Post UST’s depegging fiasco, data seems to suggest returning interest in stablecoins

Stablecoins, in general, suffered immensely post the TerraUSD (UST) de-pegging event. This event saw UST drop from its once-stable $1 parity to today’s $0.06 per UST. Now, to refill that lost trust, the second largest stablecoin (USDC) provider Circle has taken some measures.

Circle published a blog post on 13 May, called ‘How to Be Stable’. This post incorporated Circle’s efforts around trust and transparency with USDC.

Have some faith

Well, cryptocurrency exchanges did showcase some faith in the 2nd largest stablecoin within the ecosystem. The Crypto Exchange OKX announced the listing of LUNA/USDC, SOL/USDC, DOGE/USDC, FIL/USDC, DOT/USDC, NEAR/USDC, APE/USDC, AVAX/USDC, ADA/USDC, and SHIB/USDC on spot trading markets. Ergo, continuing to support the development of the USDC ecosystem.

Jeremy Allaire, the Chief Executive of Circle acknowledged this development in a tweet on 23 May that read:

“Flight to quality and safety expressed in spot markets on top exchanges. More to come soon!!”

Such narratives could play a vital role in providing some certainty amidst the chaos. Well, it did seem to work as the trading volume surged by more than 24% in the past week. In addition to maintain transparency, Allaire further promised weekly USDC reserves and liquidity operation reports.

“As promised a week ago, we are now providing weekly reports on USDC reserves and liquidity operations,” Allaire tweeted. Allaire also shared the USDC assurance report and further said: “Over the past week, we saw 8.6 billion USDC issued, and 6.3 billion USDC redeemed, with a net weekly increase in circulation of 2.3 billion USDC.” The Circle’s CEO further added:

“What makes USDC such a great product is that it’s easy to create and redeem, with seamless integration with the existing global banking system. As a result, customers are able to use it as a very efficient pipe between legacy electronic dollars and digital currency dollars.”

Having said that, consider the timing of this news; the 2018 “ICO era” scam wallet activated as developers tried to withdraw $22 million in USDC.

Wow so over the past weekend the Sparkster wallets from the 2018 ICO scam became active for the first time in ~3 years swapping 14,200 ETH for $22.7m USDC across 5 wallets.https://t.co/N1DCOzx9uQ pic.twitter.com/vHKzsjOO8i

— ZachXBT (@zachxbt) May 22, 2022

Any repercussions?

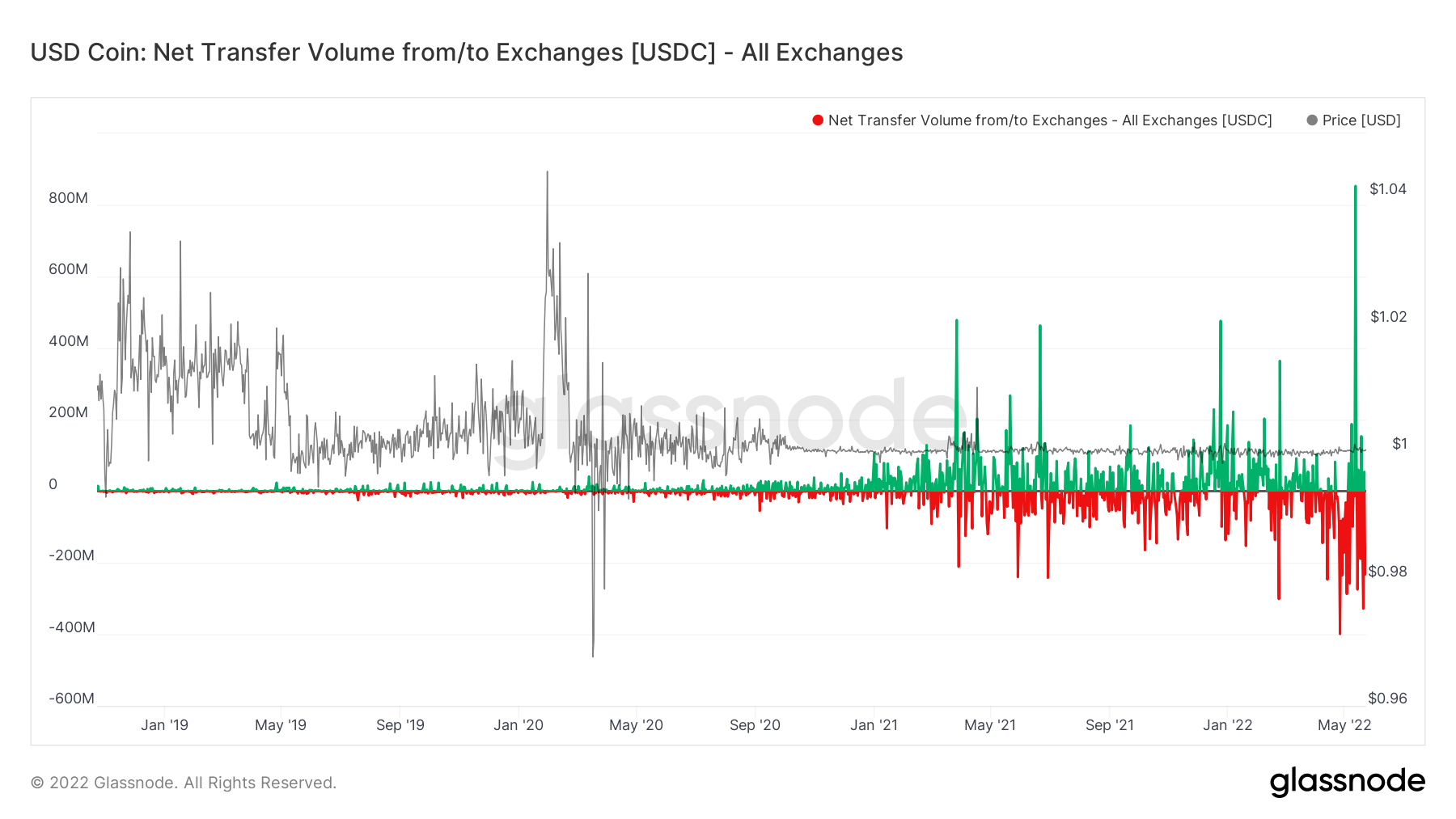

Well, not at least in the short-term. Here are a few bullish signs. The Exchange Net Flow reached an ATL of -$20,349,225.13. Ergo, signalling a bullish shift in investor sentiment. The previous ATL of -$17,229,420.56 was observed on 27 April 2022.

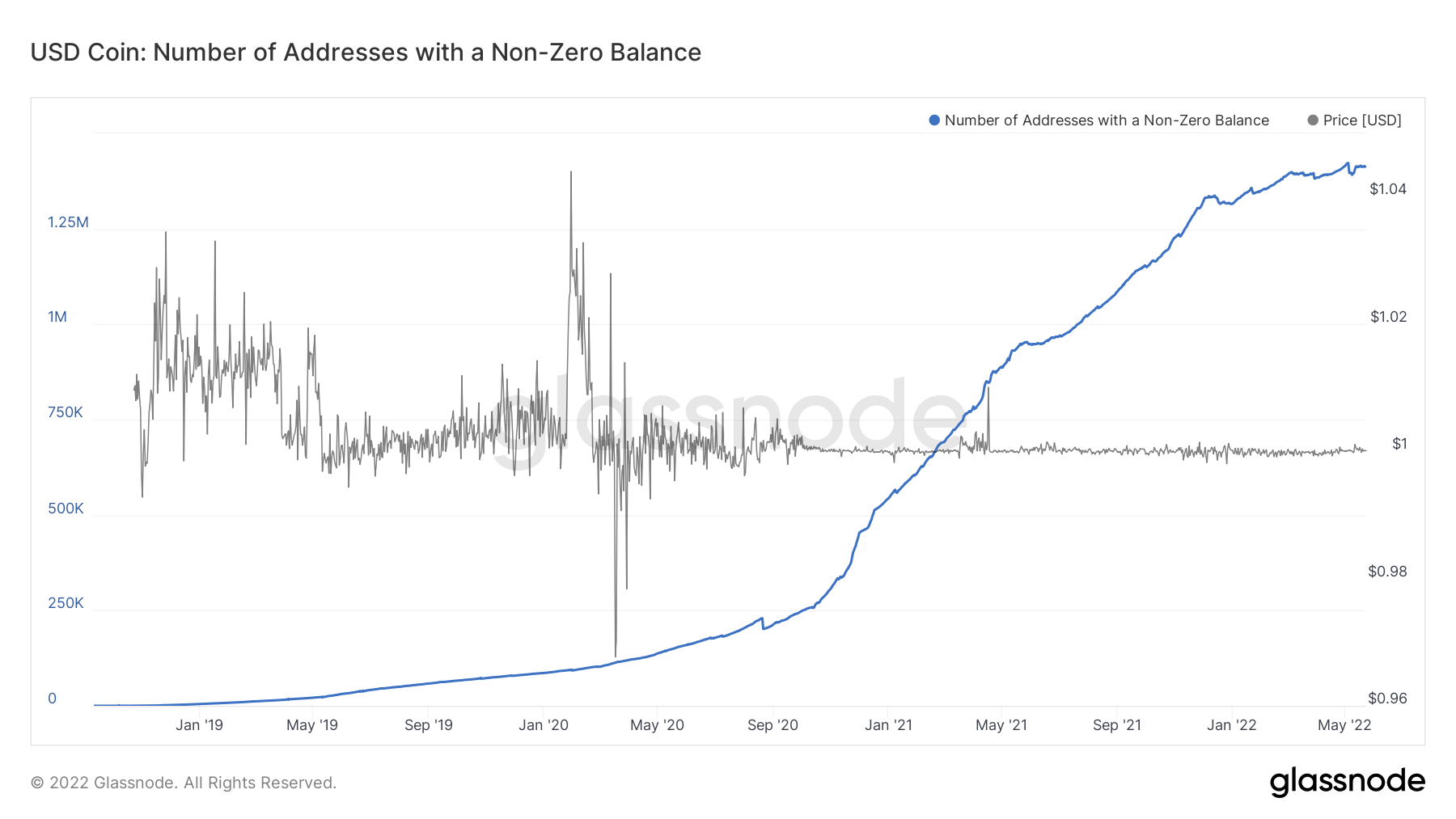

Consistent outflows would represent strong holding sentiment and take out circulating supply from the market. Moreover, the number of addresses with a non-zero balance witnessed a surge as well.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)