QNT surges 23% after bouncing off support but can it maintain the momentum

Quant’s QNT cryptocurrency earned its way into the list of top trending this weekend, accompanied by strong price action. It pulled of a 23% mid-week rally but could there be more to this performance or will it be relegated to a weekend pump?

Decoding the mystery

QNT demonstrated bullish strength for most of September, especially after crossing above its 200-day moving average. Its $96-$97 price range acted as the new price floor and that has been the case in the last few days.

Furthermore, QNT kicked off last week on a bearish trajectory but the bulls took over at the middle of the week. This resulted in a 23% upside.

Additionally, the performance may have also been influenced by strong buying pressure within an ascending support line. The latter was part of the cryptocurrency’s ascending range that prevailed for the last three months.

The bounce from support indicated that QNT might have just started its next rally. However, numerous observations suggested that the upside would face a lot of friction. QNT peaked at $124 after a strong rally in the last 24 hours at press time. It also registered a strong pullback to a $115 press time price. This confirmed that there was heavy profit-taking during the trading session.

Brace for short-term sell pressure

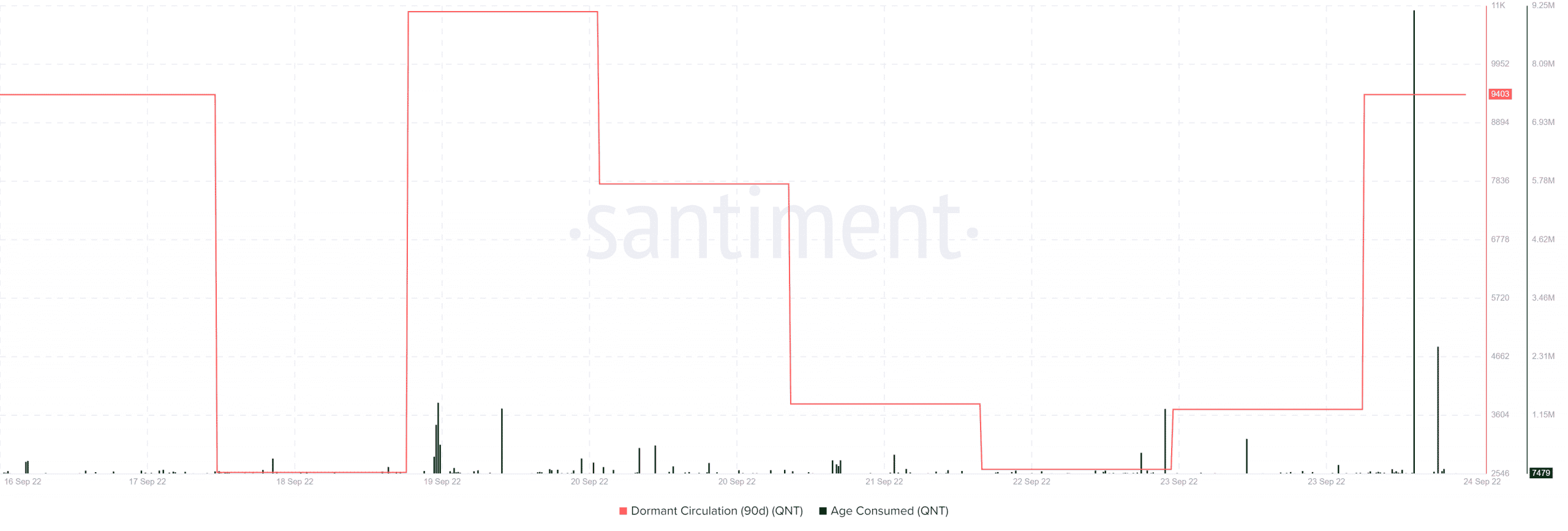

QNT’s 90-day dormant circulation achieved a notable spike in the last few hours. A confirmation that a substantial amount of the cryptocurrency previously HODLed for at least three months was moved.

Similarly, QNT’s age-consumed metric registered a large spike in the last 24 hours. As many as 9.16 million coins changed addresses during the last few hours. These metrics do not indicate whether the transacted QNT volume will support an extended upside or lead to sell pressure. Fortunately, exchange flows may provide more clarity.

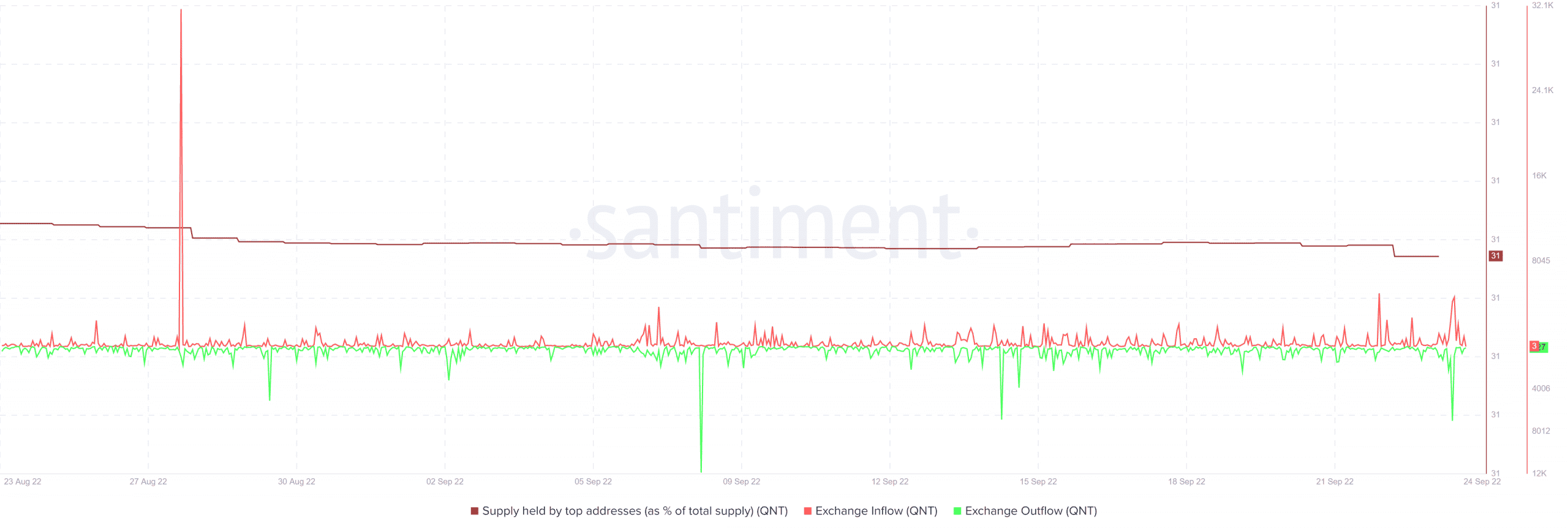

QNT’s exchange outflows registered a large spike in the last 24 hours, and supported the upside. A strong exchange inflow uptick followed, perhaps contributing to the pullback.

In addition, QNT’s supply held by top addresses registered a substantial drop during the week. This acted as confirmation that whales may have taken some profit as the price went up. These observations further confirmed that QNT was bound to face a lot of sell pressure on its way up. Enough sell pressure would then trigger a retracement.

QNT might manage to maintain its upward momentum if investors show a significant incentive to buy back. For example, if the rest of the market manages to bounce back as the new week rolls in, then QNT investors might join the trend. Such an outcome would support further upside in the short-term.

Meanwhile, QNT’s long-term outlook looked quite promising thanks to its Overledger solution. Its focus on the business world could potentially contribute to strong demand for the cryptocurrency in the future.

#QUANT THREAD?

Here is why $QNT's OVERLEDGER Revolutionise the world of business ? pic.twitter.com/oCyvIR2DSv

— TheBlockchainMedia | We are hiring! (@THECHAINMEDIA) September 23, 2022