Justin Sun-linked HTX hits out at Kaiko’s “baseless” report

Update: This article has been updated to include HTX’s response to Kaiko’s report

- Around the time of Worldcoin’s launch, HTX’s market share dramatically spiked from 4% to almost 20%

- Intense selling of USDT in favor of USDC was seen on the exchange in the last three months

- HTX was quick to dismiss these “baseless allegations”

The name may have changed but the seeds of suspicion surrounding the newly branded cryptocurrency exchange HTX [HT] continue to sprout. The actions of advisor Justin Sun, concerns of insolvency, and lack of transparency have made the Seychelles-based trading platform a big talking point in recent months.

Read HT’s Price Prediction 2023-24

The latest bombshell was dropped by a research analyst from digital assets market data provider Kaiko, who drew attention to some “unusual” activities on the exchange.

What is Kaiko claiming?

Earlier in July, the crypto-industry witnessed the launch of the controversial but hugely popular Worldcoin [WLD]. HTX, then Huobi, was among the first to list the coin and open it for trading.

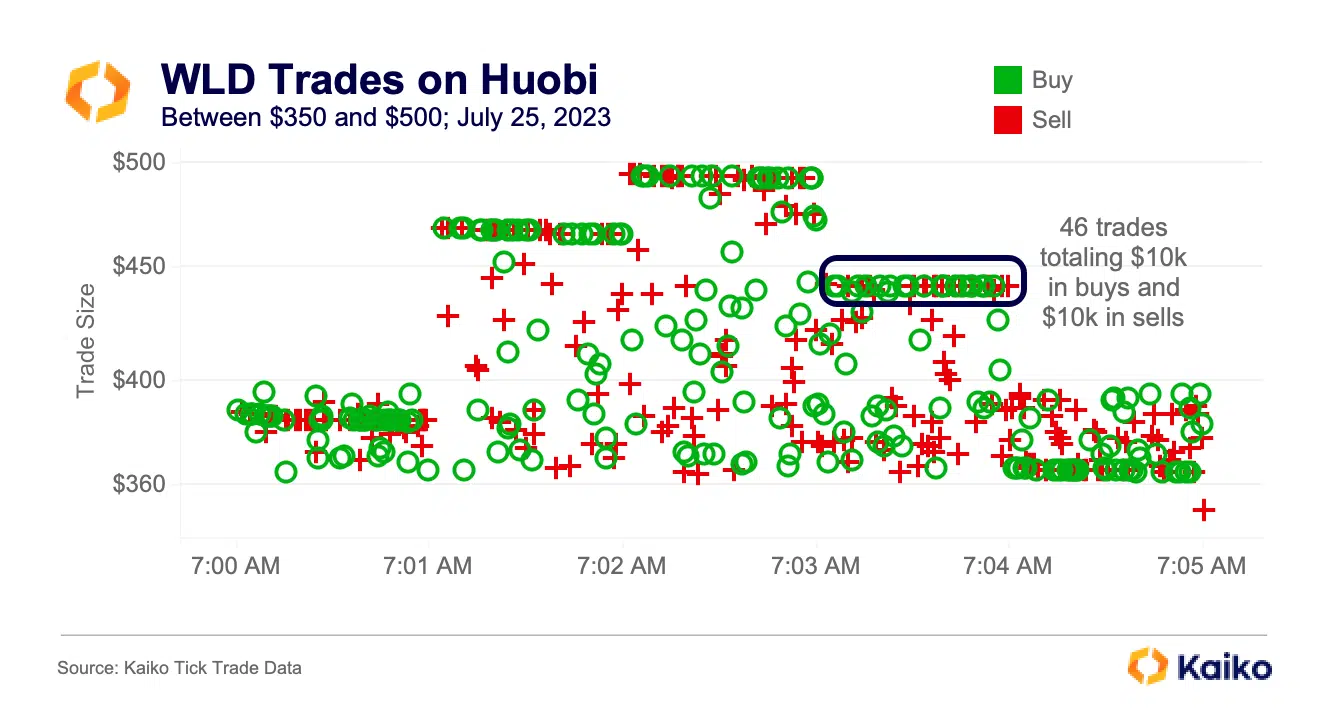

However, soon after the listing, clusters of matching buys and sells were discovered on the exchange, as indicated below.

According to Kaiko, when trades are perfectly balanced between buys and sells, it is a symptom of artificial volume.

Such cases usually involve artificially inflating volumes by buying and selling an asset at the exact same time on an exchange. Exchanges and token projects have a lot to gain from something like this.

First of all, a token with a higher trade volume would attract new investors. This is especially true for novices who rely more on trading activity than research before selecting an asset to invest in. Secondly, high volumes of token projects would also boost overall volume figures for the exchange. This, in turn, would push the exchange up the rankings table, making it look more popular and credible.

New token projects generally prefer exchanges with higher volumes to list the token. Thus, exchanges stand to profit significantly from token listing fees, which may be significant in a bear market where volumes are already subdued.

Inorganic jump in market share

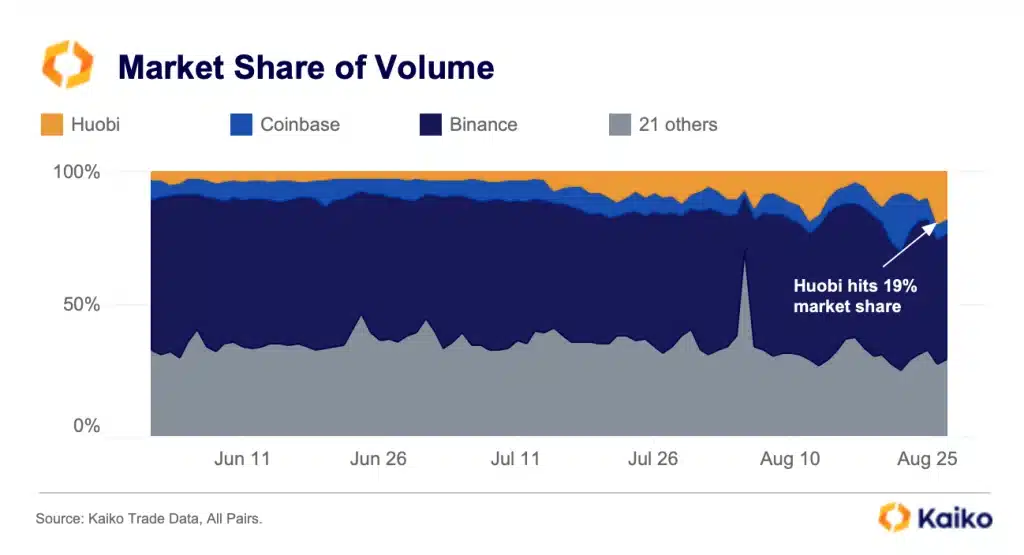

Interestingly, around the time of WLD’s launch, HTX’s market share spiked from 4% to almost 20%. This, despite the fact that none of the other major exchanges saw a similar surge in volume.

As there was no other credible explanation for HTX’s case, the mystery deepened.

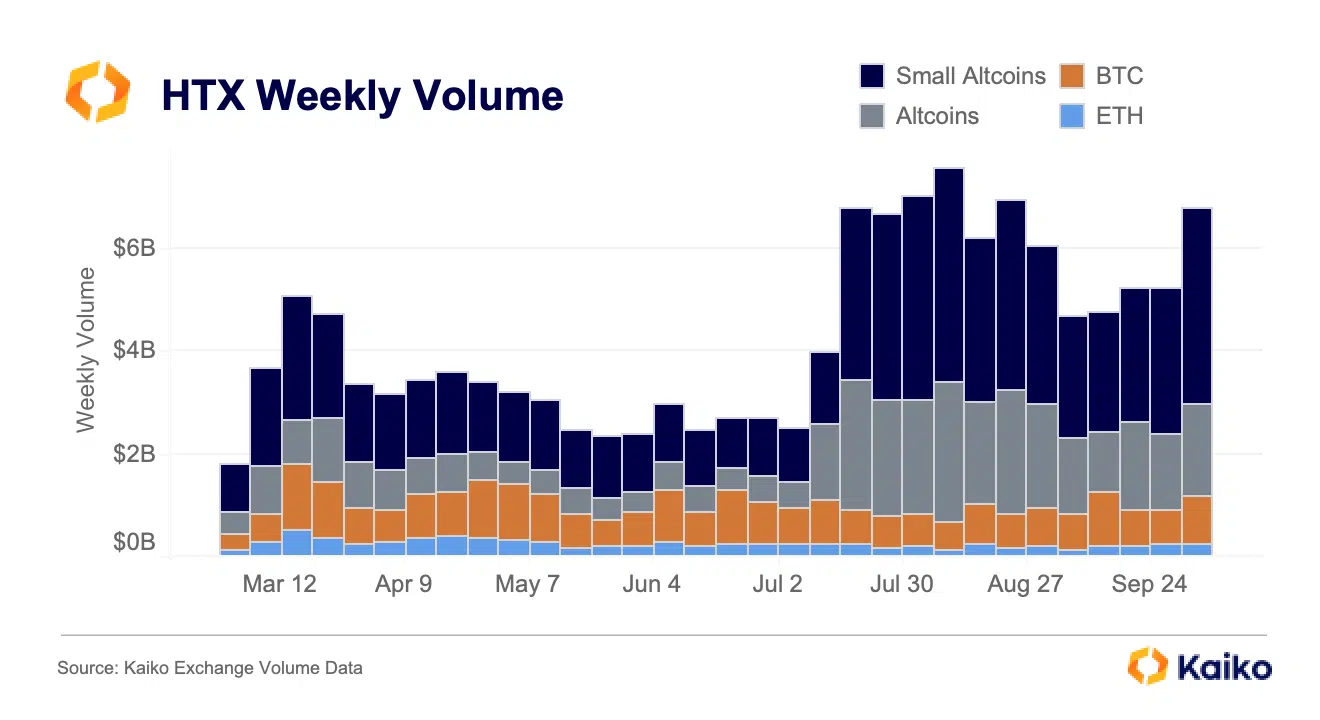

Additionally, the surge was driven by low cap altcoins i.e. Assets with an aggregated volume of less than $1 billion from March to October. During the aforementioned July phase, the volume of these assets surged from $1.4 billion to $3.4 billion in a week.

Similar behavior was seen in the trajectory of large cap altcoins, which experienced a 5x jump in weekly volume. To the contrary, top assets of the market like Bitcoin [BTC] and Ethereum [ETH] weren’t impacted at all.

These observations are in line with arguments made earlier in the article.

Increase in USDT de-pegs

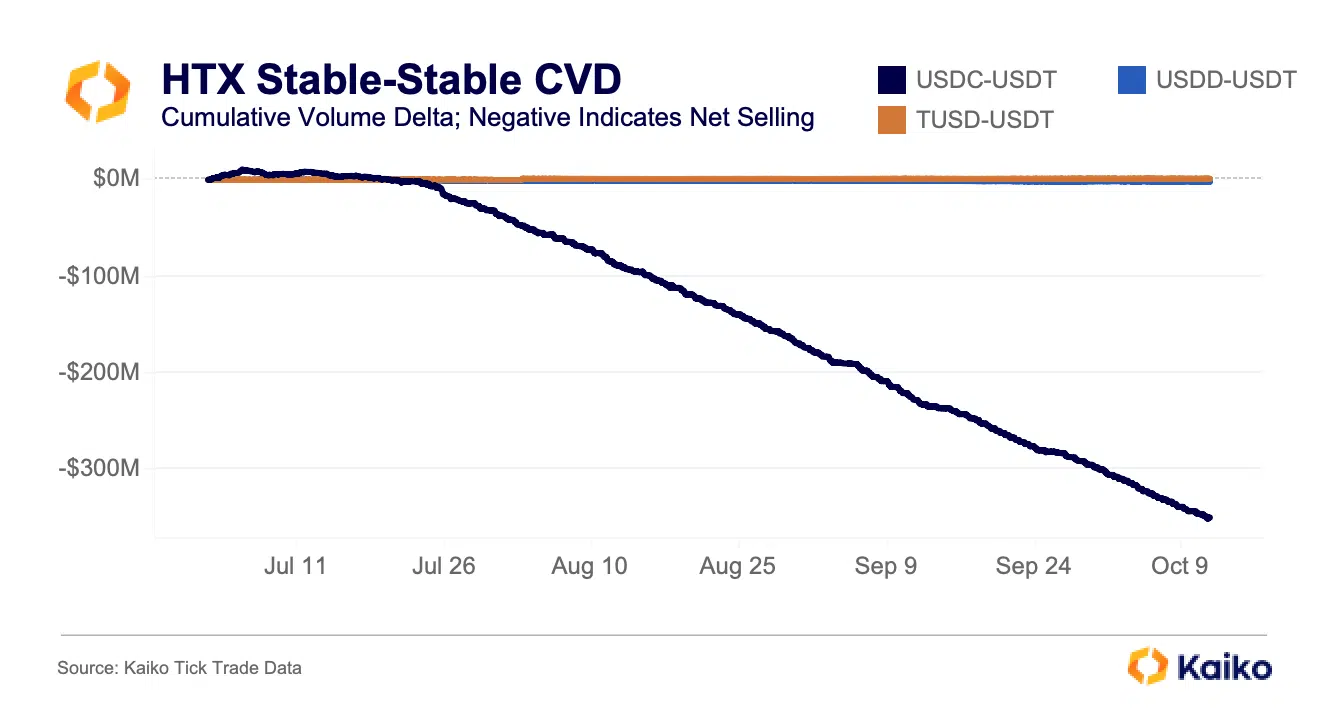

Another anomaly spotted with HTX was the high number of stablecoin Tether [USDT] de-pegs. According to the report, the de-pegs were a result of intense selling of USDT in favor of another stablecoin USD Coin [USDC].

In fact, USDT worth $350 million has been redeemed for USDC since the beginning of July. What created more doubt was that nearly $400 million in USDC flew from HTX’s wallets to Binance around the same time.

But what could possibly explain this?

Well, according to HTX, this is much ado about nothing. According to a representative,

“… accumulating 400 million USDC over three months translates to an average daily volume of 4 million USDC, a typical figure. Users’ buying and selling of USDC is routine.”

Justin Sun in the eye of the storm

Even so, Bitcoin expert Dylan LeClair took to X a few days ago, accusing HTX advisor Justin Sun of creating a ‘web of deception’ to drain USD liquidity from the crypto-ecosystem through USDC.

Are your holdings flashing green? Check the HT Profit Calculator

In a scathing thread, LeClair alleged that the founder of Tron [TRX] used the USDT brand to swap it for fake stUSDT while it appears as regular USDT in the UI/UX on HTX. Note that stUSDT was a staked version of USDT, offered by Justin Sun-owned lending platform JustLend.

These dubious allegations have put HTX in a spot of bother. At the time of writing, Justin Sun was yet to publicly refute these charges.

A Clarification

HTX, to its credit, was quick to refute these allegations, however. Speaking to AMBCrypto, a spokesperson said,

“Kaiko’s report is very misleading, with inaccurate information presented, while Dylan LeClair’s claims on X are baseless speculations.”

The spokesperson went on to add,

“… is not an accurate representation of the operational practices of HTX. While we support projects by offering user-centric products, we cannot speak for the behaviors of individuals or other entities like third-party market makers that we are not working with.”

HTX’s representative also dismissed the point made about market sentiment, stressing on its very loyal user base across Asian markets. Finally, according to HTX, all of the staked USDT went straight to purchasing RWA.

It will be very interesting to see how Kaiko and by extension, the market responds now that HTX has shared its response.