ProShares ETF’s BTC holdings touches ATH, but there are some warning signs

Bitcoin climbed to more than $44,000 for the first time in almost a month, breaking out of its recent narrow trading range amid a renewal of risk appetite. At press time, BTC was trading at the $44.7k mark with a 3% surge in 24 hours.

Give me more

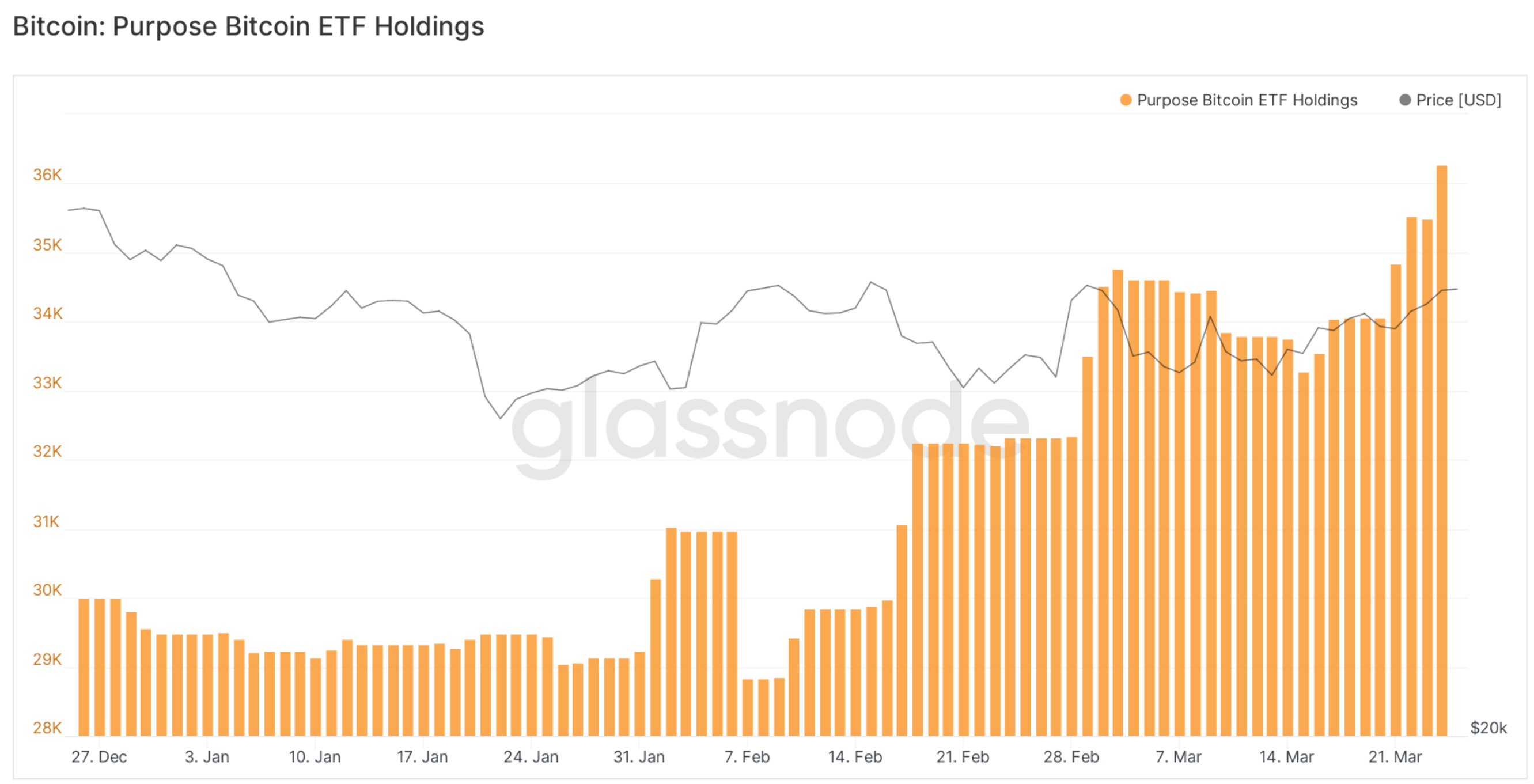

It is quite obvious that investors have rushed in to get more Bitcoin exposure. Now, the first Bitcoin futures exchange-traded fund (ETF) in North America, the Purpose Bitcoin ETF, is making headlines.

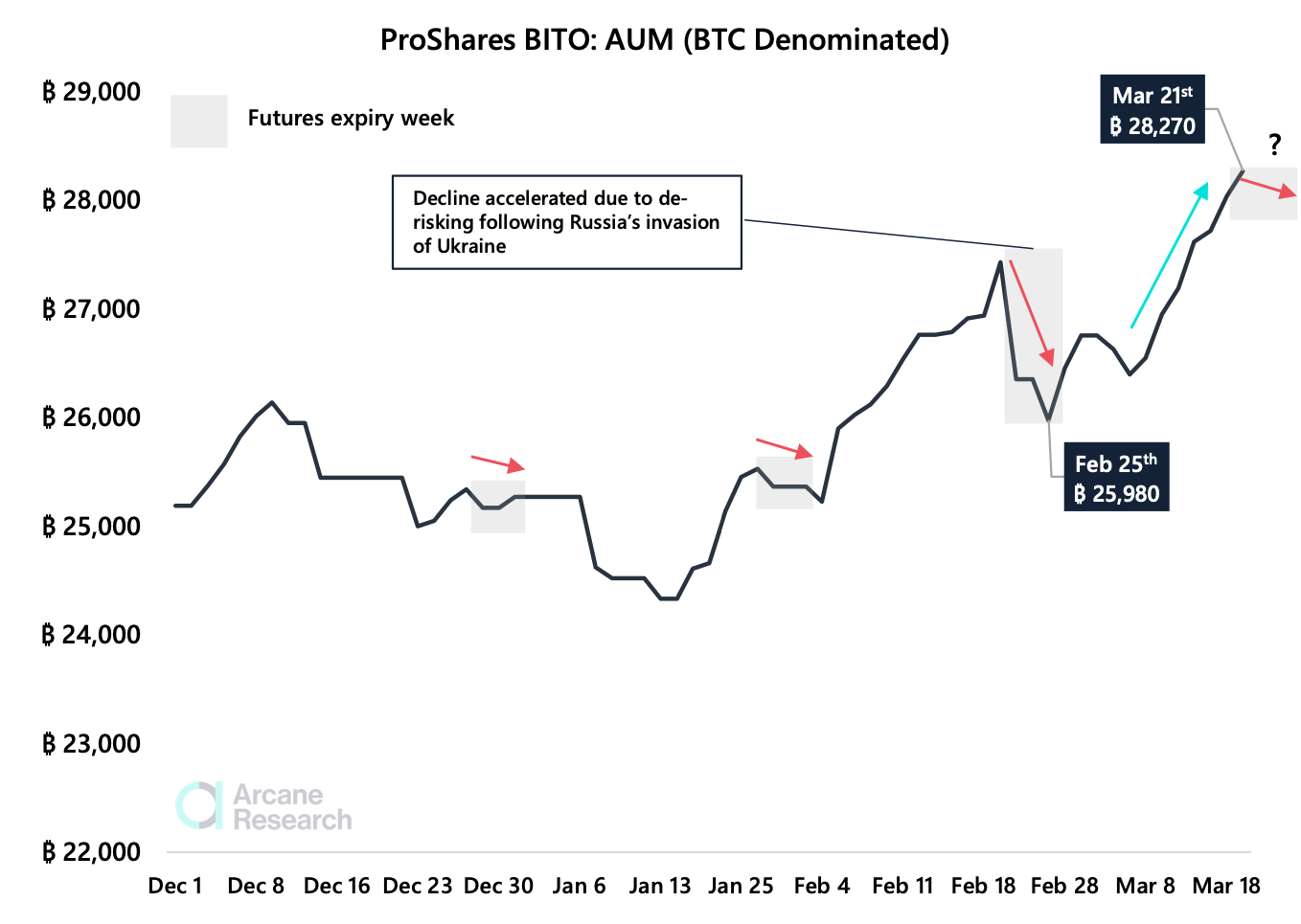

The total Bitcoin exposure in ProShares ETF trading under the ticker BITO on the New York Stock Exchange climbed to a new all-time high above 28K BTC, as of 22 March, after witnessing two weeks of solid inflows. As per information from Arcane Research, this was evident in the graph below.

In fact, according to data from Glassnode, the aforementioned number witnessed a net increase of > than 2000BTC within 24 hours. The Canadian ETF currently holds 36,271.8 BTC as shared by Wu Blockchain on 25 March.

Source: Glassnode

The rise occurred as a result of the massive traction of capital since both the market and the price of Bitcoin improved over the last two weeks. Overall, the strong inflows to BITO suggested that Bitcoin appetite through traditional investment vehicles has increased significantly.

The ProShares Bitcoin Strategy ETF (BITO) had the second-biggest trading debut for any ETF on record on 19 October. Its unit price jumped 4%.

So interested?

The benchmark crypto saw some relief in the past days, but seems unlikely to reclaim its earlier bullish momentum fully. Arcane Research recorded no significant Open Interest (OI) movements for the BTC-based derivatives sector. This metric has remained stable at around 360,000 BTC and 380,000 BTC since beginning of 2022.

As seen above, the OI for BTC futures moved sideways along the price of Bitcoin, as it registered a decrease in volatility. In other words, the BTC market could experience a period of low activity, ergo, suggesting no significant trends in either direction.

The 30-day volatility saw a 1% low in March, and trended slightly higher in the last two weeks. At press time, the metric stood at 1.5%. Nonetheless, this neutral scenario didn’t entirely stop BTC’s accumulation. Lark Davis, a renowned trader, shed light on this narrative in a tweet on 24 March.

Heavy #bitcoin accumulation has happened between 38-45k pic.twitter.com/zpRGcht6so

— Lark Davis (@TheCryptoLark) March 24, 2022