Ripple’s Liquidity Hub launches as XRP enthusiasts watch closely

-Ripple’s XRP has seen renewed interest from traders, with the number of active addresses maintaining the 1 million range.

-The Ripple liquidity hub launch has caused excitement and concerns among enthusiasts.

Traders have recently shown renewed interest in Ripple [XRP], as evidenced by a significant metric from Santiment. With a new development from Ripple on the horizon, could this interest surge even higher?

– Read Ripple’s [XRP] Price Prediction 2023-24

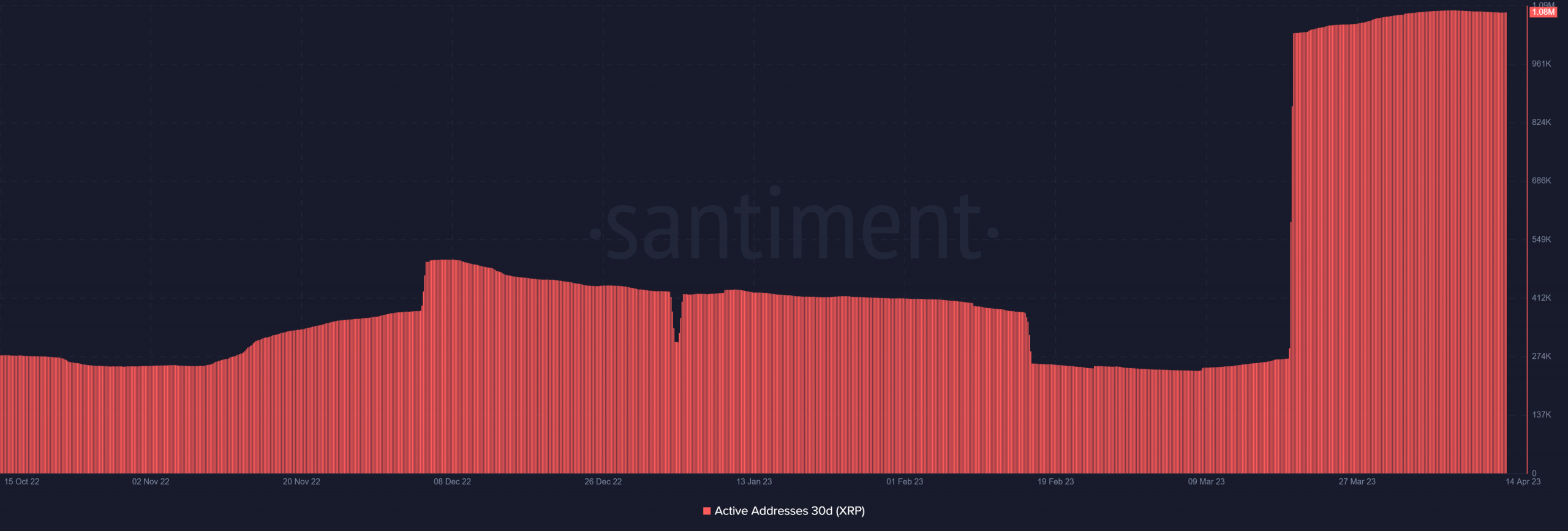

Active addresses maintain the 1 million range

Despite the ongoing Ripple/SEC case, traders are not showing signs of hesitance to engage with XRP. According to Santiment’s data, XRP experienced a significant increase in its 30-day active addresses around 19 March, and the number has remained steady within the range of 1 million ever since.

Presently, there are approximately 1.08 million active addresses. With Ripple’s latest service launch, can we witness a further surge in this metric?

Ripple launches B2B Crypto Liquidity API Solution

On 13 April, Ripple made an official announcement regarding the launch of its Liquidity Hub. According to the release, the newly launched service will operate independently and complement Ripple’s widely-used cross-border payments solution, On-Demand Liquidity (ODL).

The Liquidity Hub aims to provide its partners with access to payout rails on a global scale and has been designed with an enterprise perspective in mind. This means the platform will offer a range of digital assets from various market makers, including crypto exchanges and over-the-counter trading desks.

The initial version of the Liquidity Hub will support a range of cryptocurrencies such as Bitcoin (BTC), Ethereum [ETH], Bitcoin Cash [BCH], Ethereum Classic [ETC], and Litecoin [LTC], as well as fiat currency, the U.S. Dollar (USD).

The XRP question

Following Ripple’s announcement on Twitter, it was evident that XRP enthusiasts were excited about the launch of the Liquidity Hub. However, the official statement did not mention the role that XRP would play in the new service, nor was XRP mentioned at all.

Some commenters pointed out this omission and raised concerns about it. One possible explanation for this could be the ongoing legal battle between Ripple and the SEC.

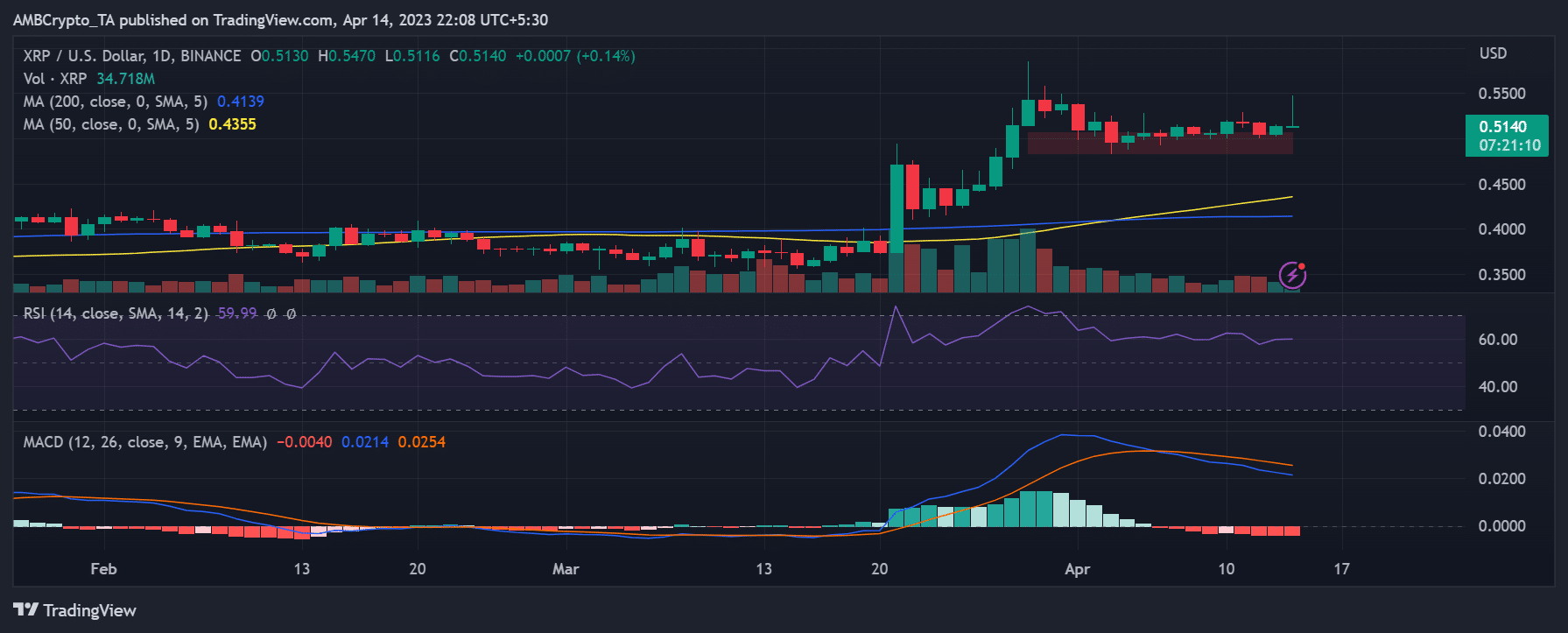

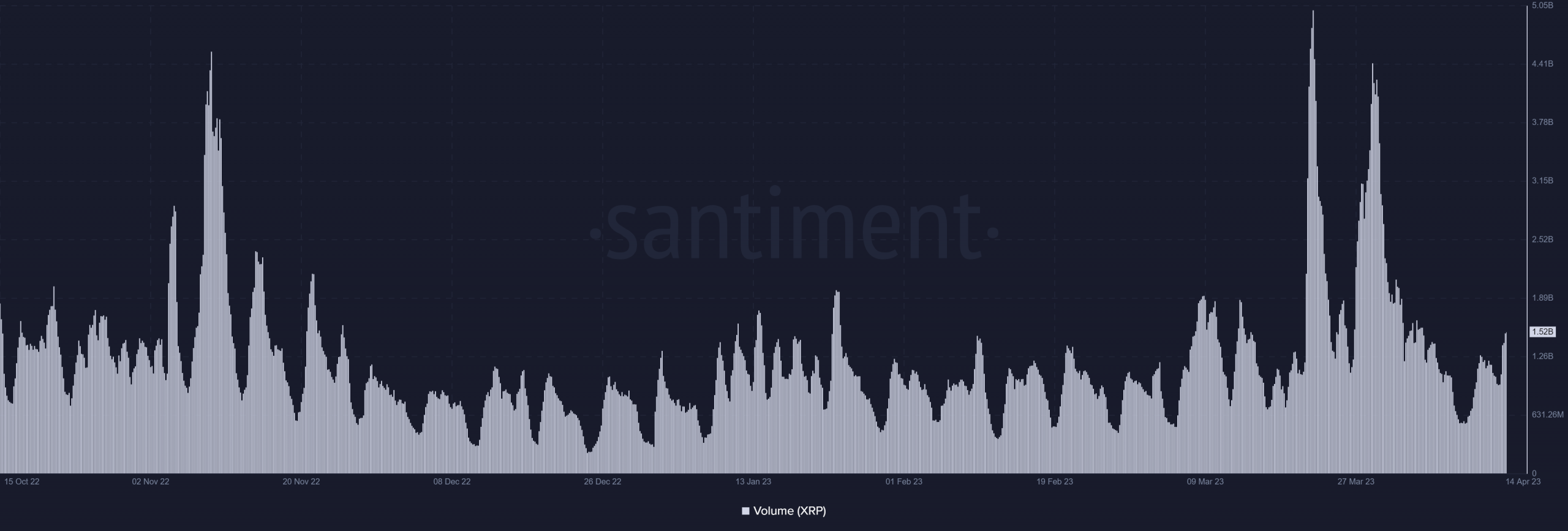

Volume and daily timeframe analysis of XRP

Upon analyzing the daily timeframe of XRP, it was evident that despite concerns surrounding the ongoing legal battle with the SEC, XRP had managed to trend upwards. As of this writing, XRP was trading at approximately $0.51, showing a gain of nearly 1%.

Additionally, a support range was forming around the $0.50 and $0.48 price levels. XRP continued its bullish trend, evidenced by its Relative Strength Index (RSI) line crossing over the 60 line.

– Realistic or not, here’s XRP market cap in BTC’s terms

Santiment’s volume metric indicated that Ripple experienced several spikes over the past month. However, there had been a subsequent decline in volume, suggesting a correction in the market. As of this writing, the trading volume for Ripple was over 1.5 billion.