RocketPool takes a page off Lido Finance’s playbook with liquid staking. Here’s how…

- RocketPool sets its sight on the staking big leagues

- RDL’s bullish performance may just be the beginning if RocketPool plays its cards right

Lido Finance has been enjoying immense success thanks to its liquid staking mechanism. As a result, other staking platforms such as RocketPool are starting to notice and emulate Lido’s staking model.

Is your portfolio green? Check out the RocketPool Profit Calculator

A recent Messari analysis took into consideration the level of growth that Lido and its competition have been enjoying since November 2020.

Based on the analysis, RocketPool achieved significant growth and dominance, coming in third after Lido and Coinbase. The Messari report also noted that the reason behind RocketPool’s growth was because it had adopted similar strategies to those of Lido Finance.

.@LidoFinance has established itself as the market leader in liquid staking protocols, contributed to by its attractive incentives.

New entrants like @RocketPool are adopting similar strategies, using their native $RPL token to increase market share and liquidity. pic.twitter.com/j9iiLAJe7f

— Messari (@MessariCrypto) April 10, 2023

Liquid staking platforms are bound to become more popular over time. This is because of the risks that come with centralized staking platforms.

History has so far proved that centralized staking platforms are hot targets for malicious attacks and theft since they operate on a custodial mechanism.

Can RocketPool compete with Lido Finance’s lead?

Lido Finance already has a strong lead thanks to its first-mover advantage. This is reminiscent of Bitcoin’s [BTC] comparison with Ethereum [ETH] where the latter was playing catch up while the former is in its own league. Similarly, RocketPool will likely struggle to get to Lido’s current level.

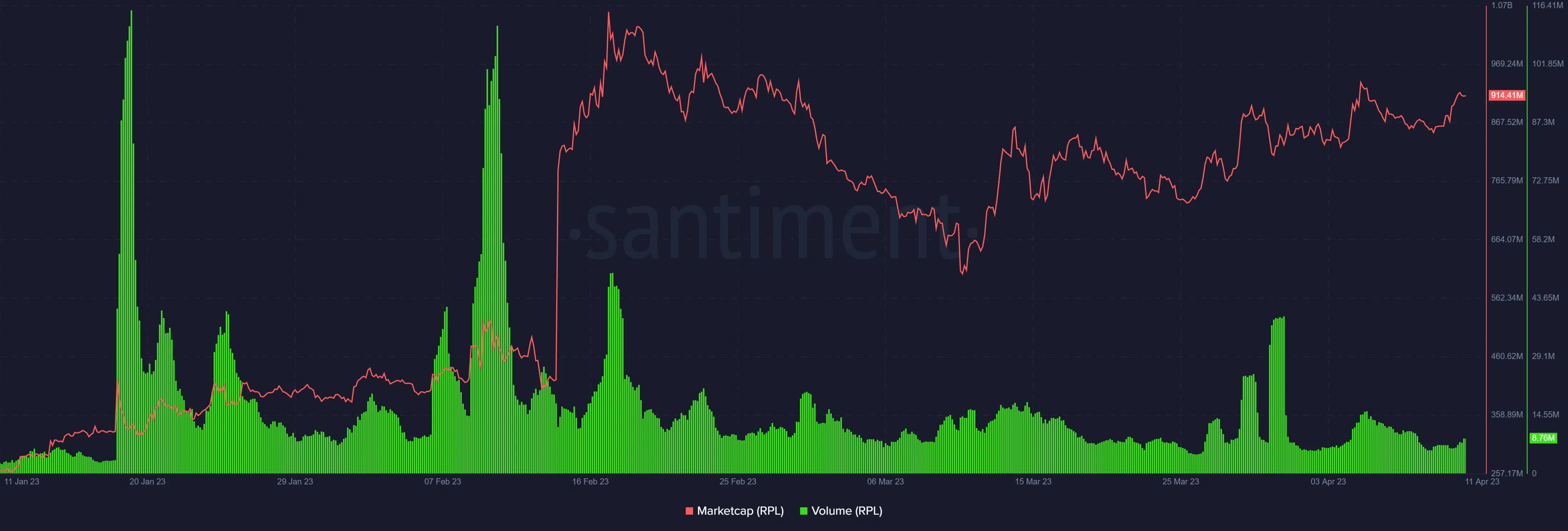

Perhaps the best way to establish whether RocketPool can compete effectively with Lido is to look at its stats since the start of 2023. RocketPool’s market cap is one of the areas that delivered robust growth in the first three months of the year.

It grew from as low as $261 million in January, and briefly managed to push above $1 billion in February.

RocketPool had a $906 million market cap at press time. For reference, Lido Finance had a $2.07 billion market cap at press time.

Realistic or not, here’s RPL’s market cap in BTC’s terms

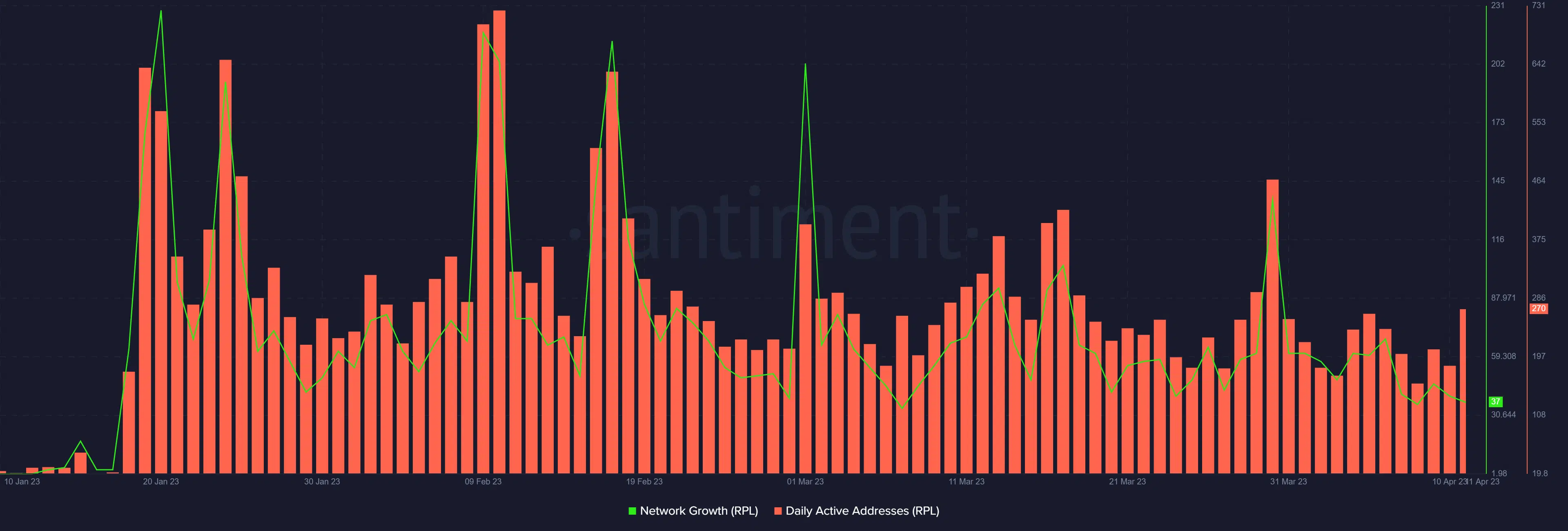

RocketPool kicked off the year with less than 30 daily active users but peaked at 724 DAU in the second week of February. It has so far maintained a daily average above 200 DAU. Its network growth reflects the daily active users.

Is Rocketpool’s native token RPL undervalued?

RPL had almost 19,257,026 tokens in circulating supply, meaning it had its total supply in circulation. Its $47.29 press time price represented a 156% upside from its historic lows.

RPL is a low cap token based on the circulating supply. The fact that it previously managed to secure $1 billion in market cap in its early stages means it is off to a healthy start. It has robust growth potential if it maintains the same trajectory.