Recapping MANA’s YTD performance amid Decentraland’s recent fashion event

- Decentraland hypes things up with a new fashion event featuring big industry players.

- MANA sess some decline despite strong whale accumulation in the second half of February.

Decentraland just concluded an interesting first two months of the year which was characterized by some recovery. Demand for metaverse projects bounced back slightly, but can it sustain the same trajectory in March?

Realistic or not, here’s MANA’s market cap in BTC terms

The latest Decentraland announcement revealed that the network is already working towards sustaining healthy activity in the metaverse.

Well, Decentraland is hosting the Metaverse fashion week which will be a global event. This means the metaverse project is off to a strong start this month as the event is expected to yield robust participation.

It is also one of the few events so far this year that are exploring synergy opportunities from the metaverse and traditional industries.

Metaverse Fashion Week 2.0 Line-Up Revealed With A Global First From @adidas (via @forbes) ?

Virtual Gear NFT holders will receive an exclusive 3D twin of their Virtual Gear piece to wear in-world for #MVFW23, a first made possible via Linked Wearables.https://t.co/YXfH0BnZai

— Decentraland (@decentraland) February 28, 2023

In addition, Decentraland mentioned that it has Adidas, one of the largest global brands involved in the partnership through Forbes.

This underscores a growing trend where metaverse projects are exploring growth opportunities through partnerships with mainstream companies. Such strategies allow Decentraland to maintain a healthy ranking.

It is here to be noted that Decentraland ranked second in the list of top gaming assets by market cap on the WEB3 and metaverse segment. It ranked second after The Sandbox with a $1.21 billion market cap.

Find your own insights with Messari Screener.https://t.co/oguj7aK58q

— Messari (@MessariCrypto) March 1, 2023

Decentraland’s MANA token was also one of the top gainers on the list, on a year-to-date basis.

MANA peaked at $0.84 on 2 February which marked its 2023 peak so far. This represents a 22% drop to its $0.64 press time price.

MANA’s price has extended its decline despite a golden cross towards the last week of February. Its RSI has so far tanked below the mid-level as the bears remain dominant. But will the bulls make a comeback now that Decentraland is showing signs of more activity?

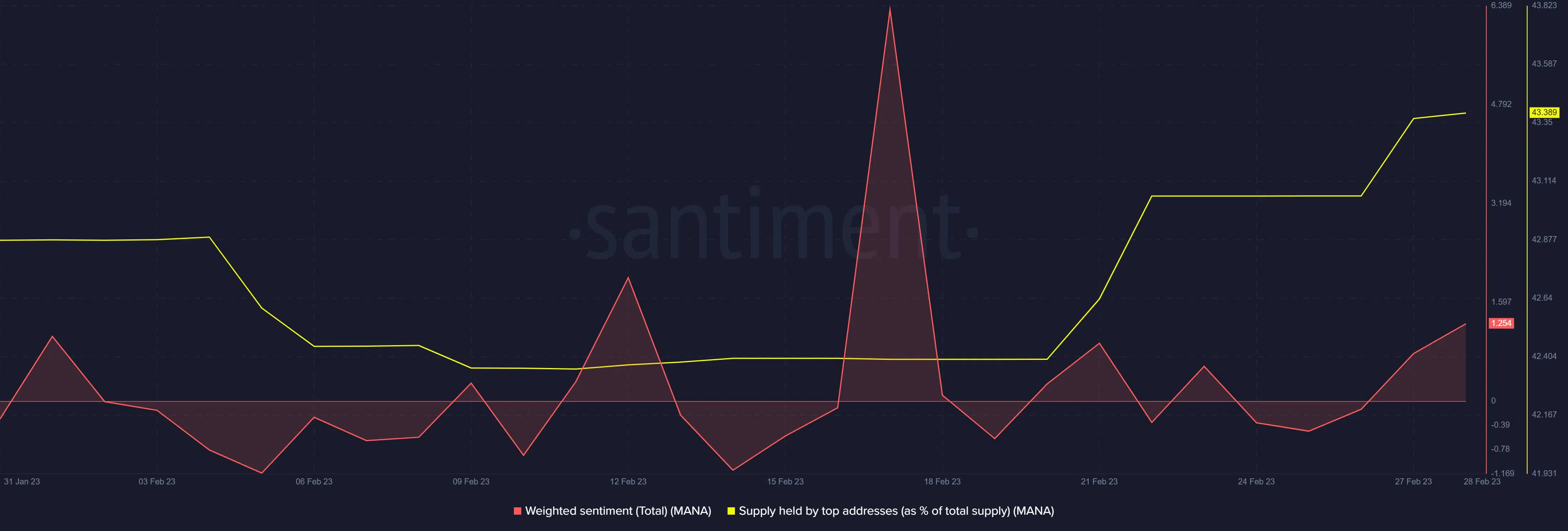

On-chain data reveals that whales have been accumulating MANA. The supply held by top addresses has been rising since 20 February despite the price drawdown.

Additionally, the market sentiment shifted to a bullish expectation since 25 February as indicated by the weighted sentiment metric.

Is your portfolio green? Check out the Decentraland Profit Calculator

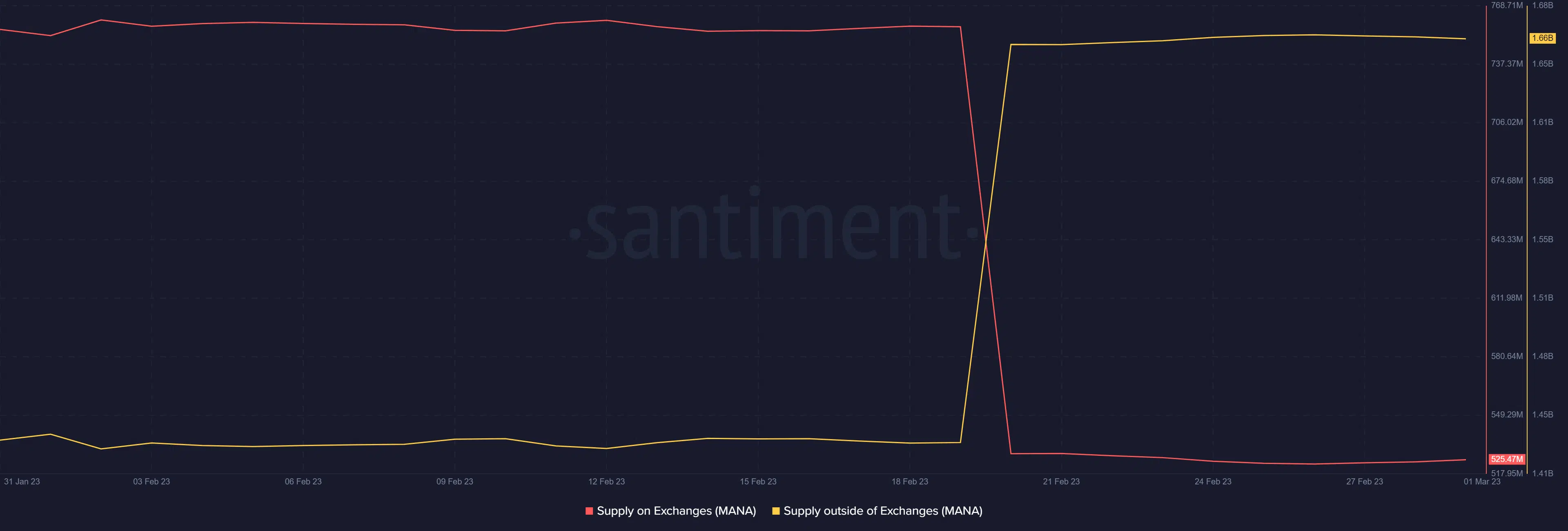

The bullish sentiment coupled with the whale accumulation also reflect on MANA’s exchange flows in February. The supply of MANA on exchanges registered a sharp drop between 19 and 20 February. At the same time, the supply outside exchanges experienced a sharp surge.

Lastly, MANA continued tanking despite these observations. The supply in exchanges and outside exchanges has not changed much despite the price drop. This may suggest that sell pressure has been coming from retail investors.