Reasons why XRP’s 14% uptick could turn into a full-fledged bull run

Ripple [XRP] is finally regaining its affinity for the upside after about three weeks of weak price action. The cryptocurrency slipped out of its short-term ascending channel after a bearish performance at the end of August. XRP’s bullish performance in the last three days has pushed it back to the previous range. But the question remains — can it sustain the current momentum?

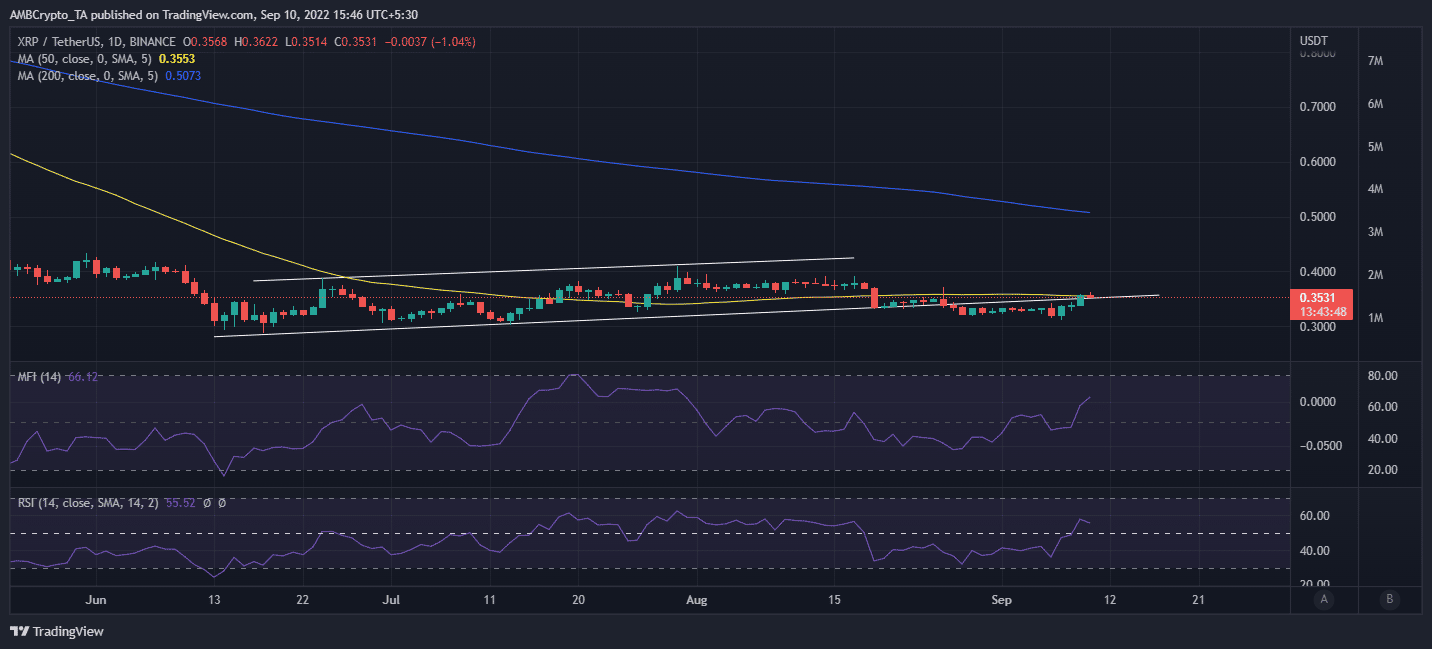

XRP pulled off a 14% uptick from its $0.31 weekly low to its current 24-hour high of $0.36. It is now trading above the same line that previously acted as support. XRP previously demonstrated bullish weakness in the last 10 days of August before capitulating and forming the next support level at $0.31.

XRP’s upside in the last 24 hours was capped after coming into contact with the 50-day Moving Average (MA). Its previous attempt to cross back above the 50-day MA was thwarted, leading to more price weakness.

XRP has already given up some of its gains after experiencing an increase in sell pressure. The similarities between the two instances highlights the potential for a bearish retracement.

On the other hand, XRP’s Relative Strength Index (RSI) indicates a stronger momentum at its current price level. Its Money Flow Index (MFI) also underscores more accumulation compared to its end of August performance. This outcome may support more upside.

XRP whales and short-term profits

On-chain metrics reveal an increase in which activity in the last three days. The whale transaction count for trades worth more than $1 million registered an influx of whale activity which likely contributed to the rally.

The whale activity aligns with observations in XRP’s whale supply distribution, as well as its latest price action. For example, whales holding between 1 million and 10 million coins increased their balances substantially between 7 and 9 September. The same category registered some outflows in the last 24 hours, which is in line with the prevailing sell pressure at press time.

Addresses holding more than 10 million XRP registered a slight uptick in the last 24 hours. This confirms that there is still some buy pressure preventing a deeper retracement.

Not so northbound it seems

XRP’s headwinds might yield a lot of volatile price movements including retracements in the short-term. Investors should however take note of these recent observations.

Whale activity in the last three days was notably higher than it has been in the last 30 days. There has also been a lot of hype regarding the potential conclusion of the SEC-Ripple lawsuit although nothing conclusive has been announced so far.