Render whale moves trigger price speculation: Are gains likely?

- Whale transactions saw a notable increase, hinting at potential institutional interest.

- The positive sentiment around Render indicates growing optimism, which might translate to higher demand.

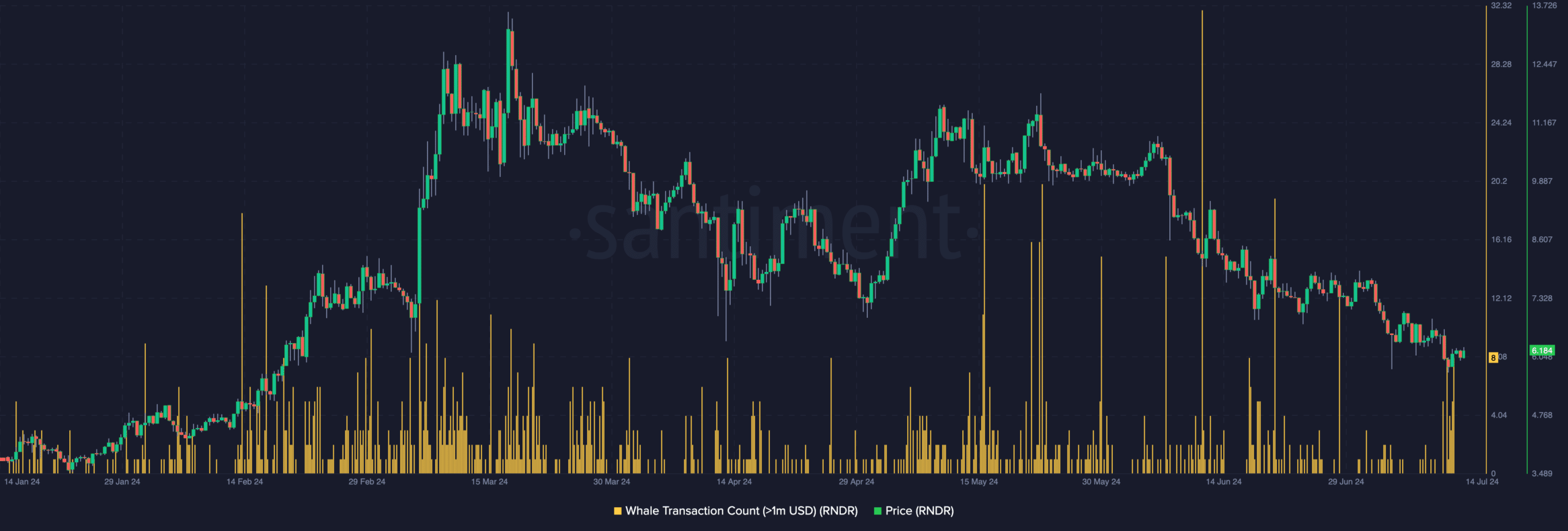

Render [RNDR], the native token of the distributed GPU rendering system, has seen a substantial increase in whale activity. According to Santiment, whale transactions valued at $1 million and above jumped on the 14th of July.

When these transactions increase, it means that there is a lot of institutional interest in the token. Also, it is important to watch the price reaction to the development. This is because, as large investors, whales tend to influence price direction.

If buying pressure from whales increases, there is a high chance that the price will jump. However, if these investors let go of some of their holdings, price falls.

Crypto big wigs are buying more RNDR

In Render’s case, whenever transactions within the value increase, the prices increases. The chart below shows evidence of this assertion. For example, if you take back to March and May, you would see a similar occurrence happening.

Therefore, it might not be out of place to affirm that RNDR’s price could be moving from bearish to bullish. At press time, RNDR changed hands at $6.20.

This was an 8.85% decrease in the last 24 hours. However, there was another indicator supporting the bullish thesis, and this was Render’s network activity.

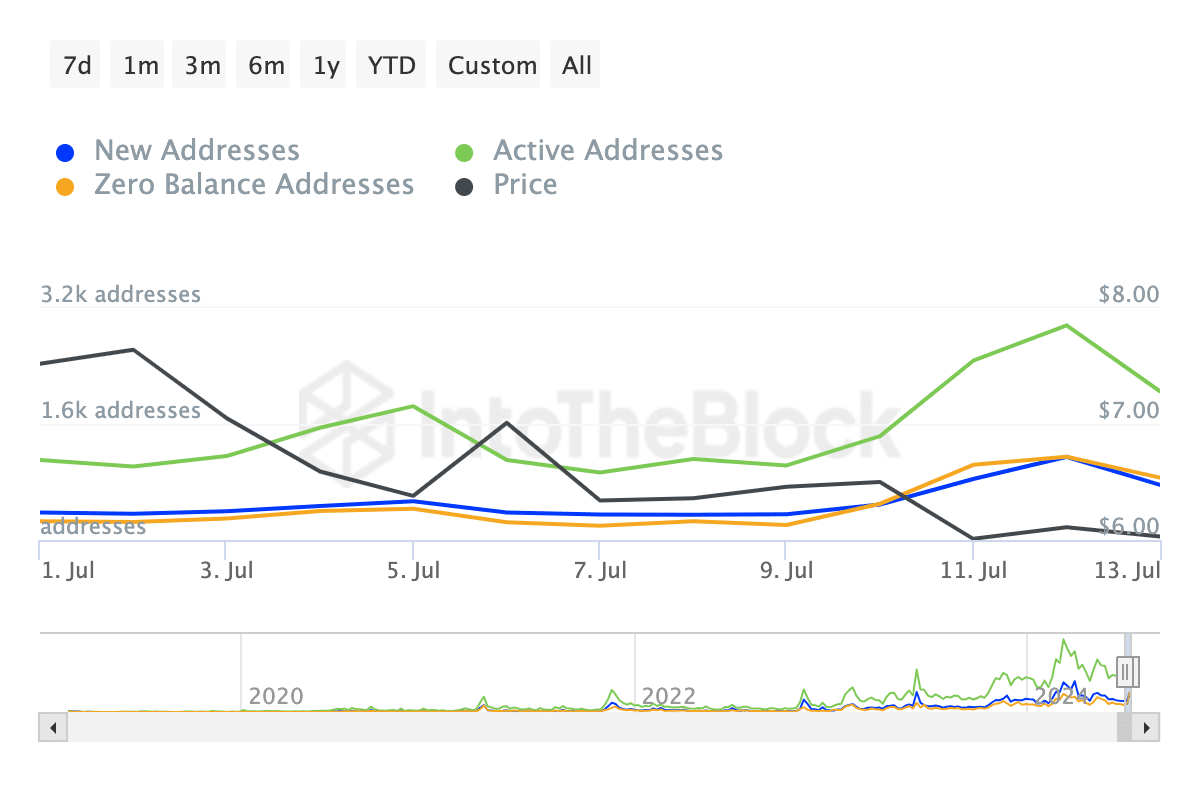

According to IntoTheBlock, activity on the network had increased by incredible figures in the last seven days. For example, active addresses, which measure the number of active users on a blockchain jumped by 100%.

New addresses, which tracks the influx of first-time participants, climbed by 86.09%. AMBCrypto also observed an increase in zero-balance addresses.

If these metrics continue to increase, it could back an upswing in RNDR’s price. Should this be the case, we could see RNDR move to $7.05 in the short term.

Bullish sentiment aims to drive price higher

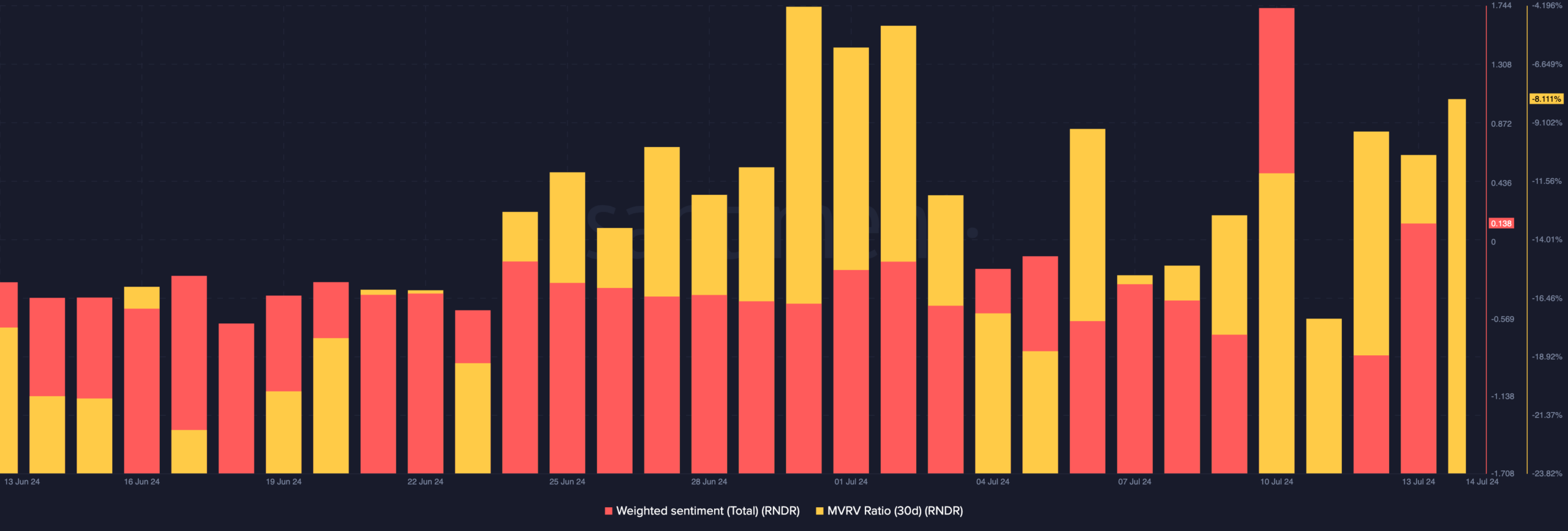

Furthermore, AMBCrypto looked at the sentiment around the token. According to Santiment, the Weighted Sentiment around Render has risen into positive territory.

Weighted Sentiment shows if the broader market has more positive opinions online about a project or otherwise. Negative readings indicate a high number of pessimistic opinions

When it is positive, it means the market share optimistic opinions, and this could be bullish for the price. If sentiment remains positive, demand for the Render native token might increase.

Meanwhile, Render’s 30-day Market Value to Realized Value (MVRV) ratio was -8.11%. The MVRV ratio uses profitability in the market to assess if a token is undervalued or overvalued.

Is your portfolio green? Check the Render Profit Calculator

In most cases, a negative reading implies that a cryptocurrency is undervalued. While a reading close to 100% suggests otherwise.

Considering the current market condition, RNDR could be undervalued. Thus, a notable price increase might be in the works.