Putting Bitcoin’s close relationship with S&P500 to test- Here’s the outcome

Bitcoin is often described as an alternative to Gold. Although, BTC’s historical price action might suggest a different scenario. Over the years, the king coin remained more closely related to stocks or the equity sector. Now the question is- Given the current bloodshed, would this relationship sustain in the future?

Hold my hand

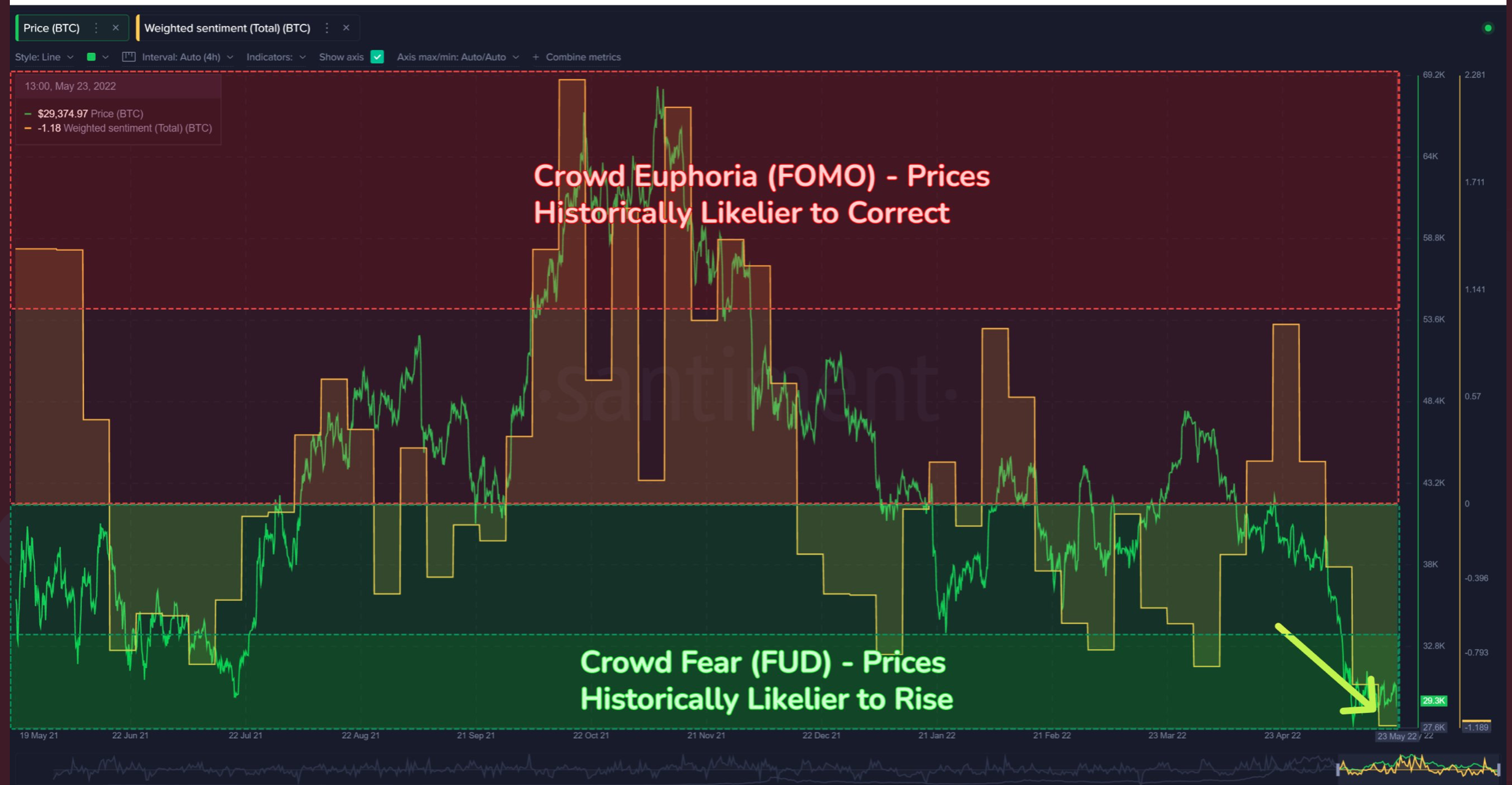

At the time of writing, BTC’s sentiment was at the rock bottom, indicating the amount of ‘doom and gloom’ surrounding BTC and crypto, in general, is at its most negative since “BlackThursday” in March 2020. BTC’s weighted sentiment has reached the lowest point as seen in the graph below.

In fact, the Bitcoin market has now traded lower for eight consecutive weeks, which is now the longest continuous string of red weekly candles in history. But there might be an opportunity to counter this situation. Basically, putting the aforementioned relationship to test.

Notably, on 23 May, BTC dropped around 4%. However, the equity counterpart (S&P500) had a good day at the office.

Santiment, the analytical platform stated,

“These two have fluctuated tightly throughout 2022, and this separation may be caused by BTC resistance at $30k. If equities continue upward, though, expect good things for crypto.”

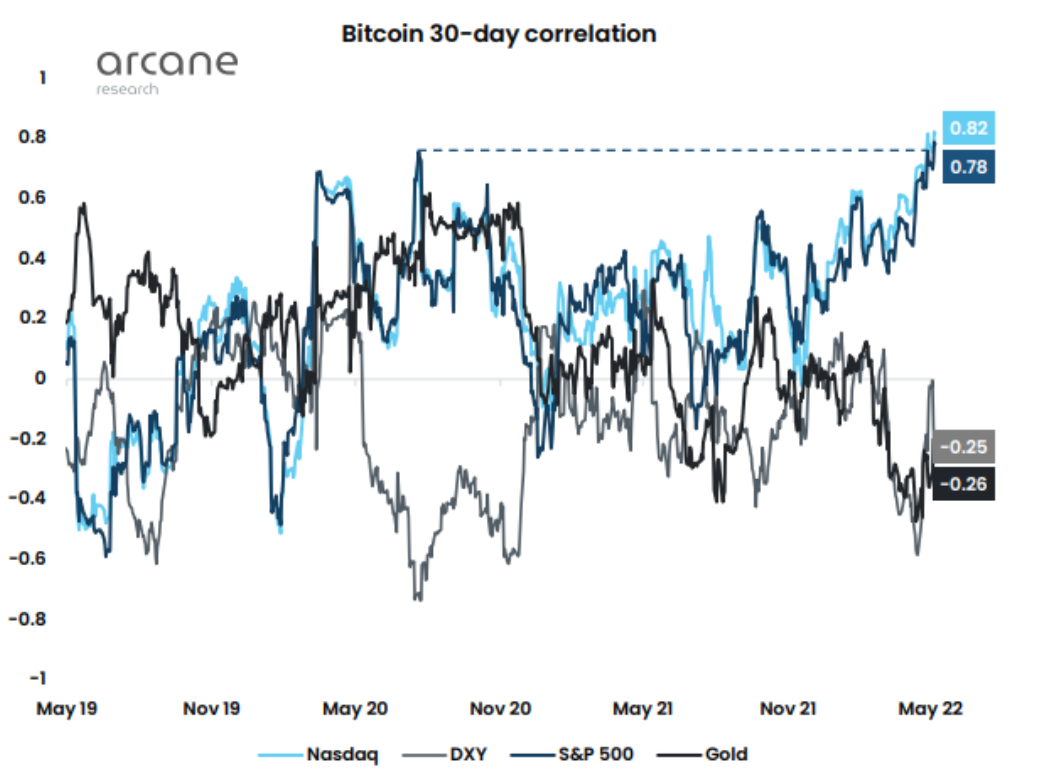

The previous data showed that Bitcoin has continued to become increasingly tied to the U.S. stock market. Even crypto’s correlation with Nasdaq reached a new all-time high two weeks ago. Interestingly, the BTC-Nasdaq correlation grew to a new ATH of over 0.8 as per the weekly report from Arcane Research.

Consider the chart below that showed the trend in the Bitcoin 30-day correlation with Nasdaq, S&P 500, DXY, and Gold over the past couple of years.

Source: Arcane Research

Bitcoin mirrored the stock market throughout this year as the correlation surged up in recent months. The growing institutionalization of Bitcoin might be behind the increasing correlation with the stock market.

In addition, the correlation between Bitcoin and the S&P 500 soared to unprecedented levels as the U.S bond sell-off spread to risk-on assets.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)