Polygon’s struggles on the on-chain front could mean this for MATIC

The state of the broader crypto-market hasn’t been winsome lately. The diminishing returns offered by top coins including Bitcoin, Ethereum, and Cardano have triggered a drop in the global crypto-market cap too. In effect, the state of the on-chain metrics for most of these cryptos has started withering already.

However, Polygon’s tale has been slightly different. It has, in fact, been on a record-breaking spree of late. The network managed to eclipse Ethereum’s layer-one in daily addresses for the first time yesterday. This, by itself, is quite a remarkable feat pulled off by the network.

Even though direct parallels are drawn here, it shouldn’t be forgotten that the network’s aim is to aid Ethereum and not compete with it. As such, Polygon is an L2 solution that runs on the Ethereum network to process transactions faster.

It also makes it easier for applications built on Ethereum to work with other blockchain platforms. The rise in adoption of this interchain scalability solution is obliquely a boon to Ethereum.

Source: Twitter

Polygon has additionally been able to bag a host of high-profile partnerships of late. Coinbase – one of the world’s most prominent crypto-exchanges, for instance, recently announced that it’s planning to integrate Polygon’s Ethereum scaling solution to reduce prices and settlement times on its platform.

Further, corporates like EY too have now started relying on Polygon’s solution for their blockchain products.

The network has also been making rapid strides on the NFT front, alongside Ethereum. Dolce and Gabbana, for example, recently picked the Polygon network for its NFT auctions.

So, are good days for MATIC already here or is the hype and hoopla merely ad interim?

All that glitters ain’t gold

Despite the aforementioned set of positives, there are a few things that are currently going off-track for the network. Unique depositors to MATIC, for starters, have been on the decline since mid-August. The same is nowhere close to its May levels.

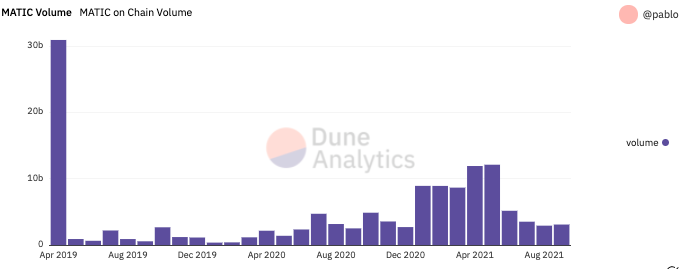

What’s more, the on-chain volume has also been spending more time towards its lows lately. This essentially implies eroding user interest across the board.

Source: Dune Analytics

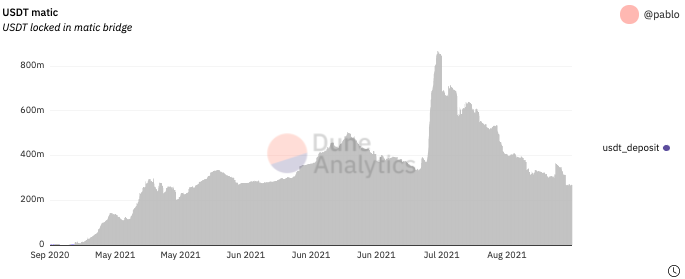

The liquidity on the network has also been diminishing. Consider this – In mid-July, over 800 million worth of USDT were locked on MATIC’s bridge. The same, however, stood at 2.7 million, at press time. This, again, is not a healthy sign.

Source: Dune Analytics

If Polygon keeps struggling to keep up on its on-chain front, MATIC might have to bear the long-term repercussions. After recording a weekly HIKE of 0.5%, MATIC was trading at $1.09 at press time.

Thus, until and unless the state of the aforementioned metrics improves, MATIC’s rally would not be sustainable.