Race to the top and the future of Ethereum

Ethereum hit a new ATH of $1732 earlier today and is currently trading at a price over 25% higher than it did last week. As this asset races to discover the price beyond $1700, the investment flow in Ethereum has increased and more institutional traders are valuing it. The valuation process is not as simple as it would seem, simply due to the dual nature of the asset. Money and commodity – it functions as both, and comparing it to Bitcoin or the likes of other altcoins may be only partially correct.

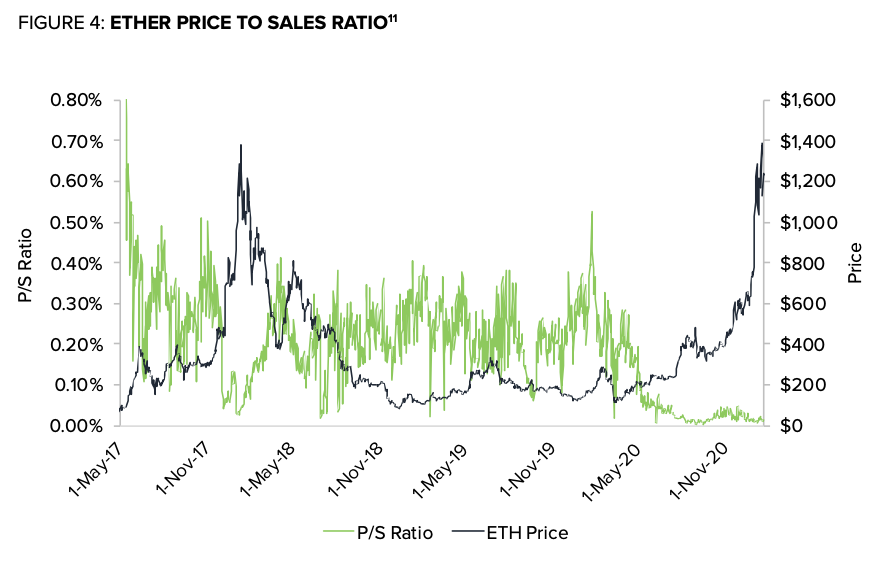

With a rapidly declining active supply, Ethereum flowing out of spot exchanges is hitting cold wallets and storage, leaving more room for vertical growth in price. Thus its valuation is sure to be bullish in the long-term. However, in the short-term, based on Grayscale’s latest report on valuing Ethereum, considering it to be a commodity may be the closest call and one important metric in terms of this valuation is the Price to Sales Ratio.

Source: Grayscale

Rather than using transaction fees to value Ethereum, one may compare Ether’s historical price to the sales (fees) on the network. The coin’s Price to Sales ratio indicates a significant dip currently. This shows that the network is generating high revenue relative to Ether’s historical market capitalization, and thus may be undervalued.

Before the price crossed $1500, there were several arguments based on the coin’s technical indicators that pointed towards the same. If the asset is undervalued even above $1600, then the price rally can be expected to continue for a longer duration. Further, considering the distribution of Ethereum and how it has changed over the past 2 years, it is clear that there is less info available than in the case of Bitcoin. It is a young network, but the emerging trend is that hodlers’ assets increased, even before Ethereum’s price went up 300% in 2020.

Ethereum 2.0 was the first step in turning around Ethereum’s valuation journey in 2020. From commodity to productive commodity, the shift in Ethereum’s utilization reflected in the price chart and adoption. Additionally, ETH 2.0 brings Ethereum closer to being an equity-like investment for retail traders. The ETH staked for ETH 2.0 is acting as a positive feedback loop at the moment, increasing the price by reducing active supply, however, this loop may remain relevant for a short duration, until the supply increases. After that, Ethereum may be valued based on its total daily transaction fees on the network.