Render: As bullish momentum builds, what are RNDR’s next levels?

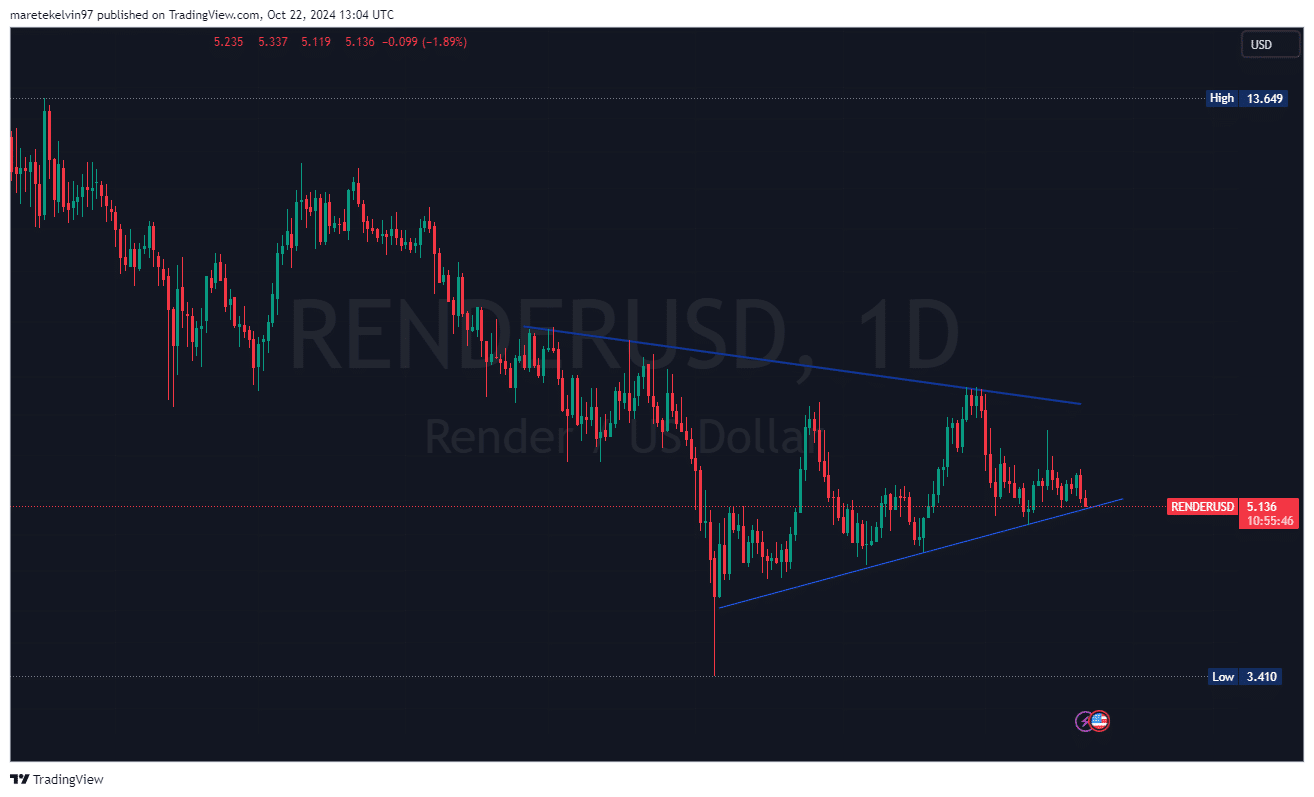

- Render gained bullish momentum after testing a key support level within a symmetrical triangle.

- Whale activity and active addresses surged, signaling growing market interest.

Render [RNDR] consolidated within a symmetrical triangle pattern at press time, which is an indicator of volatility.

While the altcoin tested a key support level, market participants are keeping a close eye on the next move.

The altcoin market sentiment is leaning bullish, and indicators are pointing upward.

In most cases, a symmetrical triangle suggests breakouts in either direction, depending on broader market conditions.

Currently, Render is showing early signs of gathering bullish momentum, fueling the likelihood of an upward breakout.

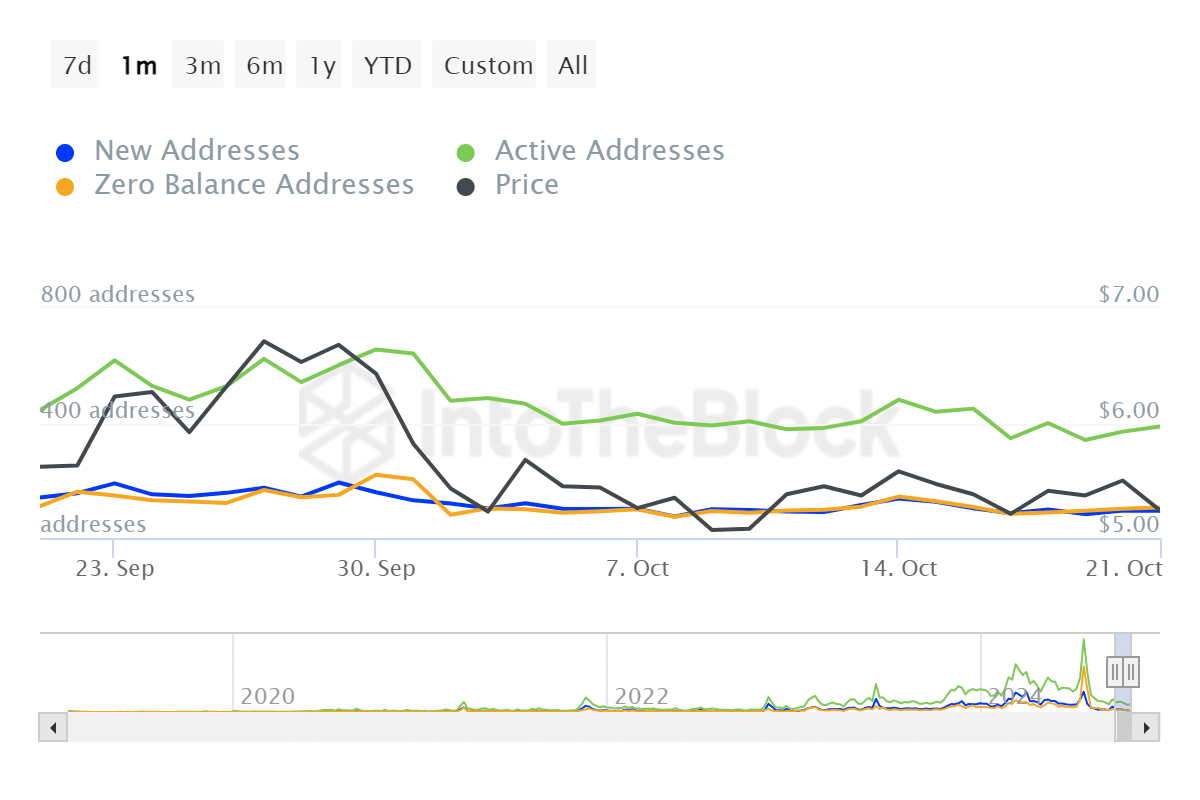

Active addresses surge by 10%

According to AMBCrypto analysis, one strong metric that supports this bullish narrative is the 10% increase in active addresses.

Increasing active addresses usually indicate high user activity, which is often a precursor to price movement.

This increase in activity could be suggesting that more users or market participants are active on the Render network, which in most cases goes hand in hand with increased market confidence.

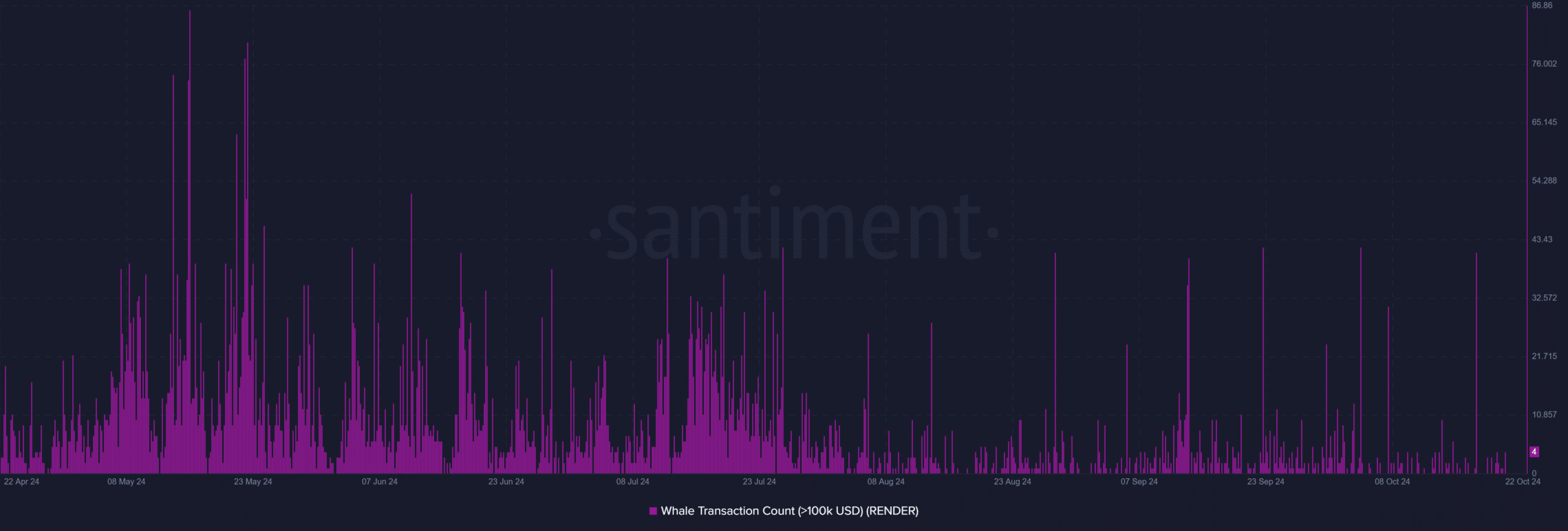

Major players enter the market

Adding to the aforementioned increased trading activity, the altcoin whale activity has surged significantly by 84%,according to the Santiment data.

Whales play a crucial role in market movements, and their increased activity often signals that a substantial price shift may be on the horizon.

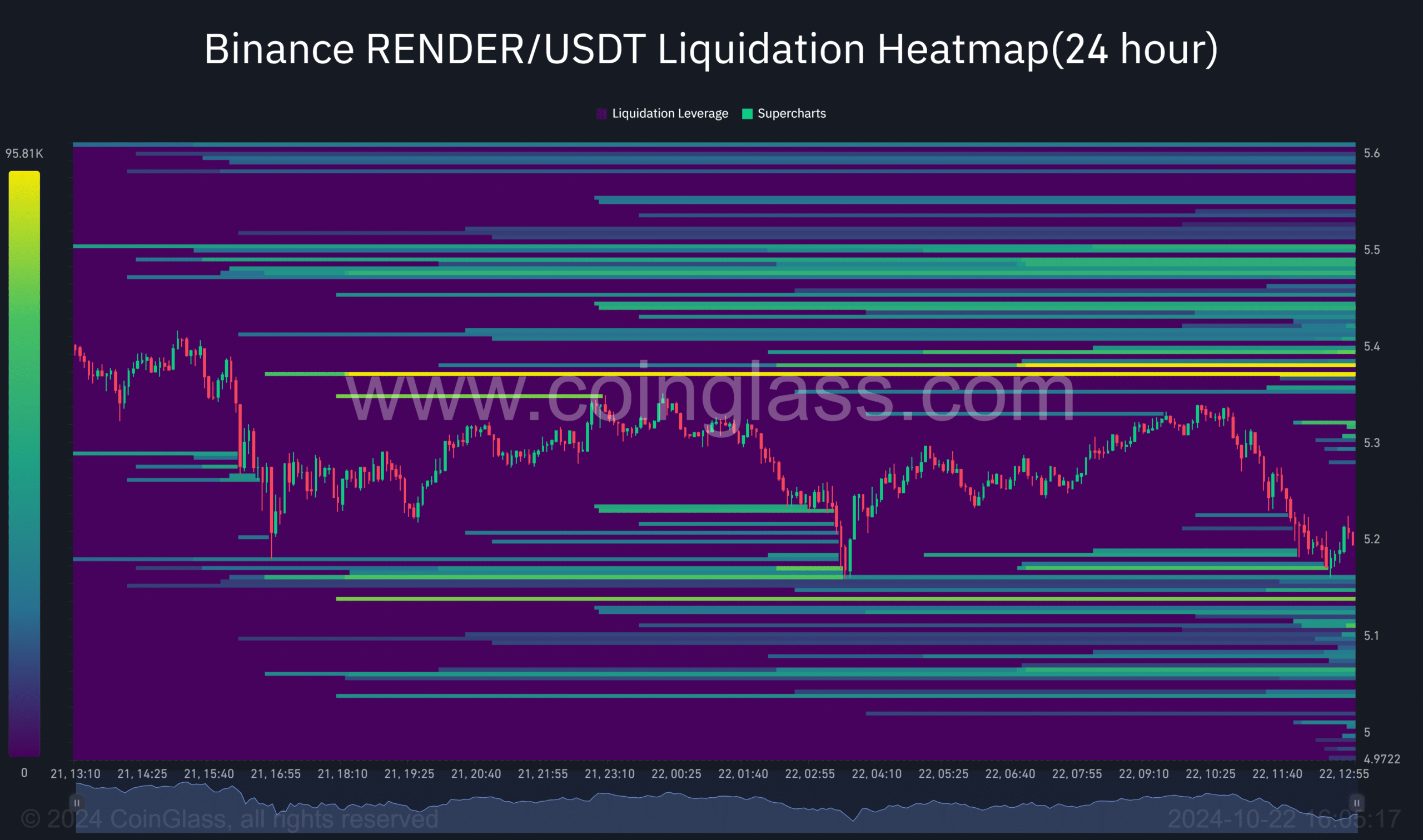

Render bullish bias adds confidence

Adding to the growing optimism, it indicates a bullish bias, with substantial liquidation pools above the current trading price. The liquidation pools may act as a price magnet to pull Render prices higher.

This could also add more fuel to the ongoing bullish run.

Read Render’s [RNDR] Price Prediction 2024–2025

Render consolidated in a symmetrical triangle at press time, driven by surging active addresses and whale activity, which pointed to growing bullish momentum.

With a positive liquidation heatmap as the background, Render could be poised for a major breakout.