XRP’s price down by 17.5%- What’s this week’s prediction?

Ripple [XRP] climbed to a local high of $0.744 on the 11th of March. Since then, the market-wide sell-off forced the altcoin’s prices to tumble.

The ongoing SEC vs. Ripple case has some important dates coming up. This could impact investor sentiment.

Another sign that bullish sentiment was cooling down was whales moving their XRP holdings to centralized exchanges.

The court rulings in the SEC-Ripple tussle, alongside the wider market forces, would likely play a vital role in XRP’s price action in the coming weeks.

Ripple Labs 101

XRP is a cryptocurrency that Ripple Labs uses to conduct transactions on its network.

While Ripple is a centralized fintech company that began as RipplePay in 2004, it was later co-founded by Chris Larsen and Jed McCaleb in 2012 with the vision of creating a faster and more secure way of doing transactions around the world.

Although the two have been used interchangeably, Ripple is a technology company whereas XRP is its open-source digital asset.

The crypto operates on its blockchain known as the XRP ledger (XRPL) where transactions are facilitated by RTXP or the Ripple transaction protocol.

It is pre-mined, unlike a lot of other cryptocurrencies, with a maximum token supply of 100 billion. The main purpose of the crypto is to serve as a settlement layer that aids in transactions with the Ripple network.

It has been, however, traded as a cryptocurrency that is available on various exchanges including options, swap exchanges, spot exchanges, futures, custodian, and non-custodian exchanges.

XRP vs. SEC: The clash

The United States SEC filed a lawsuit against Ripple Labs in 2020 for selling XRP as an “unlicensed security,” claiming that the distribution of $1.3 billion worth of the crypto to its stakeholders violated the law.

The major bone of contention here was whether XRP was a security and, therefore, whether it was a share in Ripple or if it was a cryptocurrency like Bitcoin.

Ripple has been at loggerheads with the SEC for a few years now.

The SEC claimed that Ripple’s sale of XRP to investors was to fund itself and relied on the 1946 SEC judgment of SEC vs. W.J. Howey Co. to make its case.

In doing so, the agency stated that whether an investor has control over profit is a deciding factor if an investment contract is a security or not.

Ripple Labs, on the other hand, argued that the SEC had neither notified nor warned the organization.

After three years of deliberation, the case was finally ruled on in July 2023. The court found that XRP was NOT a security in itself.

The SEC was also denied the request for an interlocutory appeal. Later, it had to drop its securities violation charges against Ripple and XRP.

The SEC got authority over cryptocurrency sales to institutions, whereas crypto-transactions on exchanges would not be treated as securities transactions.

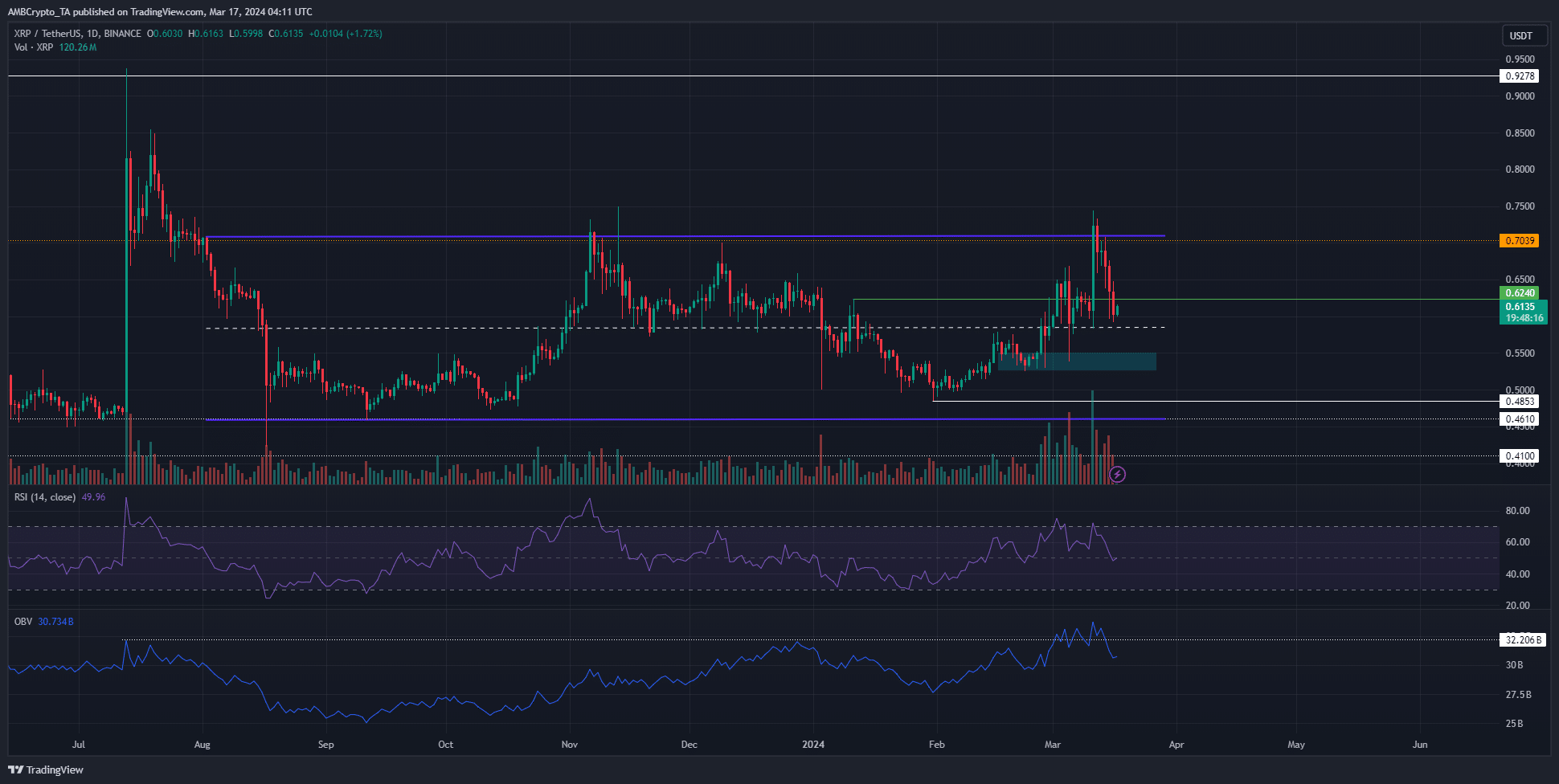

Technical analysis of the one-day chart

In the one-day timeframe, the swing low was at the $0.525 level. This was also a demand zone that the token has tested multiple times in the past month.

At press time, the momentum on the daily chart has begun to shift bearishly.

Hence, it was possible that a move to the $0.52-$0.54 demand zone could arrive over the next few days. The OBV was unable to flip the resistance level to support.

This showed that buyers did not have a clear superiority in numbers over the sellers yet.

Combined with the momentum and the losses in the past week, more southward movement appeared likely.

A look at the lower timeframe charts such as 4-hour or lower indicated that the $0.65 was a key short-term resistance region.

The magnetic zones were stronger to the south

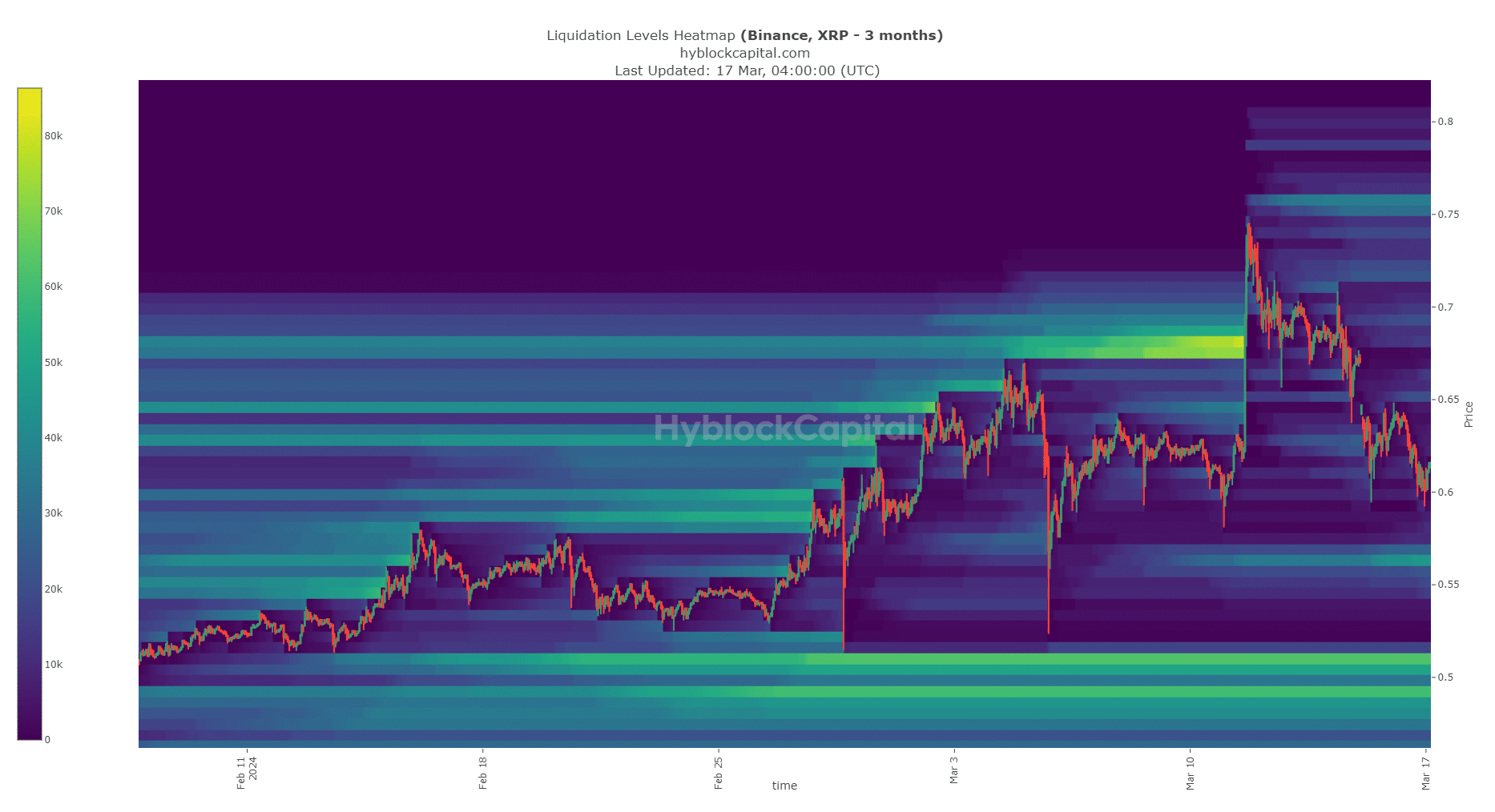

Source: Hyblock

The price is attracted to liquidity. Therefore, a large number of buy and sell orders or liquidation levels would attract prices like a magnet. At press time, the $0.56 level has a relatively high amount of liquidation levels.

Meanwhile, the $0.65 and the $0.75 levels overhead could see a reaction from XRP. Yet the chances of a bounce remained low.

AMBCrypto thinks that a move toward $0.56 is likely. The $0.51 level, which was the next significant liquidity pocket, was also possible.

Meanwhile, a bounce to the $0.65 level or higher was deemed less likely, based on the liquidation heatmap.

Conclusion

XRP has remained rangebound since August 2023. Its inability to breach the $0.7 resistance and stay there even when Bitcoin is at all-time highs did not highlight bullish strength. Investors and swing traders could wait for further losses before buying XRP, seeking to take profits near the range highs.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.