QNT’s price action flashes bullish signs – Time to jump in now?

- Quant’s price now under pressure, despite strong bullish sentiment signals

- Exchange reserves have been falling, but Open Interest declining too

Quant [QNT], at press time, seemed to show strong bullish sentiment from both retail and institutional investors, signaling optimism for a potential price reversal. In fact, Market Prophit data, on an X post (formerly Twitter), highlighted a crowd sentiment score of 2.07, while smart money sentiment stood at 0.86.

Despite this optimistic outlook, however, QNT was trading at $65.05, following a 2.39% decline at press time. This raises a critical question – Will the bullish sentiment be enough to reverse the prevailing downtrend?

QNT price action analysis – Can it hold support?

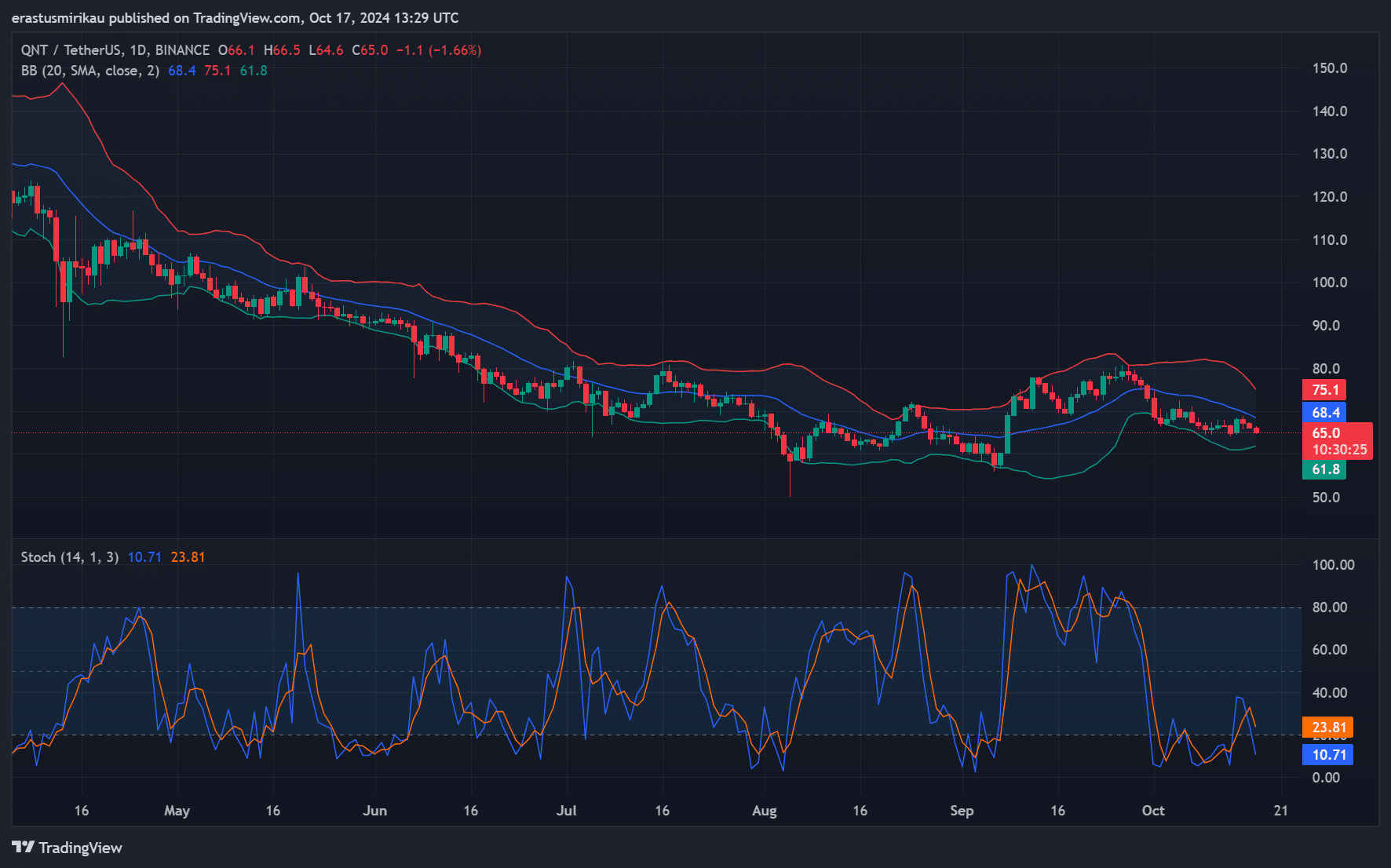

QNT has seen its price decline steadily since failing to break resistance at $80 in September. At press time, it sat near the lower Bollinger Band level of $61.80, a critical support zone. The Stochastic RSI further highlighted bearish momentum, with oversold conditions marked by the blue line at 10.71.

Therefore, even though the asset seemed oversold, the price action highlighted that sellers remain in control. If Quant can hold support, a reversal might occur. However, breaking below $61.80 could trigger further selling pressure.

Exchange flow analysis – Is selling pressure easing?

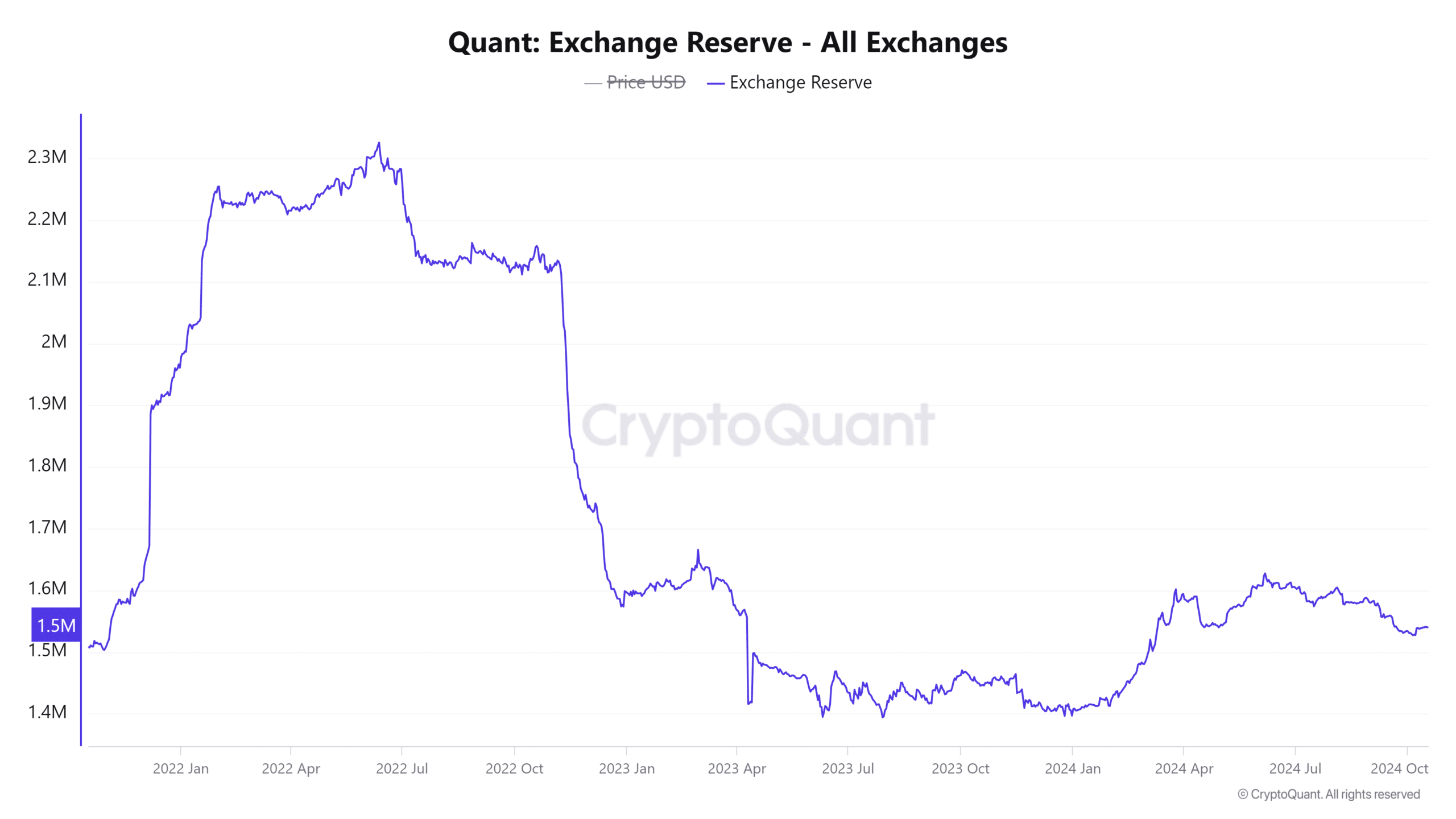

Looking into exchange reserves, QNT has seen a slight reduction, with 1.54 million tokens currently held on exchanges—A 0.21% fall in the last 24 hours. Consequently, this drop may indicate reduced selling pressure, as fewer tokens are being sent to exchanges.

However, this needs to be monitored closely. If exchange reserves start rising again, it could mean renewed selling activity. Thus, while this reduction in reserves offers some relief, it’s still unclear whether it’s enough to halt the ongoing downtrend.

QNT open interest analysis – Is market confidence faltering?

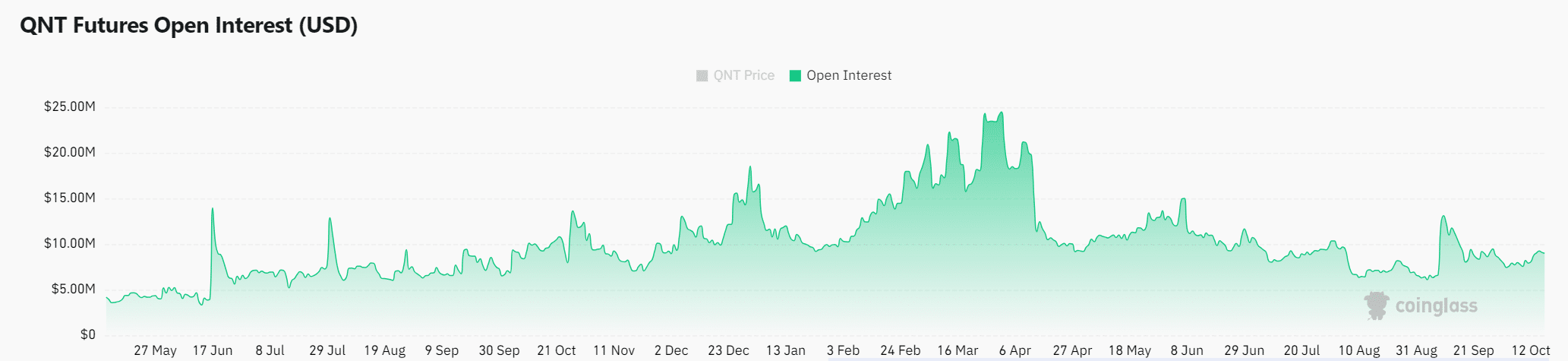

Quant’s open interest has declined by 7.39% too, settling at $8.49 million. This fall could signal a lack of confidence, as traders are closing positions instead of opening new ones.

Consequently, a sustained drop in Open Interest may further amplify bearish sentiment, as fewer traders are willing to place bets on price recovery. On the other hand, if Open Interest stabilizes, it could pave the way for more significant price movement.

QNT OI-weighted funding rate – Is there still optimism?

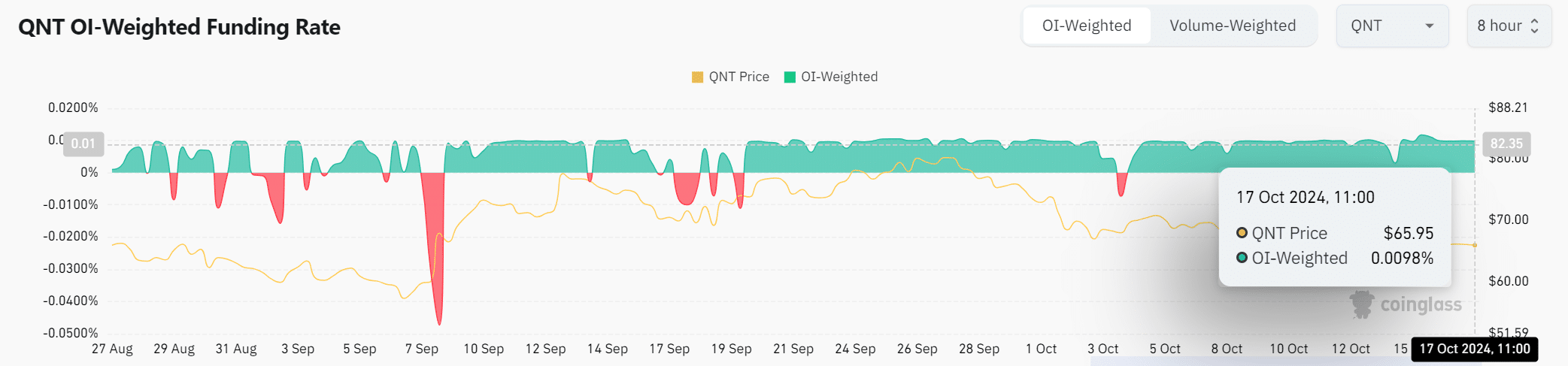

Finally, the OI-weighted funding rate was slightly positive at 0.0098%, showing that long positions are being maintained. While this is a sign of optimism, it’s not strong enough to indicate a clear shift in market sentiment. Therefore, while long traders are still holding out for a price hike, it may not be enough to drive major gains in the short term.

Read Quant’s [QNT] Price Prediction 2024–2025

Despite bullish sentiment from both retail and smart money, Quant’s technical and on-chain metrics suggested caution. The declining Open Interest and ongoing price pressure indicated that the bullish sentiment hasn’t translated into stronger price action.

Therefore, while QNT has potential, it may need additional technical confirmation before any breakout occurs on the charts.