Price Analysis: Bitcoin market bulls ward away the grizzly bears

Bitcoin was expected to respond positively to the launch of Bakkt, however, the coin instead fell by 20% and was being valued at $7,714. The coin has been pushing itself up, but the bears keep pulling it back. The dominance of BTC was noted to fall to 66%, which was earlier recorded to be around 70%.

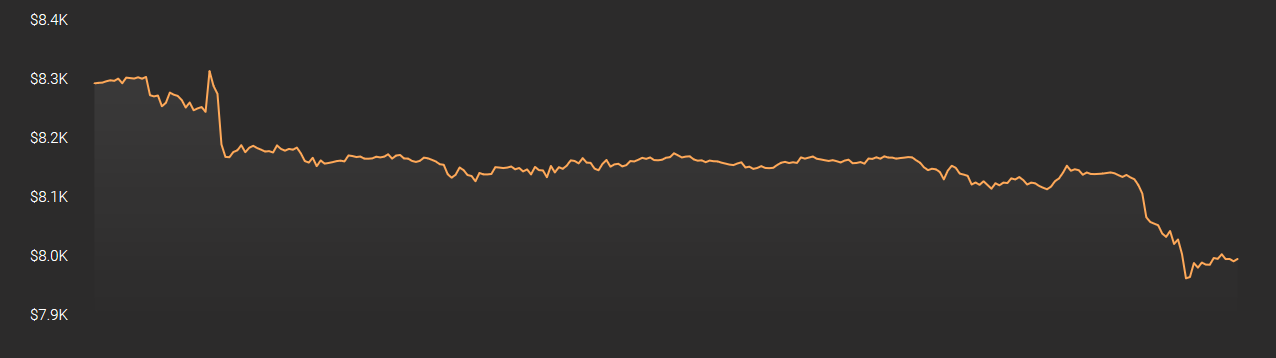

At press time, Bitcoin was trading at $8,712.61 with a market cap of $147.80 billion. The 24-hour trading volume of the largest cryptocurrency in the world was noted to be $14.96 billion as it fell by 1.75% over the past day. The coin has recorded a minimal fall of 0.08% and the recovery within an hour was also meager, 0.04%.

Source: CoinStats

1-hour

Source: BTC/USD on TradingView

Resistance- $8,638.78

Support- $7,814.36

Bollinger Bands appeared to have diverged and the moving average rested above the candlesticks, a bearish market might be dominant.

Awesome Oscillator marked a bullish market with reduced momentum.

Relative Strength Index indicated that the BTC was in the oversold zone but was attaining equilibrium.

1-day

Source: BTC/USD on TradingView

Resistance- $12,927.44

Support- $7,842.49

Parabolic SAR reflected a bullish market as the markers aligned above the candlesticks.

Chaikin Money Flow remained above the zero mark, indicating that the money was flowing in the market, making a bullish zone.

MACD line was above the signal line pointing at a bullish market, however, with reduced momentum.

Conclusion

The Bitcoin market, despite some bears, predicted a bullish uprise.