Report: 82% SMBs are open to accepting cryptos as payments in 2022

Cryptocurrencies are getting harder to ignore with each passing day. It’s not just big institutions acquiring crypto but even small businesses have been following the same tune. The crypto industry is expanding exponentially and so is its adoption for payment among small and medium-sized businesses or SMBs.

Count me in

Crypto is still not an everyday payment method for most consumers. But many small businesses showcased their interest in jumping into crypto — if they’re not already using it. The sixth edition of Visa’s Global Back to Business study found some conclusions.

About 2,250 small business owners located in nine countries, including the United Arab Emirates, Hong Kong, the United States, and Canada participated in the study. It noted:

“82% of SMBs surveyed said they will accept digital options in 2022 and nearly half (46%) of consumers surveyed expect to use digital payments more often in 2022, with just 4% saying they will use them less.”

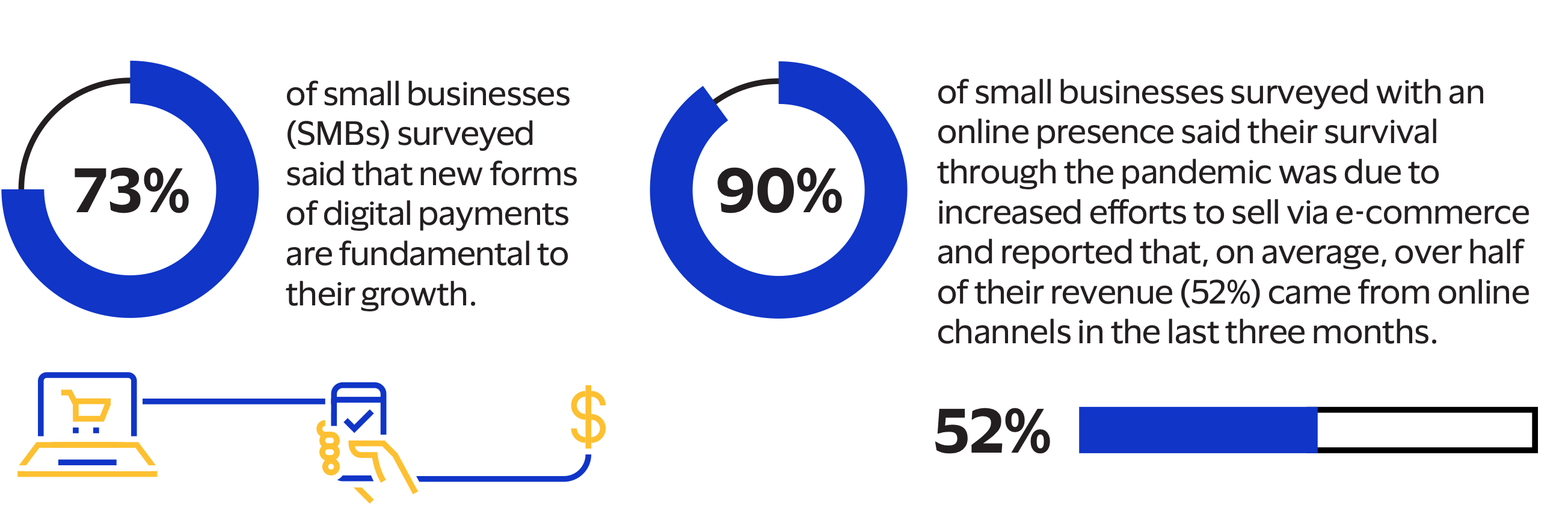

In the same study, 73% of respondents stated that accepting new forms of digital payment options is a key factor that will affect business growth in 2022. In fact, 90% of surveyed SMBs were optimistic about the future of their businesses. Here’s one of the reasons: Over half of their revenue (52%) came from online channels in the last three months.

Source: Visa.com

This was the highest level of optimism in Visa Global Back to Business studies to date, the report asserted. That said, a few of these SMBs had already incorporated digital assets. “59% of small businesses surveyed said they already are or plan to, use only digital payments within the next two years. This was largely in step with 41% of consumers surveyed who said the same.”

Jeni Mundy, Global Head Merchant Sales & Acquiring, Visa added a few quotes to further add support to the aforementioned statistics. He stated the following:

“Payments are no longer about simply completing a sale. It’s about creating a simple and secure experience that reflects one’s brand across channels and provides utility to both the business and its customer.”

Furthermore,

“The digital capabilities that small businesses built up during the pandemic – from contact-less to e-commerce – helped them pivot and survive and, by continuing to build on this foundation, can now help them find new growth and thrive.”

Here’s a proper summary:

Source: Visa.com

Even in real life some of these can actually be witnessed. Notably, different businesses started to incorporate cryptos within their operations. For instance, crypto-themed restaurant Crypto Street accepted payments in all digital assets including memecoins and “shitcoins.”

Even in the past, the flagship firm had the same conclusion concerning the crypto boom and how it could help small businesses prosper.