Rise in buyers means this for Bitcoin in the days to come

The last few days have not been the best moments for Bitcoin, as it fell by almost 15%. Yesterday, the coin closed under $45k for the first time in 22 days, which should have created some sort of bearish sentiment.

However, that is not the case as Bitcoin continued to fall and investors’ bullishness continued to rise. At press time the market was making record performances in multiple sectors.

Bitcoin investors’ bullishness peaks

Even though at press time the price was at $45,155, there would be some expectation of selling given BTC’s performance the last few days. Instead, more and more Bitcoin is being bought at present, than during the consolidation in August, last week.

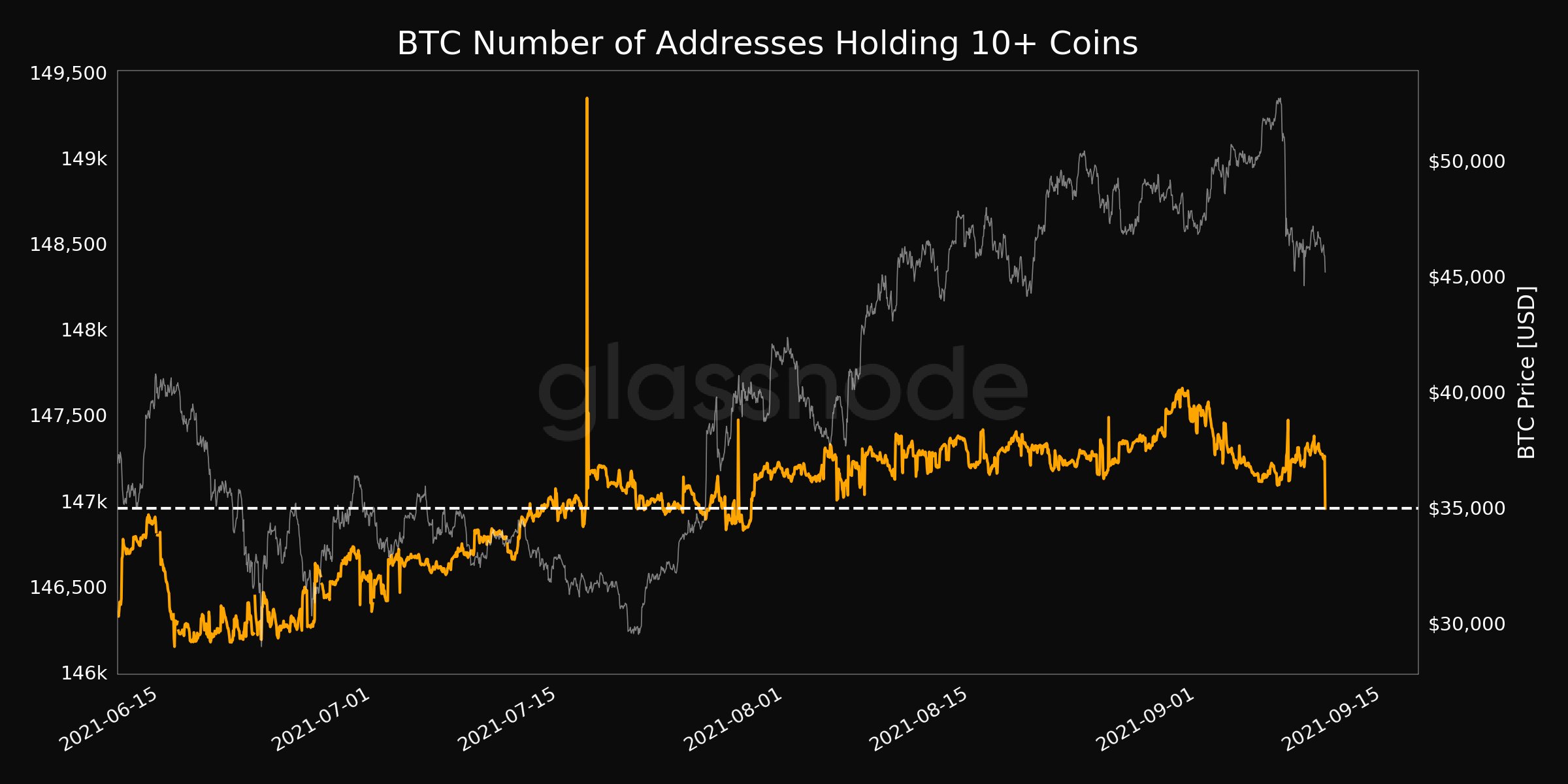

At present, addresses holding at least 10 Bitcoin reached a one-month low.

Bitcoin addresses with >= 10 BTC | Source: Glassnode

Now, this could be an indication that investors backed out of the market and sold their holdings. Except, that is not the case as over the month, daily active addresses are up by 400k and new addresses rose by 200k as well.

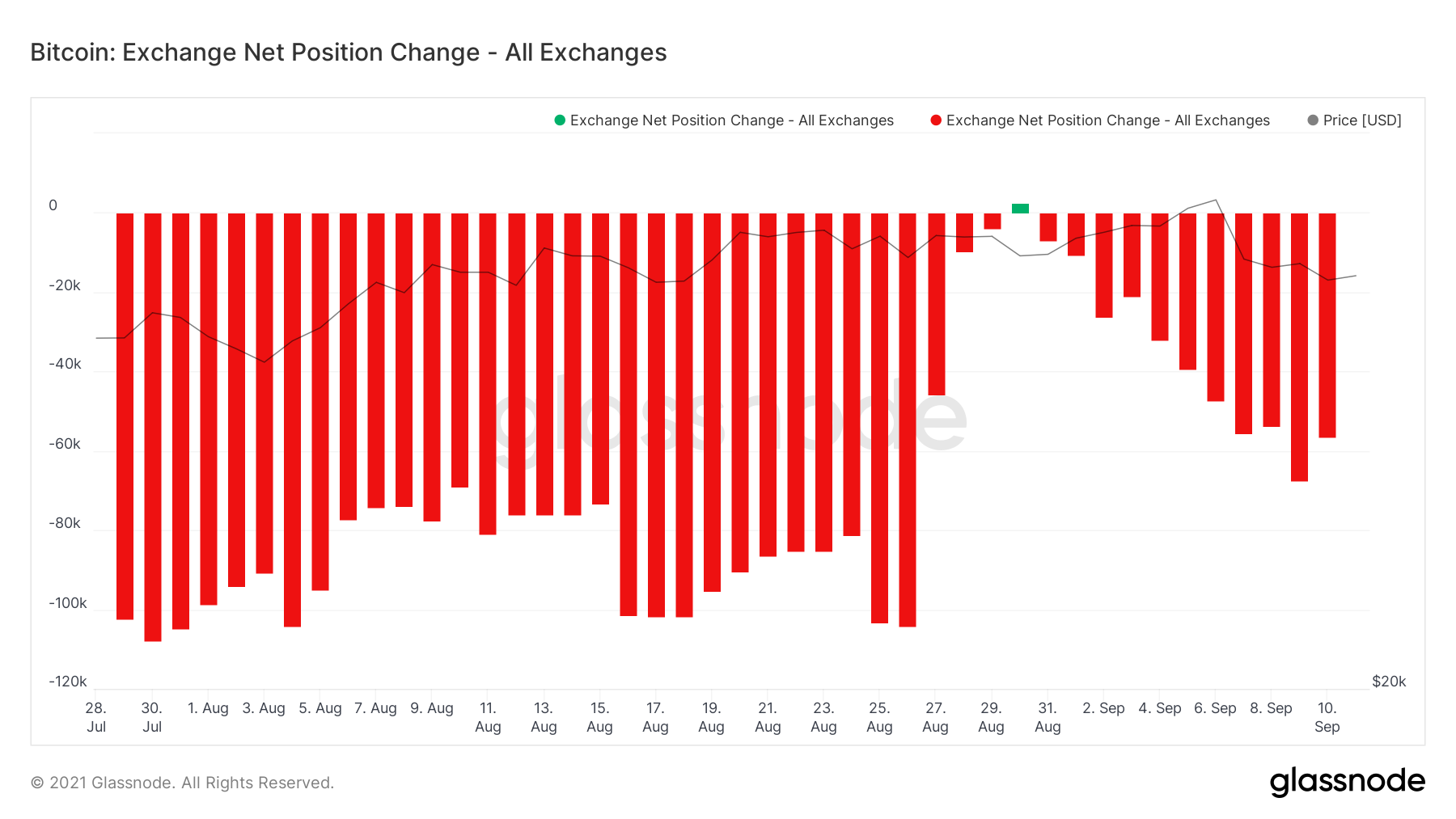

This meant that at the moment more Bitcoin was being bought as addresses balance was rising to more than just 10 BTC. This was also visible on exchange positions which showed that in the last 10 days about 70k BTC was bought. This purchase was worth well over $3.1 billion.

Bitcoin exchanges show buying dominating | Source: Glassnode – AMBCrypto

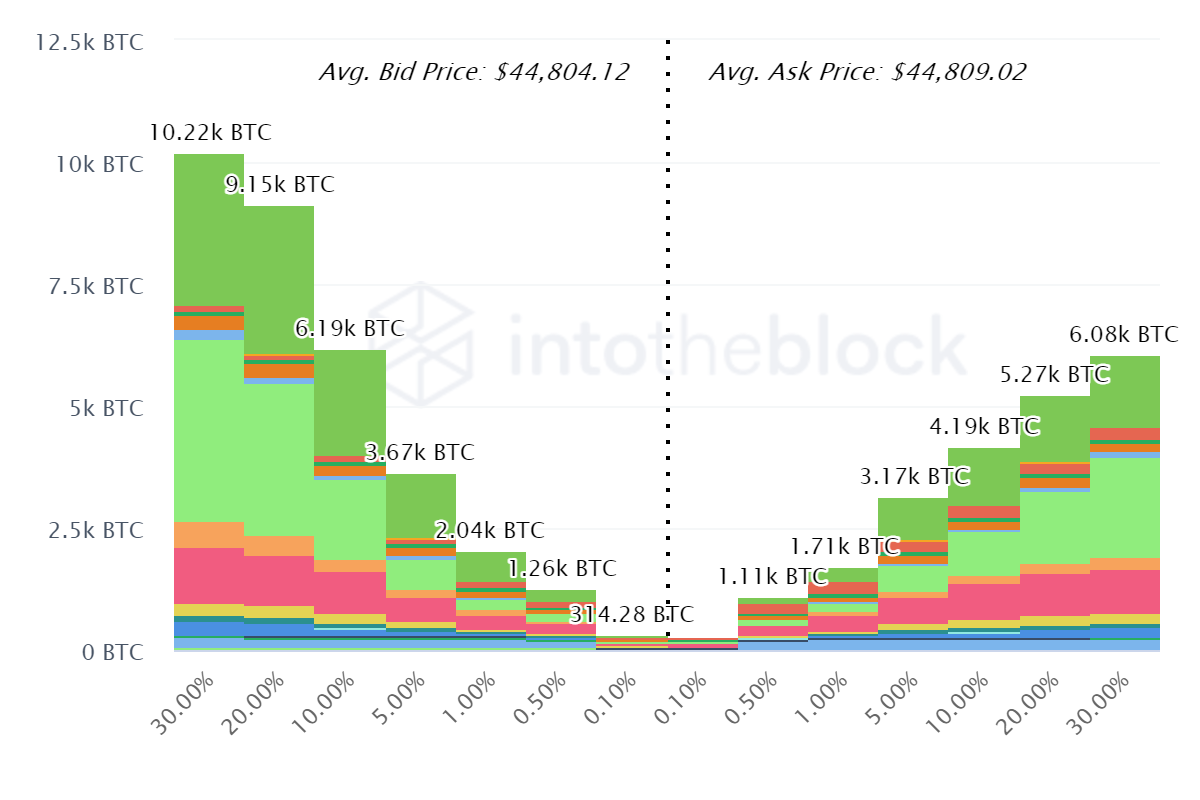

In fact, this narrative hasn’t yet changed. At press time, buy orders are were dominating the market by at least 4.2k BTC ($190 million).

Bitcoin buy vs sell orders | Source: Intotheblock – AMBCrypto

So is there no selling at all?

Nope, there has been such little selling that it almost makes it negligible. Long-term holders are already not selling as 10-year old supply just reached an ATH of 2.4 million BTC. And along with them, even the mid-term holders have stepped back when it comes to selling.

They have resolutely returned to HODLing as the supply last spent between 3-12 months touched a 2-month low.

Bitcoin spent between 3-12 months have dropped significantly | Source: Glassnode – AMBCrypto

In fact, the buying trend is so strong that addresses with balance have reached a 4-month high, matching with May ATH levels. Thus, the wise thing to do right now is to buy Bitcoin ASAP.

The Relative Strength Index (RSI) is already in the bearish-neutral zone. This indicates that a price flip could be coming soon and buying now will result in strong profits later.

Bitcoin trading above $51k | Source: TradingView – AMBCrypto