POPCAT crypto faces THIS key resistance—Its breakout depends on…

- POPCAT crypto has bounced +100% from its recent lows of $0.15.

- A key whale has intensified profit-taking during the recovery.

Popcat [POPCAT] appears to have bottomed after declining 90% and erasing nearly all its 2024 gains. So far in February, the memecoin has rallied substantially from its recent lows of $0.15.

This has raised hopes it could claw back its lost ground and eye the $1 value. But whales have begun selling into the uptrend to lock in profits.

According to the blockchain analysis platform SpotOnChain, an early whale dumped ten million POPCAT tokens worth $3.15M to Bybit.

The whale recorded a $7.32 million in profit (633% gain) and was only left with about one million POPCAT tokens.

Will whale sell-off cap POPCAT recovery?

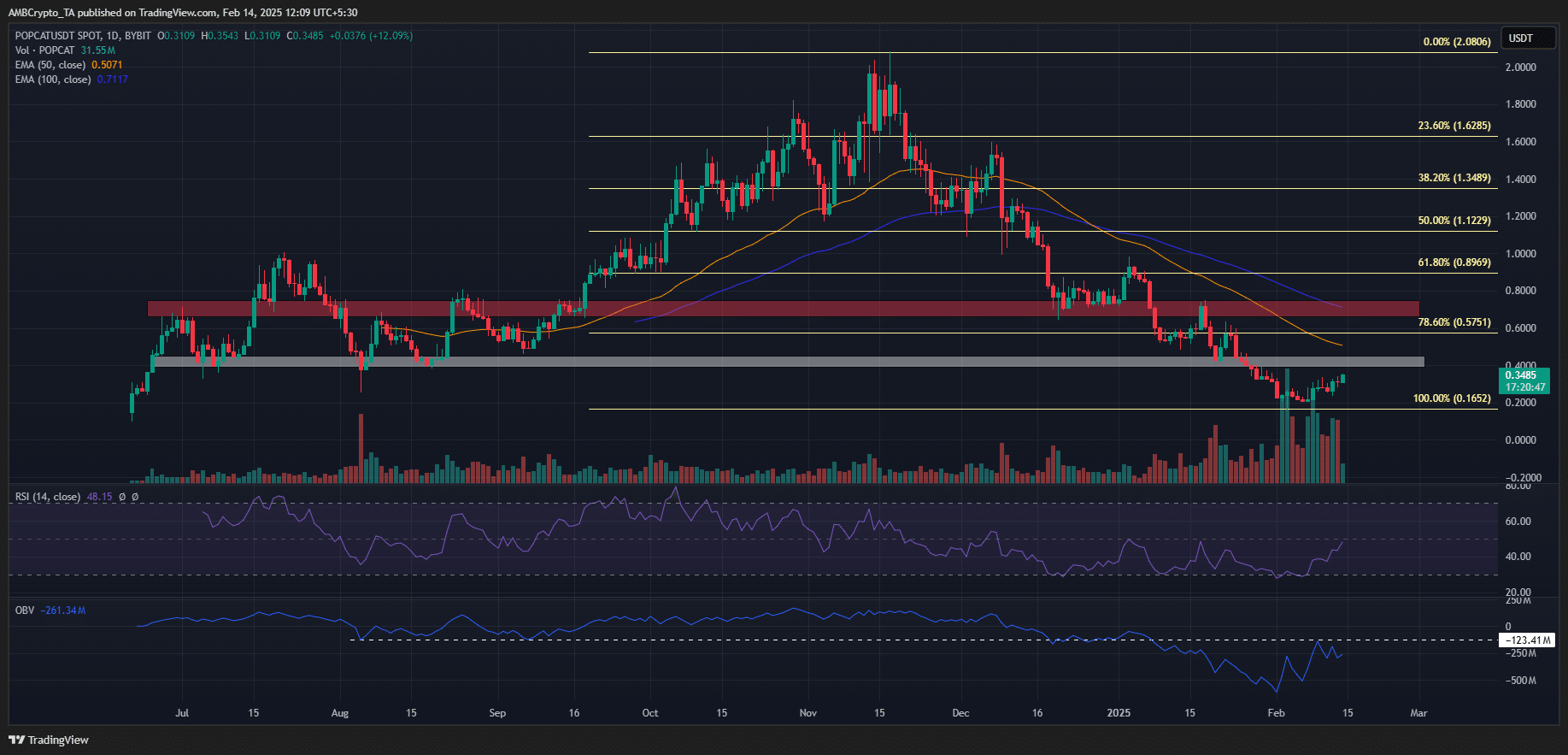

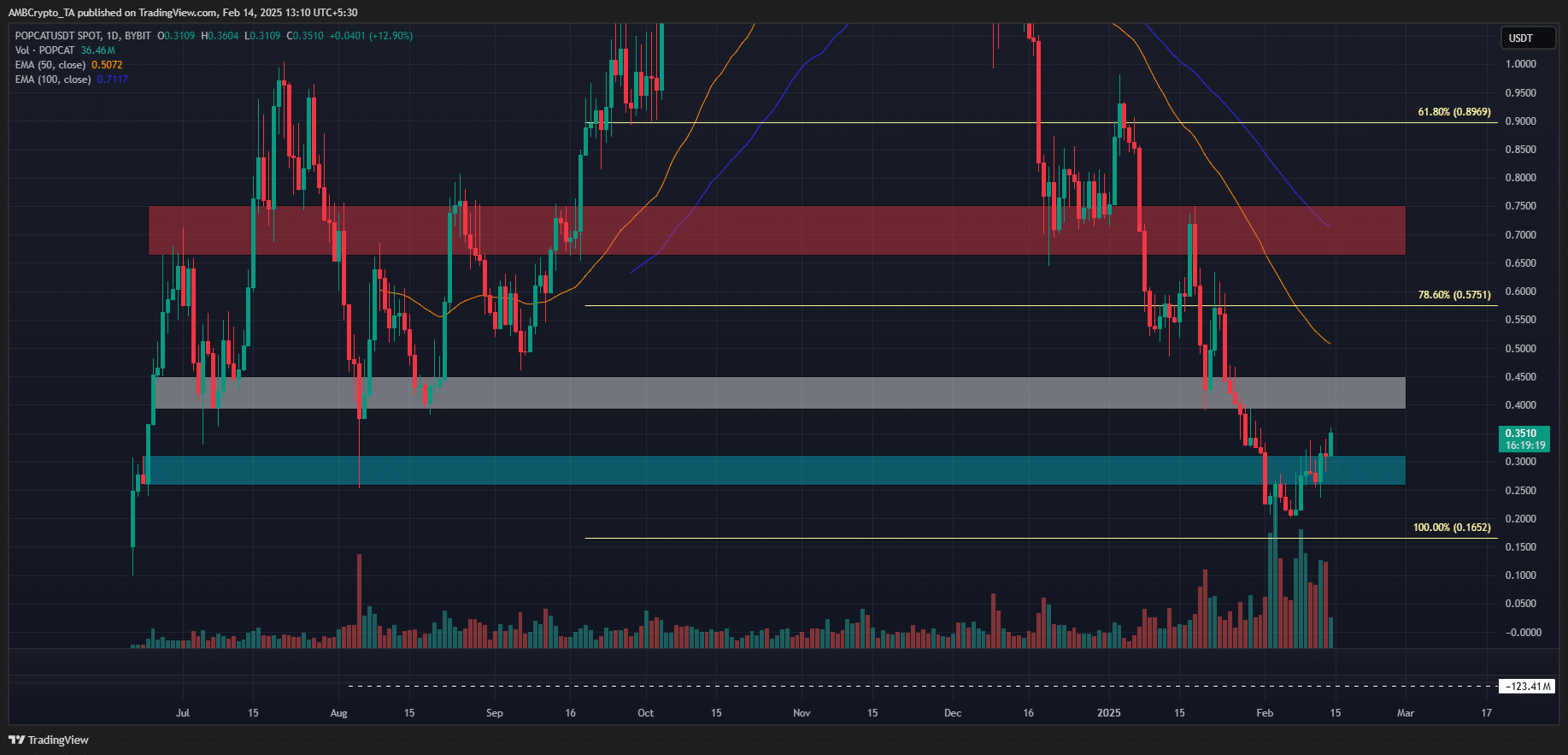

On the daily price chart, POPCAT crypto defended the $0.20 level and recovered steadily. However, immediate overhead resistance levels are at $0.40 and $0.66.

Based on current data, it is unclear if the memecoin can extend the recovery beyond $0.40. Notably, the daily RSI has recovered but has not yet flipped the neutral level into support.

Since December, the daily RSI faced rejection at this level, capping POPCAT’s uptrend. If the trend repeats, POPCAT could stall.

Additionally, the OBV (On-Balance Volume) fluctuated below the key level, suggesting volume stagnation, which could delay a strong extended rally in the short term.

If the memecoin stalls at $0.40, a retracement to $0.30 (cyan) could offer a buying opportunity.

On-chain signals rebound

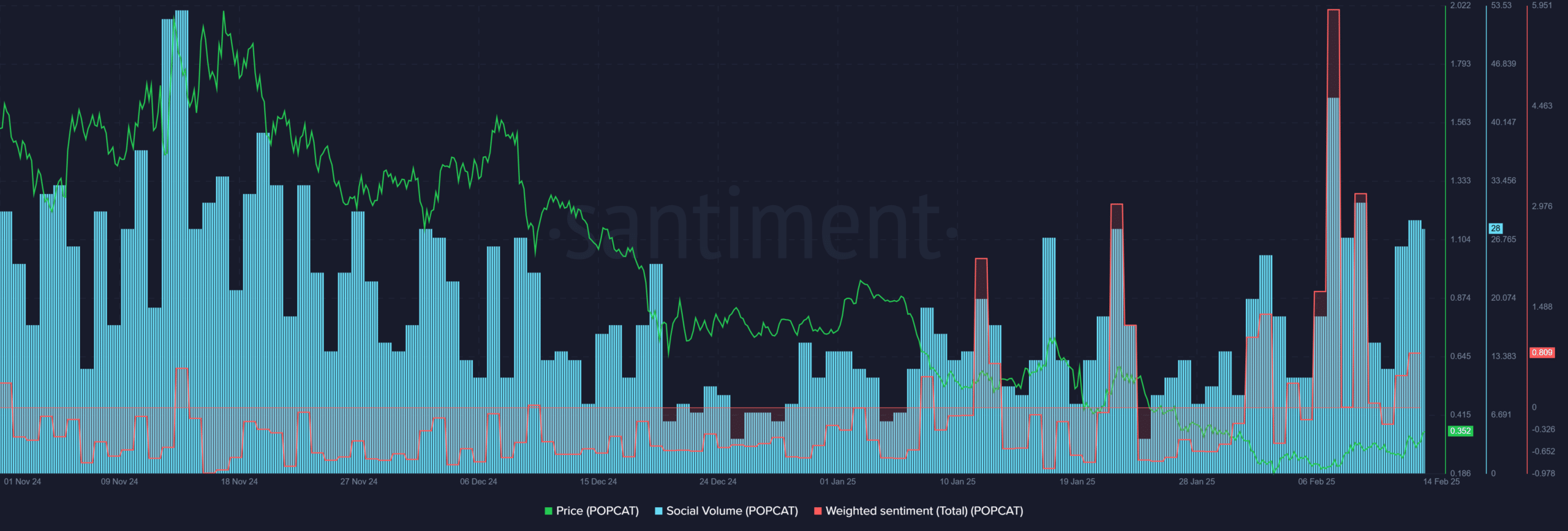

That said, the February recovery also saw improvement in key on-chain signals—sentiment and social volume.

Unlike December, when the Weighted Sentiment was firmly in the negative territory, the indicator flashed positive signals in February. It suggested that the market outlook on POPCAT improved.

Similarly, market interest and overall demand increased, as shown by spikes in Social Volume. This demonstrated increased engagement with the memecoin across social media, potentially leading to further demand on the price chart.

However, unless the expected demand pushes the daily RSI above the neutral level, further recovery could stall in the short term.