Report reveals 175% growth in crypto trades in Australia

The latest Bitcoin Markets Report showed greater investment in crypto assets in Australia in FY 2020-21. As per the report, Australians have been interested in the asset class due to several reasons, including the increased number of institutional and big players in the market.

Another factor that boosted their confidence in crypto, is the failure of most traditional asset classes to deliver amid the pandemic. Lastly, the need for portfolio diversification also contribute to increased crypto adoption.

The investor base

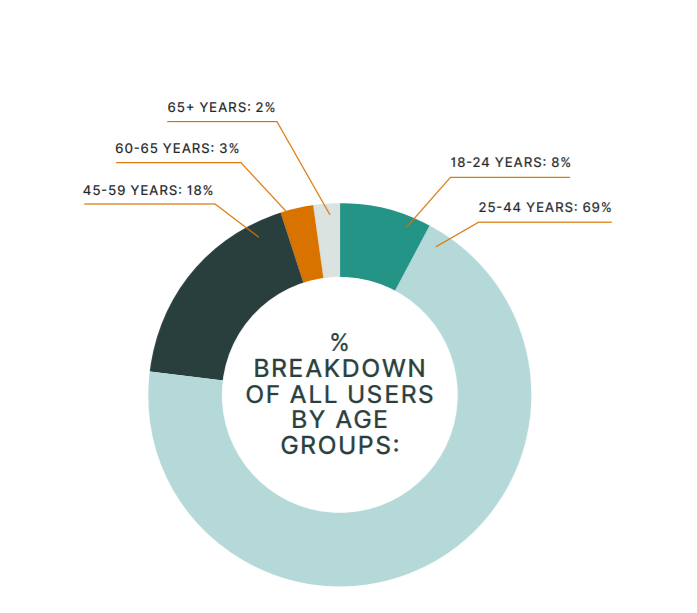

The report noted a growth of 175% in crypto trades during the financial year. It is noteworthy that Australia has the highest number of investors in the age bracket of 25-44 years. On the contrary, only 2% of crypto investors fall in the 65+ bracket.

However, interestingly, older investors tend to make larger initial deposits compared to younger investors. The 18 to 24-year-old investor has an average portfolio size of $1034. On the other hand, the 65+ group’s average portfolio size was at $5084 for 2020-2021.

Hence, the largest bracket of investors comparatively makes smaller investments. While the oldest group has invested roughly the highest of all demographics.

In terms of gender, the investing community is largely dominated by male investors at 77% while female investors are at only 23%. This gap is similar to the global average according to BlockFi’s recent survey. It stated that only 9 percent of women feel that they understand a fair bit about cryptocurrencies, with a mere 29% likely to purchase them.

The average portfolio size of females on the Australian platform was recorded at $2650, compared to $3049 for men.

Where do Australians invest?

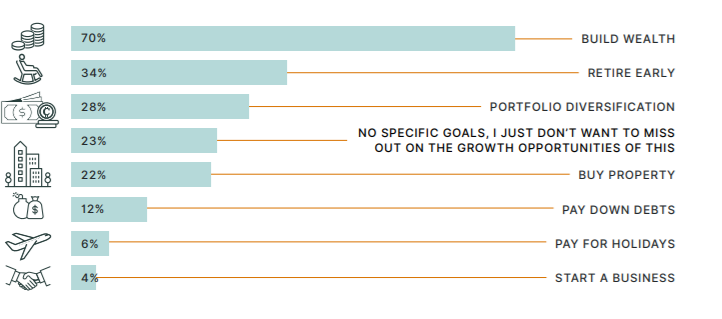

More than half of the respondents cite the project’s whitepaper as the deciding factor for investment. Right now, the top 5 coins in Australia are BTC, XRP, ETH, LTC, and XLM. Interestingly, 23% are holding only cryptos in their investment basket while the rest look at other vehicles like stocks and bonds in addition. This is despite volatility being the biggest challenge for 48% of investors. If we shift focus to financial goals, 70% of Australians are looking to build wealth through this investment while 28% are looking for portfolio diversification.

How do they invest?

Now that 1 in 6 Australians is invested in the crypto asset class, Finders Report mentioned that 15% of Australians have crypto trading apps. And, according to AUSTRAC, there are an estimated 400 digital currency exchanges in Australia.

What to expect?

As part of the report, cryptocurrency expert James Edwards stated,

“If the pace of education continues to grow, combined with easier access to cryptocurrencies, we should expect to see it as a dominant financial industry by the end of the decade, especially amongst younger generations”