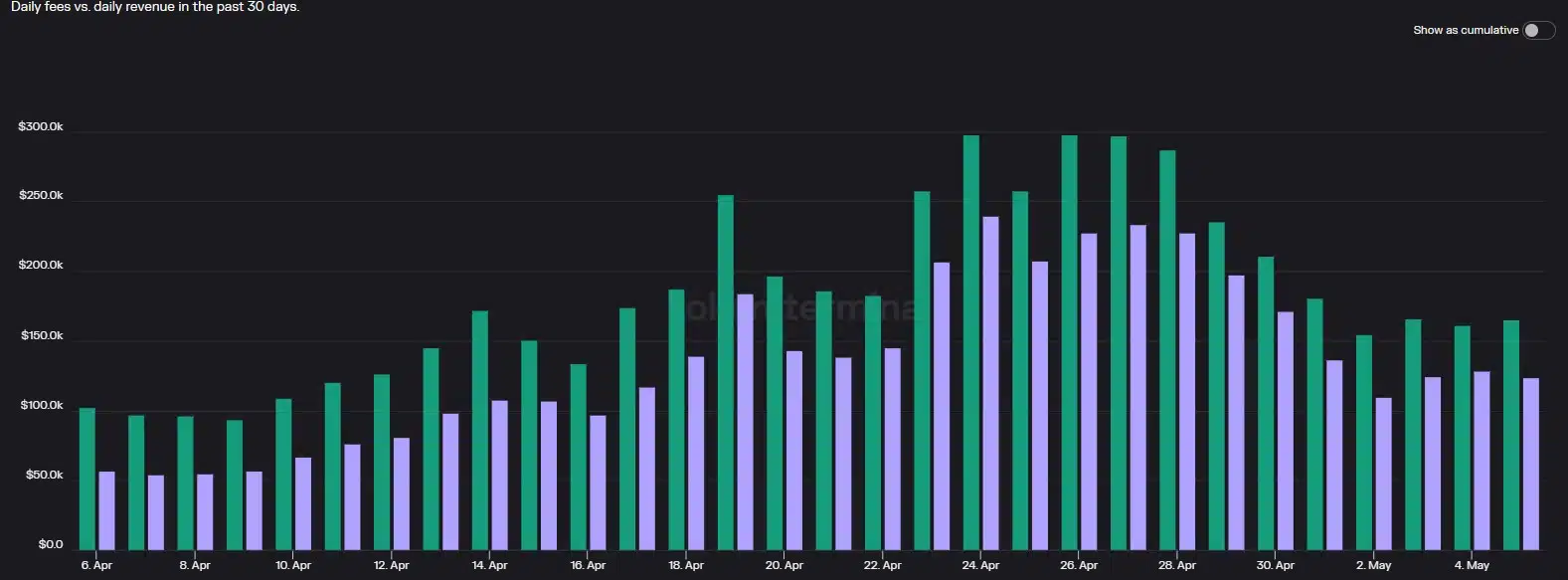

As evident from the chart, Polygon’s fees and revenue went up at the end of April. However, the uptrend was short-lived, as the second month of Q2 2023 saw a decline.

zkEVM’s TVL has been reacting differently

While Polygon’s TVL plateaued over the past months, zkEVM, on the other hand, behaved differently. DeFiLlama’s chart revealed that since its inception, zkEVM’s TVL has increased considerably.

At the time of writing, the TVL was at $2,541,403.

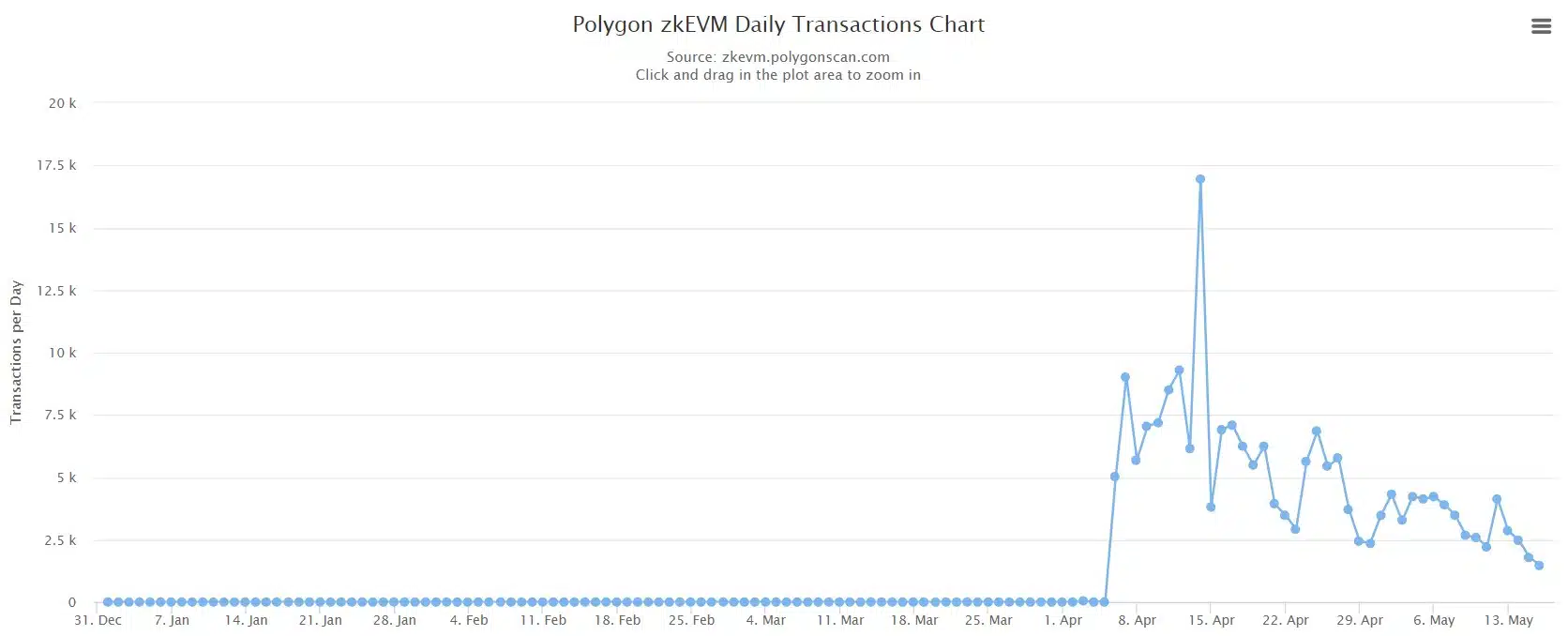

Though zkEVM’s TVL went up, the same was not true for its key statistics. For instance, Polygonscan’s chart showed that zkEVM’s daily gas usage declined sharply.

Besides, the number of daily transactions also plummeted, which indicated less usage of zkEVM. Nonetheless, zkEVM’s unique addresses continued to rise, reflecting its high adoption.

MATIC is still moving slow

Moreover, the dynamics in terms of network activity were high, but MATIC’s price action remained slow throughout the last week. According to CoinMarketCap, MATIC’s price declined by more than 2% in the last seven days.

At the time of writing, it was trading at $0.9802 with a market capitalization of over $9 billion.

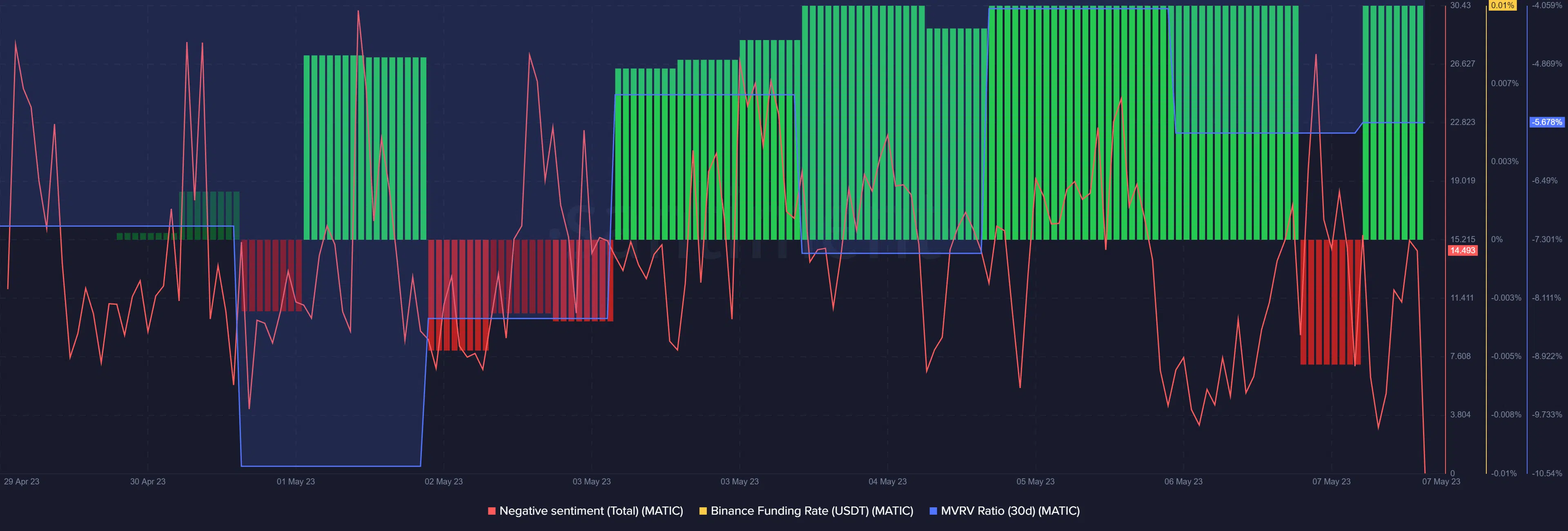

CryptoQuant’s data suggested that the hardship might continue as Polygon’s exchange reserve increased. Negative sentiment around MATIC also spiked, suggesting less confidence in the token.

Realistic or not, here’s MATIC market cap in BTC‘s terms

Nonetheless, a few of the metrics looked bullish. For instance, MATIC’s funding rate was high, indicating increased demand in the derivatives market.

The token’s MVRV Ratio also recovered, which by and large was a positive signal. Coinglass also pointed out a bullish indicator for MATIC.

As per the data, MATIC’s long/short ratio registered an uptick. This gave hope for a trend reversal- a high ratio suggests bullish market sentiment.