Polygon’s ‘impeccable’ recovery gives MATIC HODLers cause to…

The crypto market has grown tremendously over the years. The space has seen relatively new projects such as Polygon come, conquer and dominate. The solutions offered by the network have, by and large, been quite apropos.

The Polygon network was formed to address the challenges faced by the Ethereum network – including high fees, low transactions per second and poor user experience. With time, it has already been able to foster a multi-chain ecosystem of compatible blockchains. Polygon, today, has its foot spread across all major crypto-associated spheres, right from DeFi and dApps to DAOs and NFTs.

The network’s native token, MATIC, has already carved a niche for itself among the top 25 coins. With a market cap of over $8.6 billion, the 22nd largest crypto was trading at $1.33 at press time.

Breaking down its performance

As highlighted in a previous article, Polygon has been able to fare well in the DeFi and dApps space. Well, as per latest stats, the network has been making rapid strides on the NFT front too.

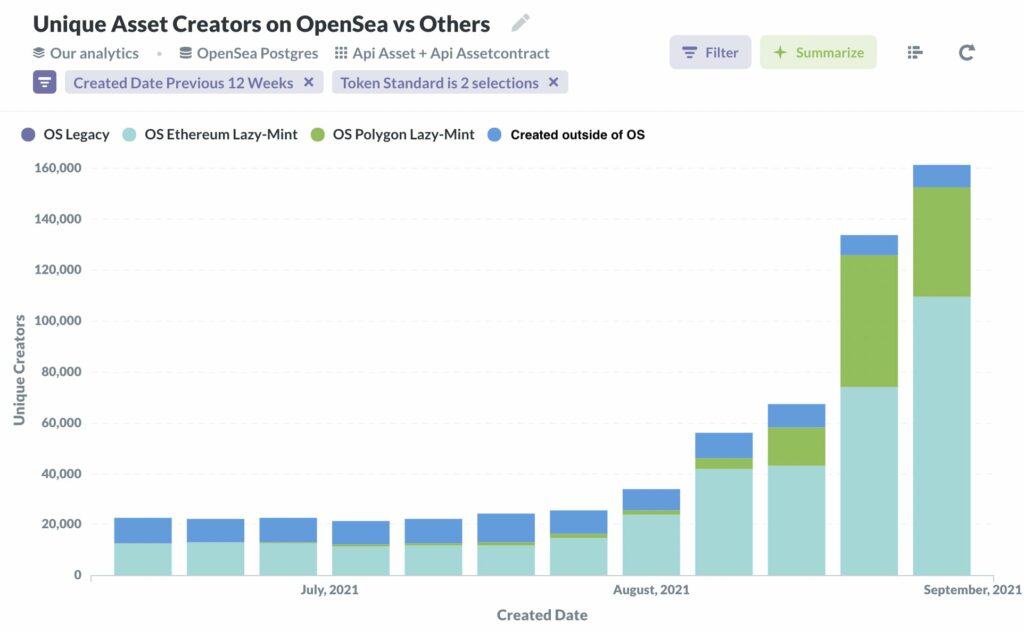

Even though Ethereum NFTs have been garnering more public spotlight of late, it should be noted that more than 1/4th of the NFT creators [27% approximately] now use the Polygon network on OpenSea. As seen from the chart attached, the same has witnessed a drastic surge when compared to early August’s mere 4% creators.

Source: Twitter

Retention

Less than three-weeks back, it was reported that the Polygon network was not able to retain the users on its network. However, the aforementioned trend has already started showing signs of a reversal.

Its week-on-week retention figure was as high as 60.65% at the time of writing. Last week, this metric made a massive jump from 7.13% to 13.8%, while the same surged from 13.8% to 22.17% this week. In retrospect, Polygon has successfully been able to break out from the bottom quartile for the first time in over 5-weeks.

Source: Twitter

Inevitably, the network’s daily active users have also been on the rise. As far as the oldest cohorts are concerned, they continue to depict a “smiling curve” on the chart. However, addresses belonging to relatively newer cohorts seem to continue declining along with the cohort size. That being said, it should also be noted that the same is still significantly higher than anything before August 1.

At the end of the day, Polygon’s strength is its users. In fact, one of the network’s cofounders – Mihailo Bjelic specified the same in a recent tweet and said that a “scaling juggernaut” was in the making.

Monetization

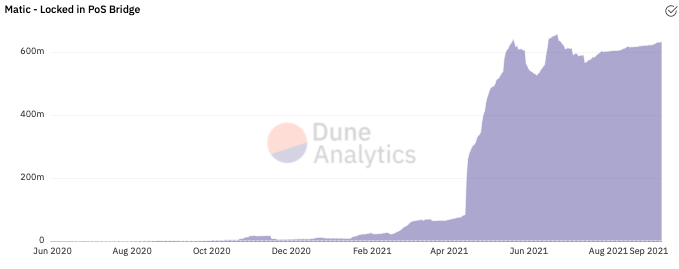

The network has been able to preform quite well on the monetization front too. Dune Analytics’ data highlighted that the revenue generated by Polygon has surged by 70.56% in the last 7-days alone.

Further, the number of MATIC tokens locked in the PoS bridge has been increasing of late. As seen from the chart attached, the current levels already crossed June’s highs and are almost at par with that of July’s.

Source: Dune Analytics

As evidenced by the data above, Polygon has been able to recover impeccably from its sluggish phase. If the growth continues in the same direction, MATIC’s appreciation would be almost inevitable. Ergo, token HODLers directly benefit from the same.