Polygon’s DeFi space shows increased promise: How will MATIC react?

- MATIC flipped SHIB to become the most traded token among whales.

- MATIC’s weekly chart was green and market indicators suggested a further price hike.

Polygon [MATIC] has shown growth in its DeFi space over the past, with several new integrations that help increase the network’s offerings and capabilities. The latest one is the integration with Dopex, a decentralized options exchange.

And just like that @dopex_io, the decentralized options protocol, has launched #onPolygon.

Users can now take advantage of the range of options products Dopex has to offer ??

Learn more ?? https://t.co/bcSxdfYVZf

?? pic.twitter.com/oesAxzVIl8— Polygon (@0xPolygon) February 3, 2023

Realistic or not, here’s MATIC market cap in BTC’s terms

According to the official announcement on 4 February, Dopex’s launch on Polygon brought with it Atlantic Straddles and SSOVs (Single Staking Option Vaults) to the DeFi ecosystem. Polygon mentioned that this launch was a step forward for Dopex, allowing the platform to reach a wider audience and provide more opportunities for users to take advantage of its innovative features.

MATIC also reacted

Polygon’s growth in the DeFi space was further proven by having a look at DeFiLlama’s data, as its Total Value Locked (TVL) gained an upward momentum since the beginning of this year. MATIC’s price also responded positively to these developments, and its daily and weekly charts were painted green.

As per CoinMarketCap, MATIC was up by over 3% and 6% in the last 24 hours and past week, respectively. At press time, it was trading at $1.23, with a market capitalization of more than $10.7 billion.

The increase in MATIC’s price might have played a role in making the token popular again among the whales. WhaleStats revealed that MATIC flipped Shiba Inu [SHIB] to become the most traded token among the top 100 Ethereum [ETH] whales.

? JUST IN: $MATIC @0xPolygon flipped $SHIB for MOST TRADED token among top 100 #ETH whales

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#MATIC #SHIB #whalestats #babywhale #BBW pic.twitter.com/Roktl61yqr

— WhaleStats (tracking crypto whales) (@WhaleStats) February 4, 2023

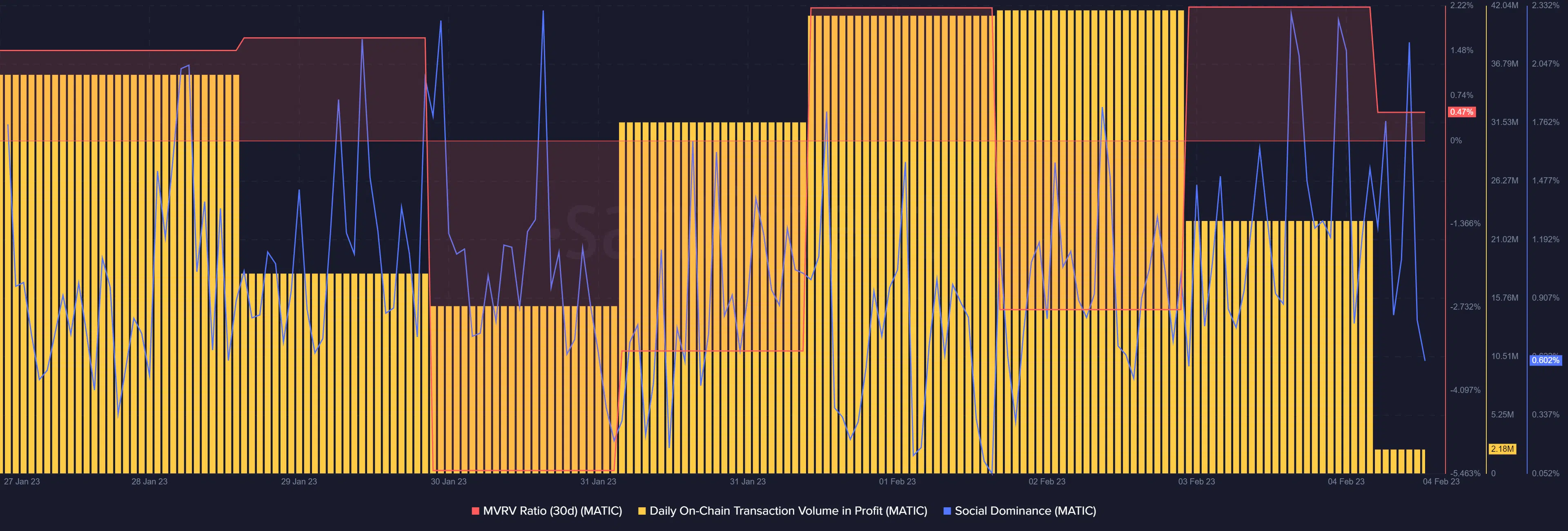

While the price rose, MATIC’s MVRV Ratio registered an uptick, which looked optimistic. MATIC’s popularity grew in tandem with its social dominance. Moreover, MATIC’s daily on-chain transaction volume in profit also increased, which can be attributed to the recent price gains.

However, CryptoQuant’s data revealed a few metrics that were concerning. For example, MATIC’s net deposits on exchanges are high compared to the seven-day average, indicating higher selling pressure. The exchange reserve also rose, yet again proving an increase in sell pressure.

How much are 1,10,100 MATICs worth today?

The bull-run to continue?

MATIC’s daily chart painted a bullish picture as most of the market indicators were supportive of a continued surge. The MACD revealed that the bulls had the upper hand in the market.

MATIC’s Chaikin Money Flow (CMF) and On Balance Volume (OBV), despite registering a slight downtick, were relatively high. The Bollinger Bands indicated that MATIC’s price was in a high volatility zone, further increasing the chances of a price increase in the days to follow.